Question

Coronano Herbs Sdn Bhd (CHSB) is a resident company that manufactures health and beauty products. The company just started its business on 1.3.2019 with a

Coronano Herbs Sdn Bhd (CHSB) is a resident company that manufactures health and beauty products. The company just started its business on 1.3.2019 with a paid-up capital of RM2 millions. The accounts are closed on 30 September every year. CHSB presented its Statement of Profit or Loss and Other Comprehensive Income for the financial year ended 30 September 2020 as follows:

REQUIRED:

Assuming that you are the appointed tax agent for Coronano Herbs Sdn Bhd, compute the tax liability for the company for the year of assessment 2020 by showing all relevant tax adjustments. Beside changes in Budget 2020, you need to also consider the economic stimulus package 2020 in calculating the tax liability. (Note: Your answer must list every item stated in the profit or loss statement and notes. Indicate with 'NIL' where no adjustment is necessary).

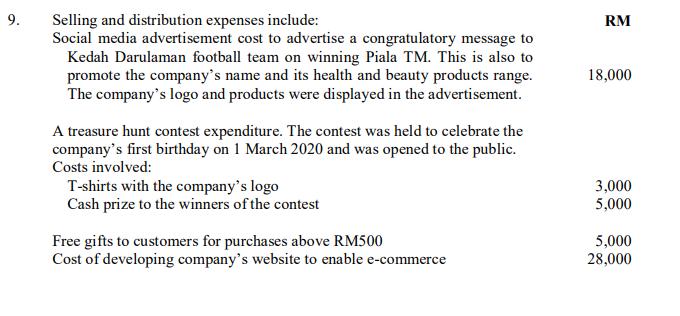

Coronano Herbs Sdn Bhd Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 September 2020 Note Sales Less: Cost of sales Gross profit Dividend income Other income Less: Expenses Salaries and wages Legal and professional fees Depreciation of property, plant and machinery Entertainment expenses Repair and maintenance Provision for bad debts (general) Research and development expenditure Selling and distribution expenses Other expenses Profit before tax 1 23 4 45 5 69 7 8 9 10 RM 313,000 44,200 120,000 70,000 39,900 28,000 65,000 64,000 28,800 RM 2,800,000 (1,270,000) 1,530,000 127,000 83,300 1,740,300 (772,900) 967,400

Step by Step Solution

3.37 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

i Profit before tax RM 4 000 000 ii Tax payable RM 1 000 000 iii ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started