Answered step by step

Verified Expert Solution

Question

1 Approved Answer

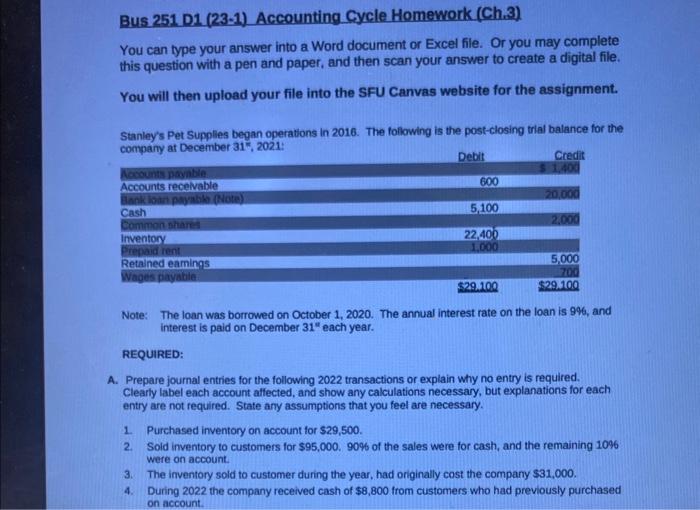

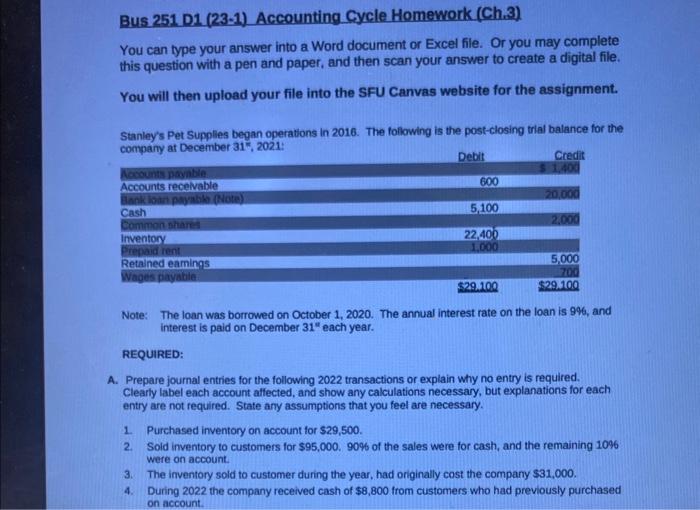

Accounting cycle Bus 251 D1 (23-1) Accounting Cycle Homework (Ch.3) You can type your answer into a Word document or Excel file. Or you may

