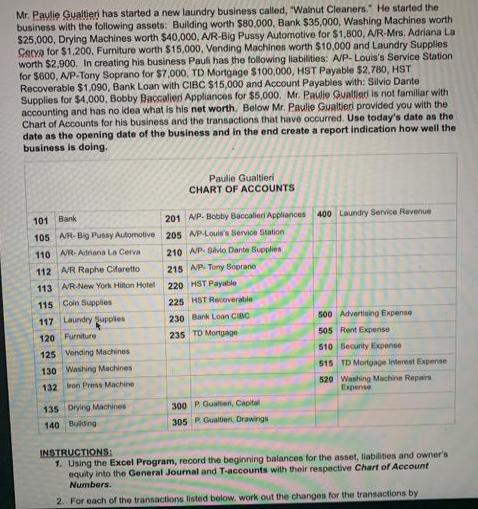

Mr. Paulie Gualtieri has started a new laundry business called, Walnut Cleaners. He started the business with the following assets: Building worth $80,000, Bank

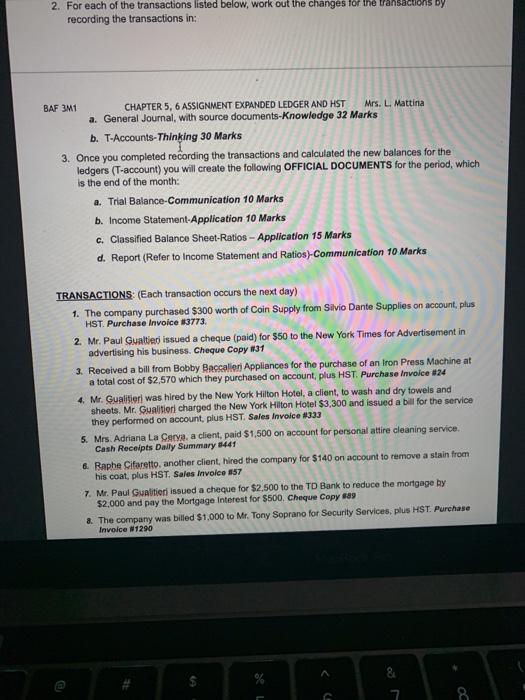

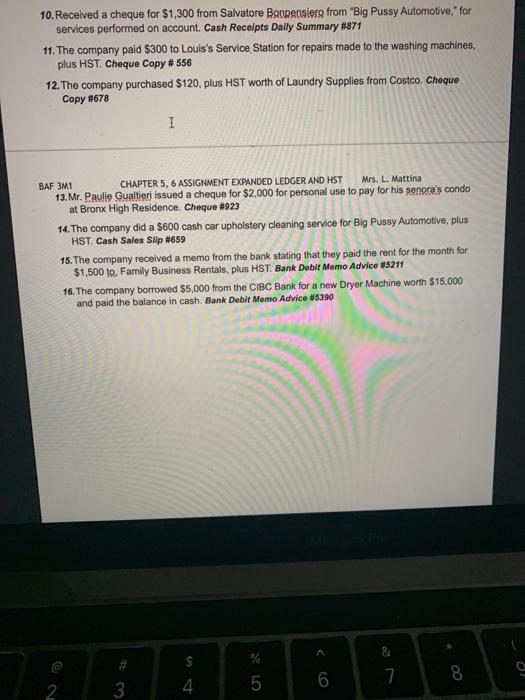

Mr. Paulie Gualtieri has started a new laundry business called, "Walnut Cleaners. He started the business with the following assets: Building worth $80,000, Bank $35,000, Washing Machines worth $25,000, Drying Machines worth $40,000, A/R-Big Pussy Automotive for $1,800, A/R-Mrs. Adriana La Cetva for $1,200, Furniture worth $15,000, Vending Machines worth $10,000 and Laundry Supplies worth $2,900. In creating his business Pauli has the following liabilities: A/P-Louis's Service Station for $600, A/P-Tony Soprano for $7,000, TD Mortgage $100,000, HST Payable $2,780, HST Recoverable $1,090, Bank Loan with CIBC $15,000 and Account Payables with: Silvio Dante Supplies for $4,000, Bobby Baccaliers Appliances for $5,000. Mr. Paulie Gualtier is not familiar with accounting and has no idea what is his net worth. Below Mr. Paulie Gualtieri provided you with the Chart of Accounts for his business and the transactions that have occurred. Use today's date as the date as the opening date of the business and in the end create a report indication how well the business is doing. 101 Bank 105 AVR-Big Pussy Automotive 110 AR-Adriana La Cerva 112 A/R Raphe Cifaretto 113 A/R-New York Hilton Hotel 115 Coin Supplies 117 Laundry Supples 120 Furniture 125 Vending Machines 130 Washing Machines 132 on Press Machine 135 Drying Machines 140 Building Paulie Gualtieri CHART OF ACCOUNTS 201 A/P- Bobby Baccalieri Appliances 400 Laundry Service Revenue 205 AP-Louis's Service Station 210 A/P Sivio Dante Supplies 215 A/P Tony Soprano 220 HST Payable 225 HST Recoverable 230 Bank Loan CIBC 235 TD Mortgage 300 P. Gualten, Capital 305 P. Gualtier, Drawings 500 Advertising Expense 505 Rent Expense 510 Becurity Expense 515 TD Mortgage Interest Expense 520 Washing Machine Repairs Expense INSTRUCTIONS: 1. Using the Excel Program, record the beginning balances for the asset, liabilities and owner's equity into the General Journal and T-accounts with their respective Chart of Account Numbers. 2. For each of the transactions listed below. work out the changes for the transactions by 2. For each of the transactions listed below, work out the changes for the transactions recording the transactions in: BAF 3M1 CHAPTER 5, 6 ASSIGNMENT EXPANDED LEDGER AND HST Mrs. L. Mattina a. General Journal, with source documents-Knowledge 32 Marks b. T-Accounts-Thinking 30 Marks 3. Once you completed recording the transactions and calculated the new balances for the ledgers (T-account) you will create the following