Question

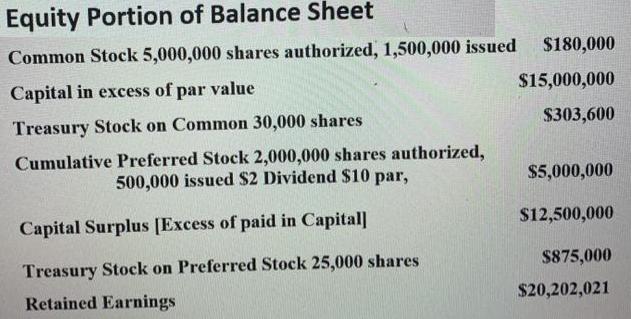

1.How is a $6,000,000 cash dividend to be split between preferred and common stockholders? Show Work 2.Suppose the company is 4 years behind in dividends

1.How is a $6,000,000 cash dividend to be split between preferred and common stockholders? Show Work

1.How is a $6,000,000 cash dividend to be split between preferred and common stockholders? Show Work

2.Suppose the company is 4 years behind in dividends what is the new split for the $6,000,000 dividend payment between preferred and common stockholders? Show work

3.How many common stock shares are outstanding?

4.What was the initial stock price per share of Common Stock?

5.What was the initial stock price per share of the Preferred Stock?

6.Using your answer to question four what is the payout rate per share for the Common Stock?

Equity Portion of Balance Sheet Common Stock 5,000,000 shares authorized, 1,500,000 issued $180,000 Capital in excess of par value $15,000,000 Treasury Stock on Common 30,000 shares $303,600 Cumulative Preferred Stock 2,000,000 shares authorized, 500,000 issued $2 Dividend $10 par, $5,000,000 Capital Surplus [Excess of paid in Capital] $12,500,000 Treasury Stock on Preferred Stock 25,000 shares $875,000 Retained Earnings $20,202,021

Step by Step Solution

3.33 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

6 the payout rate p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started