Answered step by step

Verified Expert Solution

Question

1 Approved Answer

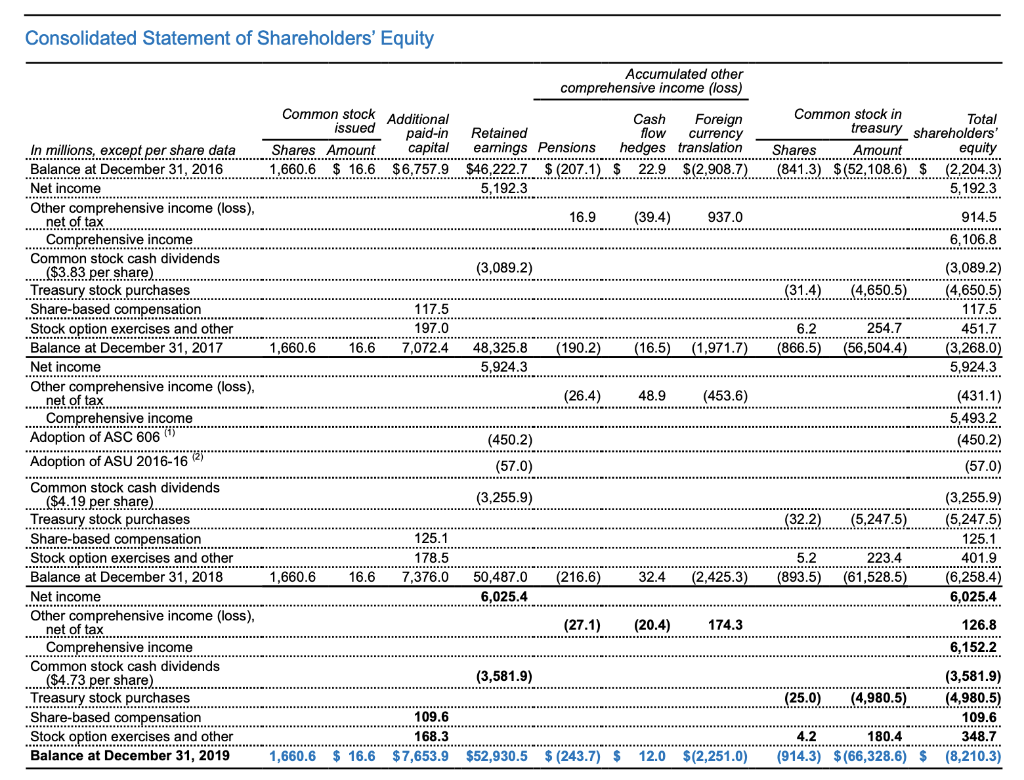

Consolidated Statement of Shareholders' Equity In millions, except per share data ............. Balance at December 31, 2016 Net income Other comprehensive income (loss), net