Accounting cycle

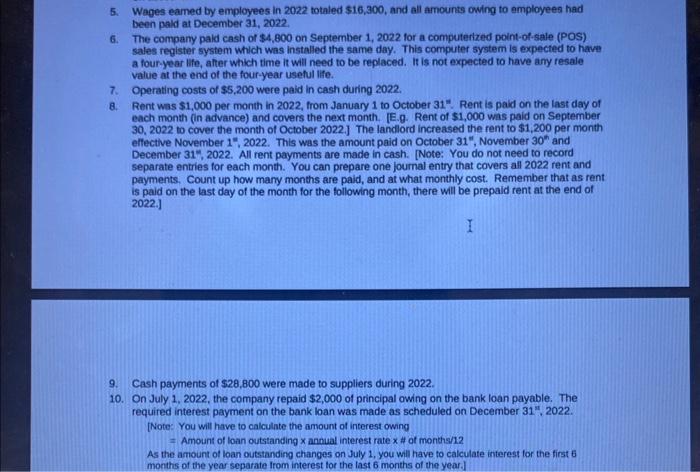

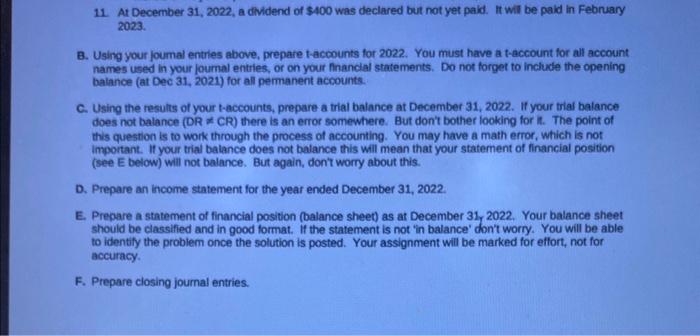

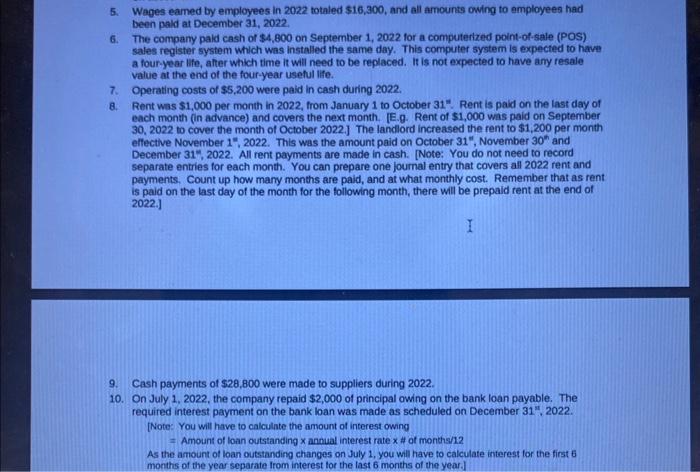

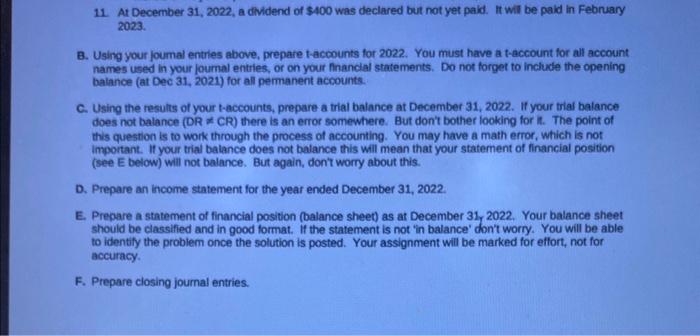

Bus 251 D1 (23-1) Accounting Cycle Homework (Ch.3) You can type your answer into a Word document or Excel file. Or you may complete this question with a pen and paper, and then scan your answer to create a digital file. You will then upload your file into the SFU Canvas website for the assignment. Stanleys Pet Supplies began operations in 2016. The following is the post-closing trial balance for the Sankeys Pet Supples began operato Note: The loan was borrowed on October 1,2020 . The annual interest rate on the loan is 996 , and interest is paid on December 31 each year. REQUIRED: A. Prepare journal entries for the following 2022 transactions or explain why no entry is required. Clearly label each account affected, and show any calculations necessary, but explanations for each entry are not required. State any assumptions that you feel are necessary. 1. Purchased inventory on account for $29,500. 2. Sold inventory to customers for $95,000. 90% of the sales were for cash, and the remaining 10%6 were on account. 3. The inventory sold to customer during the year, had originally cost the company $31,000. 4. During 2022 the company received cash of $8,800 from customers who had previously purchased on account. 5. Wages eamed by employees in 2022 totaled $16,300, and all amounts owing to amployees had been pald at December 31, 2022. 6. The company paid cash of $4,800 on September 1, 2022 for a computerized point-of-sale (POS) sales register system which was installed the same day. This computer system is expected to have a four-year life, ahter which time it will need to be replaced. It is not expected to have any resale value at the end of the four-year useful life. 7. Operating costs of $5.200 were paid in cash during 2022. 8. Rent was $1,000 per month in 2022, from January 1 to October 31=. Rent is paid on the last day of each month (in advance) and covers the next month. [E.g. Rent of $1,000 was paid on September 30,2022 to cover the month of October 2022.] The landlord increased the rent to $1,200 per month effective November 1", 2022. This was the amount paid on October 31, November 30n and December 31 ", 2022. All rent payments are made in cash. [Note: You do not need to record separate entries for each month. You can prepare one journal entry that covers all 2022 rent and payments. Count up how many months are paid, and at what monthly cost. Remember that as rent is paid on the last day of the month for the following month, there will be prepaid rent at the end of 2022.] 9. Cash payments of 528,800 were made to suppliers during 2022. 10. On July 1, 2022, the company repaid $2,000 of principal owing on the bank loan payable. The required interest payment on the bank loan was made as scheduled on December 3171,2022. [Note: You will have to calculate the amount of interest owing = Amount of loan outstanding x annual interest rate x \# of months/12. As the amount of loan outstanding changes on July 1 , you will have to calculate interest for the first 6 months of the year separate trom interest tor the last 6 months of the year.] 11. At December 31, 2022, a dividend of $400 was declared but not yet paid. It wil be paid in February 2023. B. Using your joumal entries above, prepare t-accounts for 2022. You must have a t-account for all account names used in your jourmal entries, or on your financial statements. Do not forget to include the opening balance (at Dec 31, 2021) for all permanent accounts. C. Using the results of your t-accounts, prepare a trial balance at December 31, 2022. If your trial balance does not balance (DR CR) there is an error somewhere. But don't bother looking for it. The point of this question is to work through the process of accounting. You may have a math error, which is not important. If your trial balance does not balance this will mean that your statement of financial position (see E below) will not balance. But again, don't worry about this. D. Prepare an income statement for the year ended December 31, 2022. E. Prepare a statement of financial position (balance sheet) as at December 31 y 2022. Your balance sheet should be classified and in good format. If the statement is not 'in balance' don't worry. You will be able to identify the problem once the solution is posted. Your assignment will be marked for effort, not for accuracy. F. Prepare closing journal entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started