Answered step by step

Verified Expert Solution

Question

1 Approved Answer

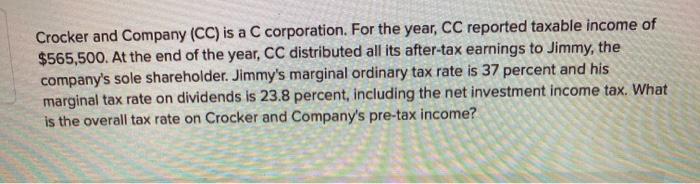

Crocker and Company (CC) is a C corporation. For the year, CC reported taxable income of $565,500. At the end of the year, CC

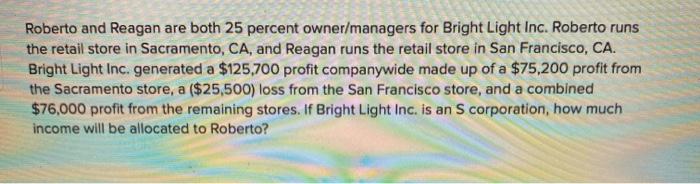

Crocker and Company (CC) is a C corporation. For the year, CC reported taxable income of $565,500. At the end of the year, CC distributed all its after-tax earnings to Jimmy, the company's sole shareholder. Jimmy's marginal ordinary tax rate is 37 percent and his marginal tax rate on dividends is 23.8 percent, including the net investment income tax. What is the overall tax rate on Crocker and Company's pre-tax income? Roberto and Reagan are both 25 percent owner/managers for Bright Light Inc. Roberto runs the retail store in Sacramento, CA, and Reagan runs the retail store in San Francisco, CA. Bright Light Inc. generated a $125,700 profit companywide made up of a $75,200 profit from the Sacramento store, a ($25,500) loss from the San Francisco store, and a combined $76,000 profit from the remaining stores. If Bright Light Inc. is an S corporation, how much income will be allocated to Roberto?

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started