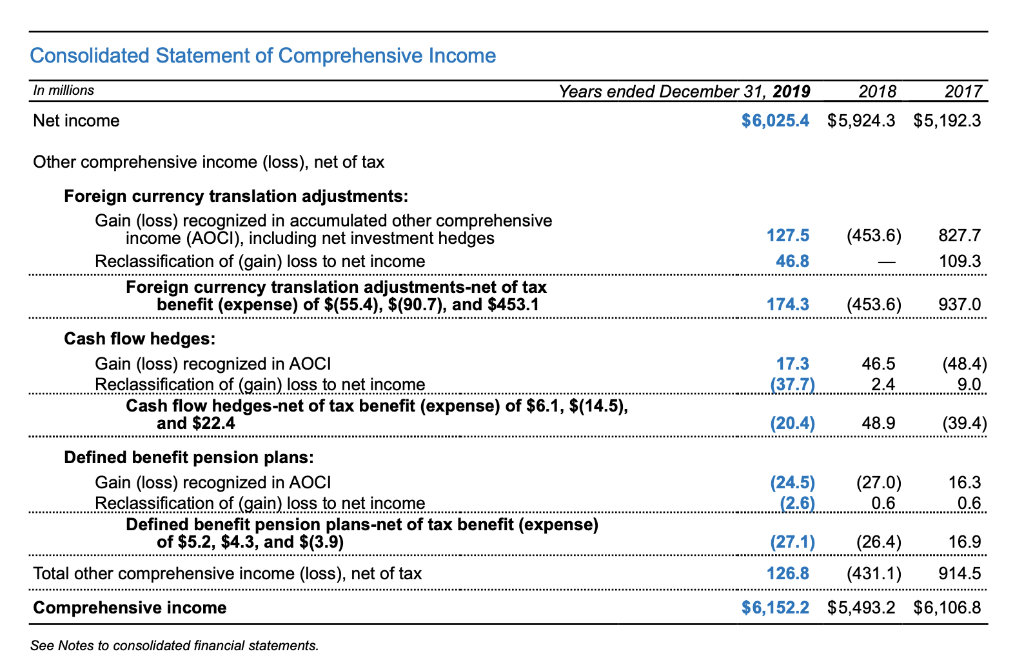

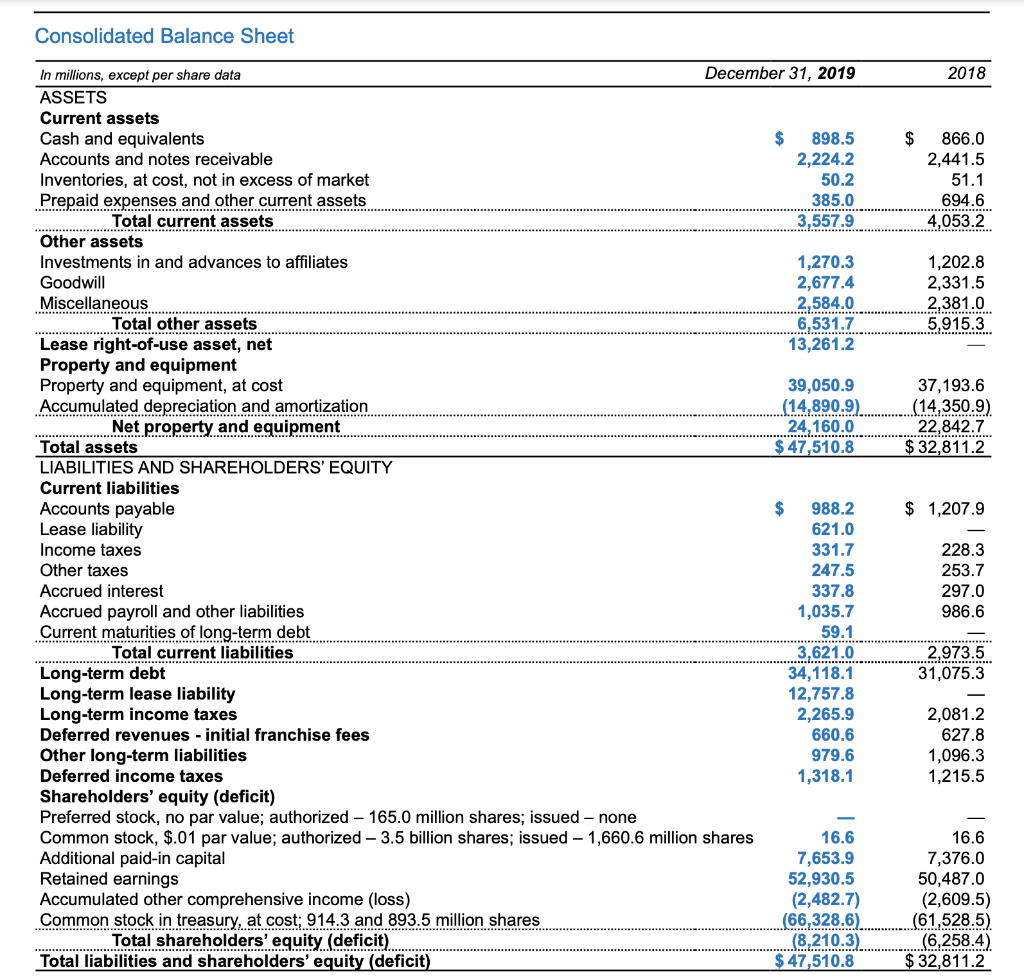

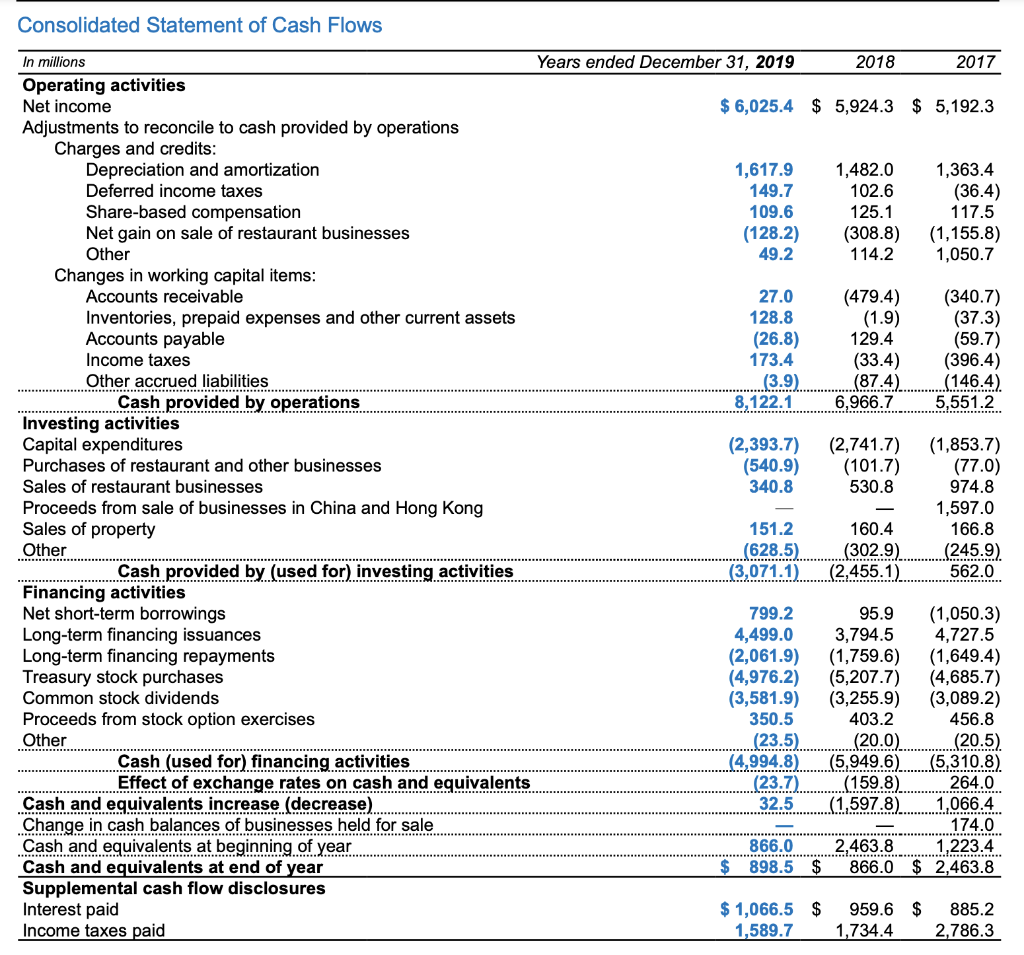

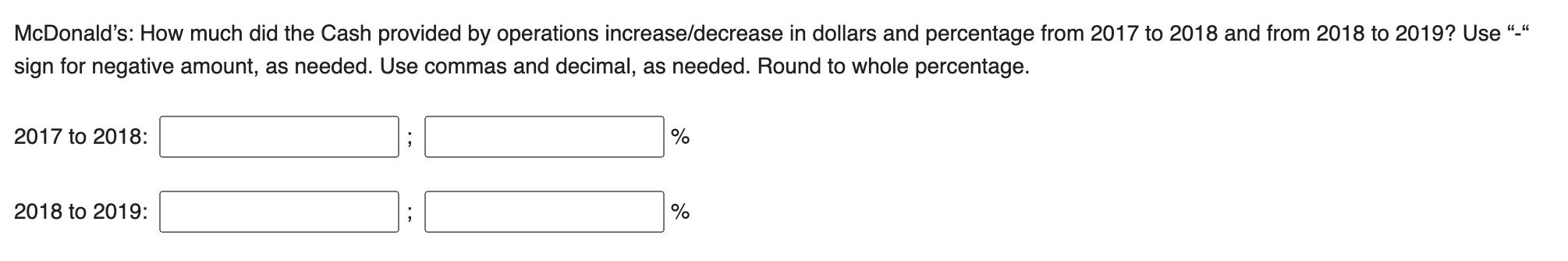

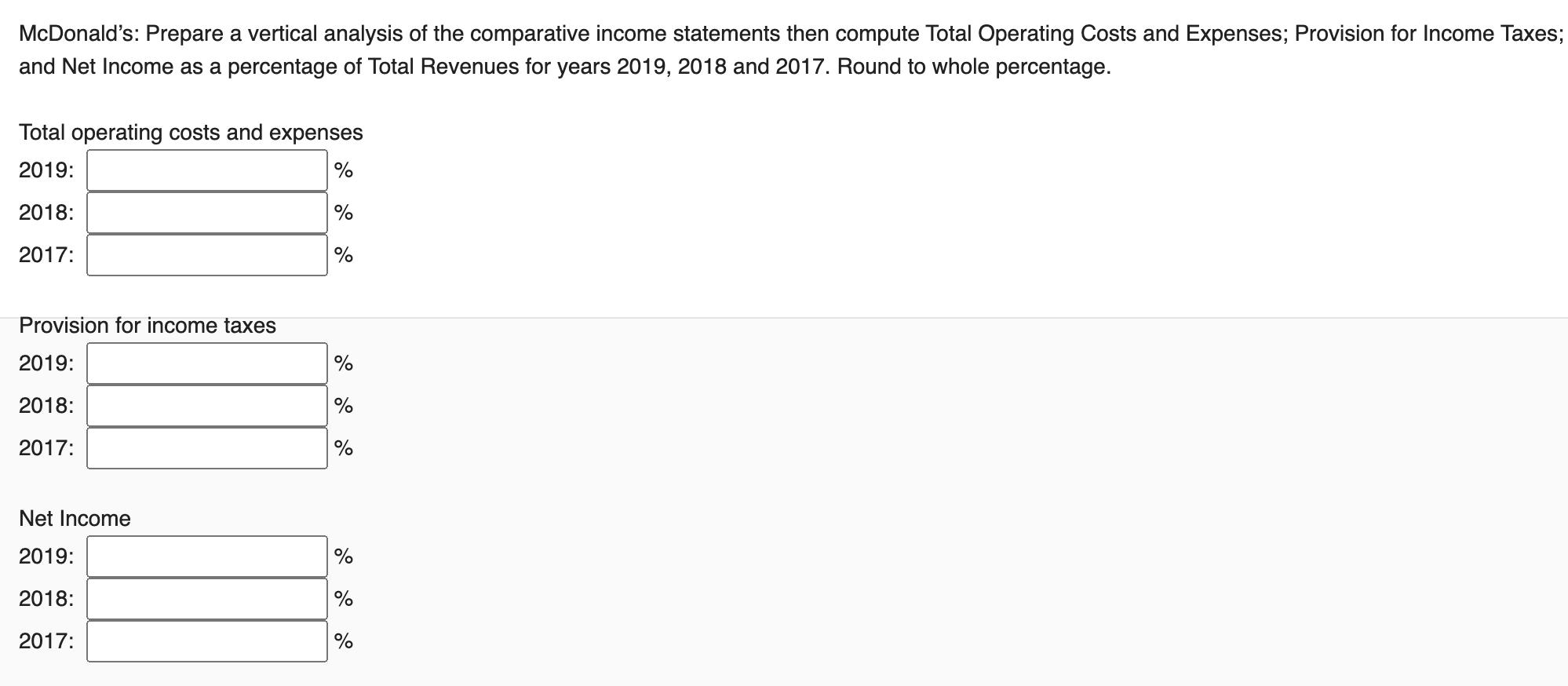

Consolidated Statement of Shareholders' Equity In millions, except per share data ............. Balance at December 31, 2016 Net income Other comprehensive income (loss), net of tax Comprehensive income Common stock cash dividends ($3.83 per share) Treasury stock purchases Share-based compensation .............. Stock option exercises and other Balance at December 31, 2017 Net income Other comprehensive income (loss), net of tax............... Comprehensive income Adoption of ASC 606 ......... Adoption of ASU 2016-16 (2) . Common stock cash dividends ($4.19 per share) Treasury stock purchases Share-based compensation Stock option exercises and other Balance at December 31, 2018 Net income ******** Other comprehensive income (loss), ...... net of tax Comprehensive income Common stock cash dividends ($4.73 per share) Treasury stock purchases Share-based compensation Stock option exercises and other Balance at December 31, 2019 Common stock Additional issued paid-in Shares Amount capital 1,660.6 $16.6 $6,757.9 1,660.6 1,660.6 117.5 197.0 16.6 7,072.4 125.1 178.5 16.6 7,376.0 Cash flow Foreign currency Retained earnings Pensions hedges translation $46,222.7 $(207.1) $ 22.9 $(2,908.7) 5,192.3 (3,089.2) 48,325.8 5,924.3 (450.2) (57.0) (3,255.9) 50,487.0 6,025.4 Accumulated other comprehensive income (loss) (3,581.9) 16.9 (39.4) 937.0 (190.2) (26.4) (216.6) 48.9 6.2 (16.5) (1,971.7) (866.5) (453.6) 