Answered step by step

Verified Expert Solution

Question

1 Approved Answer

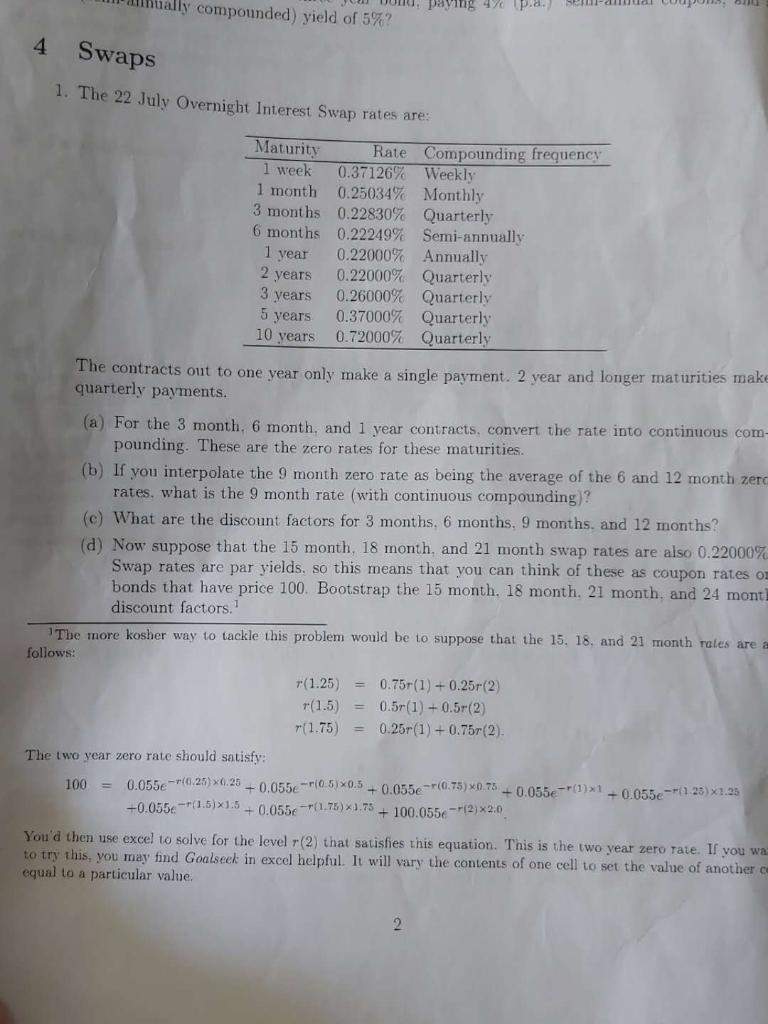

paying 47 (p.a.) compounded) yield of 5%? 4 Swaps 1. The 22 July Overnight Interest Swap rates are: Maturity 1 week 1 month 3

paying 47 (p.a.) compounded) yield of 5%? 4 Swaps 1. The 22 July Overnight Interest Swap rates are: Maturity 1 week 1 month 3 months 0.22830% Quarterly 6 months 0.22249% Semi-annually 1 year 2 years 3 years 5 years 10 years Rate Compouinding frequency 0.37126% Weekly 0.25034% Monthly 0.22000% Annually 0.22000% Quarterly 0.26000% Quarterly 0.37000% Quarterly 0.72000% Quarterly The contracts out to one year only make a single payment. 2 year and longer maturities make quarterly payments. (a) For the 3 month, 6 month, and 1 vear contracts, convert the rate into continuous com- pounding. These are the zero rates for these maturities. (b) If you interpolate the 9 month zero rate as being the average of the 6 and 12 month zerc rates, what is the 9 month rate (with continuous compounding)? (c) What are the discount factors for 3 months, 6 months, 9 months, and 12 months? (d) Now suppose that the 15 month, 18 month, and 21 month swap rates are also 0.22000% Swap rates are par yields. so this means that you can think of these as coupon rates on bonds that have price 100. Bootstrap the 15 month, 18 month, 21 month, and 24 month discount factors." IThe more kosher way to tackle this problem would be to suppose that the 15, 18. and 21 month rates are follows: r(1.25) 0.75r(1) + 0.25r (2) r(1.5) = 0.5r(1) +0.5r(2) r(1.75) 0.25r(1) +0.75r(2). %3D The two year zero rate should satisfy: 0.055e-r(0.26) x0.25 + 0.055e-r(0.5)x0.5 + 0.055er(0.75) x0.75- 0.055e-r(1)x1 +0.055e-r(1 25) x1.25 +0.055e-r(1.5) 1.5 + 0.055e(1,75) x1.75 + 100.055e-r(2) x2:0 100 %3D You'd then use excel to solve for the level r(2) that satisfies this equation. This is the two year zero rate. If you wa to try this, you may find Goalseek in excel helpful. It will vary the contents of one cell to set the value of another ce equal to a particular value.

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a Here is the calculation of the rate conversion into the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started