Accounting Cycle Exercise Exercise: In this exercise, you are asked to identify and define the types/characteristics of recurring or year-end adjusting entries that are applicable

Accounting Cycle Exercise

Exercise:

In this exercise, you are asked to identify and define the types/characteristics of recurring or year-end adjusting entries that are applicable and suitable for reversing entries.

In business, many accounting entries are recorded to (or captured directly by) the accounting system each day. Some of these entries will be repeating because of the nature of the events, such as paying wages, paying utility bills, etc. These entries are called "recurring" entries.

In the accounting cycle, accountants record fiscal year-end adjusting entries (FYE) before they prepare for the financial statements. Many of these FYEs are relate to some of the recurring entries previously described, such as accrued wages expense, accrued utility expense, etc. Go through Step 2 below thoroughly and carefully if you are not familiar with different types of FYEs.

A very last step in the accounting cycle is the reversing entries which is optional. That means accountants have the choice to adopt it or not. Go through Step 1 below thoroughly and carefully if you are not familiar with the reversing entry concept.

This exercise requires you to identify recurring entries and FYEs relate to 8 out of 10 most commonly involved accounts in the year-end procedure. System Understanding Aid case covers some of them. Intermediate Accounting I and II courses cover them all. You can go back to these sources if you need to refresh your memory.

In this exercise, you are going to find that some of these entries, recurring or FYEs, are applicable to the reversing entries and others are not, after you follow through Step 1 and 2 below. Your task in this exercise is to discover/define the reasons causing this difference. Try to make sure the accuracy of your entries in Step 1 and 2 before you move on to Step 3.

One of the results from your analysis may include this: reversing entries should be adopted to recurring entries and/or FYEs with xxxxxx (i.e., certain characteristics) because xxxxxx. Reversing entries should NOT be adopted to recurring entries and/or FYEs with xxxxxx (i.e., certain characteristics) because xxxxxx.

Requirements:

Please follow three steps below and turn in the following items:

- (20 points) A business memo addressing to me about your finding (i.e., types/characteristics of year-end adjusting entries that are applicable and suitable for reversing entries). Please follow the memo writing rubric,

- (10 points) Your work in Table I,

- (20 points) Diagrams that you come up with to support your work in Table I (you can use those that I have created below, but please use different dates and figures),

- (10 points) Your work in Table III

Please follow the following steps:

Step 1: Understand What a Reversing Entry Is?