32.4 (2,425.3) (27.1) (20.4) 174.3 Common stock in Total treasury shareholders' Amount equity Shares (841.3) $(52,108.6) $ (2,204.3) 5.192.3 109.6 168.3 1,660.6 $ 16.6 $7,653.9 $52,930.5 $(243.7) $ 12.0 $(2,251.0) (31.4) (32.2) 5.2 (893.5) (4,650.5) (25.0) 254.7 (56,504.4) (5,247.5) 223.4 (61,528.5) 914.5 0,100.0. 6.106.8 (4,980.5) (3,089.2) (4,650.5) 117.5 451.7 (3,268.0) 5,924.3 wwwwww (431.1) .............. 5,493.2 (450.2) (57.0) (3,255.9) .... (5,247.5) 125.1 401.9 (6,258.4) 6,025.4 (3,581.9) (4,980.5) 4,900.0 109.6 4.2 180.4 348.7 (914.3) $(66,328.6) $ (8,210.3) 126.8 6.152.2 Consolidated Statement of Comprehensive Income In millions Net income Other comprehensive income (loss), net of tax Foreign currency translation adjustments: Gain (loss) recognized in accumulated other comprehensive income (AOCI), including net investment hedges Reclassification of (gain) loss to net income Foreign currency translation adjustments-net of tax benefit (expense) of $(55.4), $(90.7), and $453.1 Cash flow hedges: Gain (loss) recognized in AOCI Reclassification of (gain) loss to net income Cash flow hedges-net of tax benefit (expense) of $6.1, $(14.5), and $22.4 Defined benefit pension plans: Gain (loss) recognized in AOCI Reclassification of (gain) loss to net income Defined benefit pension plans-net of tax benefit (expense) of $5.2, $4.3, and $(3.9) Total other comprehensive income (loss), net of tax Comprehensive income Years ended December 31, 2019 See Notes to consolidated financial statements. 