OFFICIAL DOCUMENTS for the period, which is the end of the month: a. Trial Balance-Communication 10 Marks b. Income Statement-Application 10 Marks C. Classified Balance Sheet-Ratios - Application 15 Marks d. Report (Refer to Income Statement and Ratios)-Communication 10 Marks TRANSACTIONS: (Each transaction occurs the next day) 1. The company purchased $300 worth of Coin Supply from Silvic Dante Supplies on account, plus HST. Purchase Invoice #3773. 2. Mr. Paul Gualtier issued a cheque (paid) for $50 to the New York Times for Advertisement in advertising his business. Cheque Copy #31 3. Received a bill from Bobby Baccalier) Appliances for the purchase of an Iron Press Machine at a total cost of $2,570 which they purchased on account, plus HST. Purchase Invoice #24 4. Mr. Gualitieri was hired by the New York Hilton Hotel, a client, to wash and dry towels and sheets. Mr. Gualtieri charged the New York Hilton Hotel $3,300 and issued a bill for the service they performed on account, plus HST. Sales Invoice #333 5. Mrs. Adriana La Cerva, a client, paid $1,500 on account for personal attire cleaning service. Cash Receipts Daily Summary $441 6 Raphe Cifaretto, another client, hired the company for $140 on account to remove a stain from his coat, plus HST. Sales Invoice #57 7. Mr. Paul Gualitieri issued a cheque for $2.500 to the TD Bank to reduce the mortgage by $2,000 and pay the Mortgage Interest for $500. Cheque Copy 889 Security Services, plus HST. Purchase 8. The company was billed $1,000 to Mr. Tony Soprano for Invoice #1290 < G 8 10. Received a cheque for $1,300 from Salvatore Bonpensiero from "Big Pussy Automotive," for services performed on account. Cash Receipts Daily Summary # 871 11. The company paid $300 to Louis's Service, Station for repairs made to the washing machines, plus HST. Cheque Copy # 556 12. The company purchased $120, plus HST worth of Laundry Supplies from Costco. Cheque Copy # 678 BAF 3M1 CHAPTER 5, 6 ASSIGNMENT EXPANDED LEDGER AND HST Mrs. L. Mattina 13. Mr. Paulie Gualtieri issued a cheque for $2,000 for personal use to pay for his senora's condo at Bronx High Residence. Cheque #923 14. The company did a $600 cash car upholstery cleaning service for Big Pussy Automotive, plus HST. Cash Sales Slip #659 2 I 15. The company received a memo from the bank stating that they paid the rent for the month for $1,500 to, Family Business Rentals, plus HST. Bank Debit Memo Advice #5211 16. The company borrowed $5,000 from the CIBC Bank for a new Dryer Machine worth $15,000 and paid the balance in cash. Bank Debit Memo Advice #5390 # 3 4 5 A 6 7 8

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information given Net Worth of Walnut Cleaners Laundry is 77610 and H...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started