2018 2017 $6,025.4 $5,924.3 $5,192.3 127.5 46.8 174.3 17.3 (37.7) (20.4) (24.5) (2.6) (453.6) 827.7 109.3 (453.6) 46.5 (48.4) 2.4 9.0 (39.4) 48.9 937.0 (27.0) 0.6 16.3 0.6 (27.1) (26.4) 16.9 126.8 (431.1) 914.5 $6,152.2 $5,493.2 $6,106.8 Consolidated Balance Sheet In millions, except per share data ASSETS Current assets Cash and equivalents Accounts and notes receivable Inventories, at cost, not in excess of market Prepaid expenses and other current assets Total current assets Other assets Investments in and advances to affiliates Goodwill Miscellaneous Total other assets Lease right-of-use asset, net Property and equipment Property and equipment, at cost Accumulated imulated depreciation and amortization Net property and equipment Total assets LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable Lease liability Income taxes Other taxes Accrued interest Accrued payroll and other liabilities Current maturities of long-term debt Total current liabilities Long-term debt Long-term lease liability Long-term income taxes Deferred revenues - initial franchise fees Other long-term liabilities Deferred income taxes December 31, 2019 Shareholders' equity (deficit) Preferred stock, no par value; authorized - 165.0 million shares; issued - none Common stock, $.01 par value; authorized - 3.5 billion shares; issued - 1,660.6 million shares Additional paid-in capital Retained earnings Accumulated other comprehensive income (loss) Common stock in treasury, at cost; 914.3 and 893.5 million shares Total shareholders' equity (deficit) Total liabilities and shareholders' equity (deficit) $ 898.5 2,224.2 50.2 385.0 3,557.9 1,270.3 2,677.4 2,584.0 6,531.7 13,261.2 39,050.9 (14,890.9) 24,160.0 $ 47,510.8 $ 988.2 621.0 331.7 247.5 337.8 1,035.7 59.1 3,621.0 34,118.1 12,757.8 2,265.9 660.6 979.6 1,318.1 16.6 7,653.9 52,930.5 (2,482.7) (66,328.6) (8,210.3) $ 47,510.8 $ 2018 866.0 2,441.5 51.1 694.6 4,053.2 1,202.8 2,331.5 2.381.0 5,915.3 37,193.6 (14,350.9) 22,842.7 $ 32,811.2 $ 1,207.9 228.3 253.7 297.0 986.6 ********* 2,973.5 31,075.3 2,081.2 627.8 1,096.3 1,215.5 16.6 7,376.0 50,487.0 (2,609.5) (61,528.5) (6,258.4) $ 32,811.2 Consolidated Statement of Cash Flows In millions Operating activities Net income Adjustments to reconcile to cash provided by operations Charges and credits: Depreciation and amortization Deferred income taxes Share-based compensation Net gain on sale of restaurant businesses Other Changes in working capital items: Accounts receivable Inventories, prepaid expenses and other current assets Accounts payable Income taxes Other accrued liabilities Cash provided by operations Investing activities Capital expenditures Purchases of restaurant and other businesses Sales of restaurant businesses Proceeds from sale of businesses in China and Hong Kong Sales of property Other Cash provided by (used for) investing activities Financing activities Net short-term borrowings Long-term financing issuances Long-term financing repayments Treasury stock purchases Common stock dividends Proceeds from stock option exercises Other Cash (used for) financing activities Effect of exchange rates on cash and equivalents Cash and equivalents increase (decrease) Change in cash balances of businesses held for sale Cash and equivalents at beginning of year Cash and equivalents at end of year Supplemental cash flow disclosures Interest paid Income taxes paid Years ended December 31, 2019 1,617.9 149.7 109.6 (128.2) 49.2 $6,025.4 $ 5,924.3 $ 5,192.3 27.0 128.8 (26.8) 173.4 (3.9) 2018 151.2 (628.5) (3,071.1) (33.4) (87.4) 8,122.1 6,966.7 1,482.0 102.6 125.1 (308.8) 114.2 (479.4) (1.9) (2,393.7) (2,741.7) (540.9) (101.7) 340.8 530.8 (23.7) 32.5 94.9 129.4 866.0 $ 898.5 $ 799.2 95.9 4,499.0 3,794.5 (2,061.9) (1,759.6) (4,976.2) (5,207.7) (3,581.9) (3,255.9) 403.2 350.5 (23.5) (20.0) 160.4 (302.9) (2,455.1) (4,994.8) (5,949.6) (159.8) (1,597.8) 2017 2,463.8 1,363.4 (36.4) 117.5 (1,155.8) 1,050.7 (340.7) (37.3) (59.7) (396.4) (146.4) 5,551.2 (1,853.7) (77.0) 974.8 1,597.0 166.8 (245.9) 562.0 (1,050.3) 4,727.5 (1,649.4) (4,685.7) (3,089.2) 456.8 (20.5) (5,310.8) 264.0 1,066.4 174.0 1,223.4 866.0 $ 2,463.8 $1,066.5 $ 959.6 $ 885.2 1,589.7 1,734.4 2,786.3 McDonald's: How much did the Cash provided by operations increase/decrease in dollars and percentage from 2017 to 2018 and from 2018 to 2019? Use "-" sign for negative amount, as needed. Use commas and decimal, as needed. Round to whole percentage. 2017 to 2018: 2018 to 2019: % % McDonald's: Prepare a vertical analysis of the comparative income statements then compute Total Operating Costs and Expenses; Provision for Income Taxes; and Net Income as a percentage of Total Revenues for years 2019, 2018 and 2017. Round to whole percentage. Total operating costs and expenses 2019: % 2018: 2017: Provision for income taxes 2019: 2018: 2017: Net Income 2019: 2018: 2017: % % % % % % % %

Step by Step Solution

★★★★★

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started