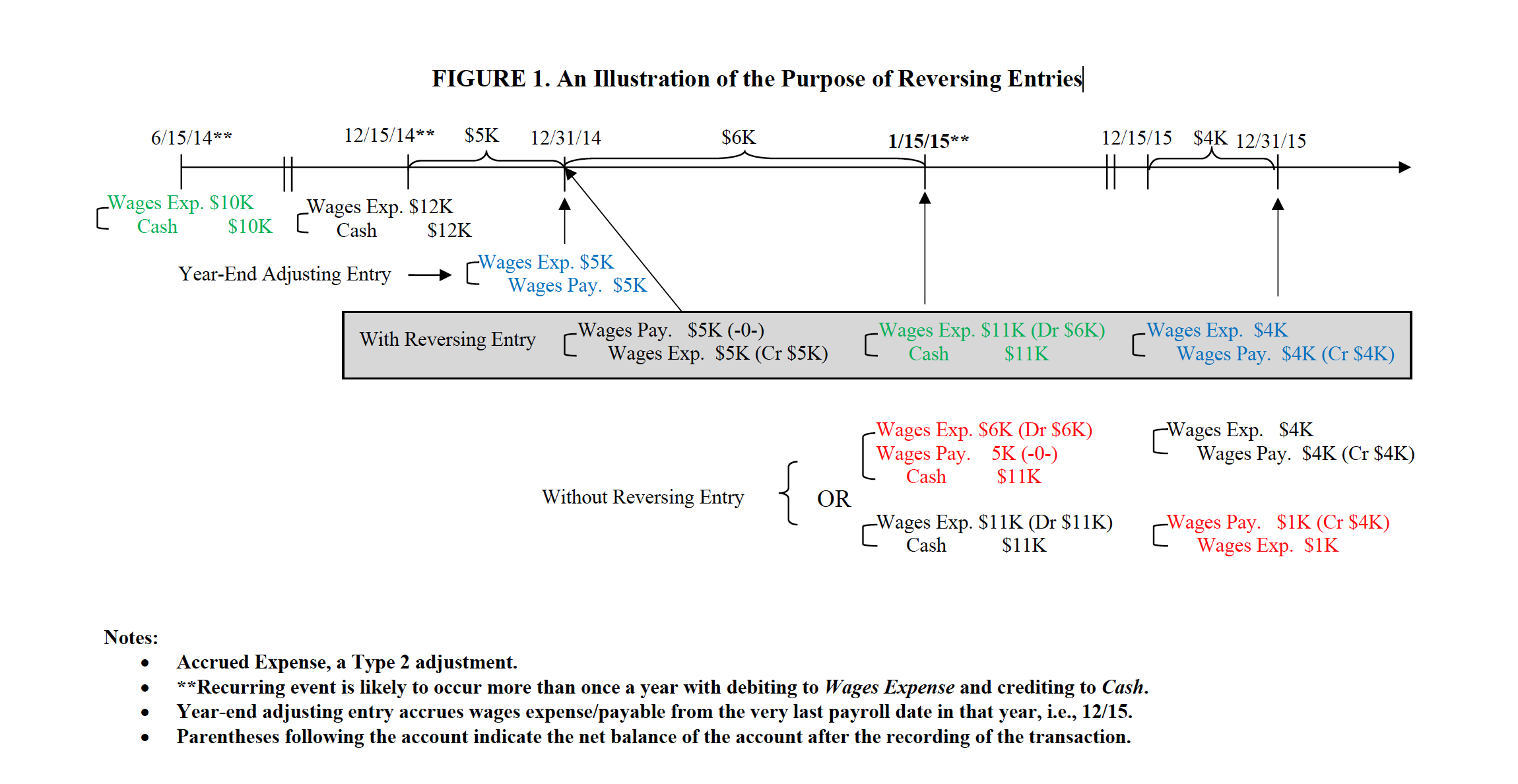

The purpose of reversing entries, as indicated in the textbooks, is to ease the process of recording for some of the routinely occurred transactions that are involved in year-end adjusting entries as if these adjusting entries had not taken place or as if the fiscal year-end had not occurred (Kieso, Weygandt, and Warfield, 2013; Scott 2013; Walther, 2000; and Weygandt, Kimmel and Kieso, 2014). Figure 1 illustrates a commonly adopted example from the textbooks, i.e., payroll transaction. In the example, the company processes and records its payroll on the fifteenth of each month. The illustration shows that a routinely occurred monthly payroll transaction involves a debit to Wages Expense and a credit to Cash with a monthly incurred payroll amount (e.g., $10K for the month of May 15th - June 14th paid on June 15th, $12K for November 15th - December 14th paid on December 15th, and $11K for December 15th - January 14th paid on January 15th).

Since the fiscal year-end of the company is on December 31, 2014, the company accrues its payroll from December 15th to December 31st in year-end adjustments by debiting to Wages Expense and crediting to Wages Payable for $5K. The Wages Expense will be closed in the closing process at the year end, leaving a credit balance in the amount of $5K in the Wages Payable account before the beginning of the next fiscal year, a new accounting cycle. Without reversing entries, the company will have Wages Payable and Wages Expense accounts overstated in the system after they process and record their payroll on January 15th until the year end of 2015 when they prepare and record year-end adjusting entries, assuming that they record the payroll transaction the same way routinely as in 2014. The company needs to take into account the overstatements in these two accounts and the accrued payroll from December 15th to December 31st, instead of just the latter, when they make year-end adjustments in the second year, 2015.

The company may make an adjustment to the recording of the payroll on January 15th, 2015, instead of just following their routine payroll entries, to offset the overstatements. For example, they can debit Wages Expense for $6K and Wages Payable for $5K, and credit Cash for $11K. This way, the overstatements in Wages Expense and Wages Payable are offset in the recurring transaction, and the ending adjusting entry for the second year is going to follow the same routine; that is, to accrue for the payroll from December 15th to December 31st, 2015.

However, it will be efficient and effective for the company to adopt the reversing entry process right after they close the book and begin a new accounting cycle, especially if the recording of payroll entries and year-end adjustments are done by two different employees. When the reversing entry procedure is followed, the overstatement in Wages Payable will be offset and a reduction in Wages Expense equal to the amount that was accrued in the year-end adjustment will be entered into the book at the beginning of a new cycle. The Wages Expense account will end up with a correct amount equal to the wages accrued from January 1st to January 14th when the payroll transaction is recorded as usual on January 15th (Figure 1). In addition, in the year-end adjustments of the second year, the company only needs to accrue for the payroll that is accrued between their last payroll transaction and the end of the fiscal year as they have encountered in 2014. They are free from concerns about any overstatements from the beginning of the year in their year-end adjustments as indicated previously. As a result, it is efficient and effective in terms of recording transactions if we follow the procedure of recording reversing entries in this example.

To sum up, we can say that based on the illustration in Figure 1, there are two outcomes after a reversing entry is applied correctly, i.e., (1) the recording of the repeating/recurring entry stays the same as previously, and (2) the recording of the fiscal year-end adjusting entry in the subsequent year stays the same as previously. Both conditions are required in order for the reversing entries to be applicable.

Step 2: Apply the Concept of Reversing Entry

Reversing entries are only applicable/suitable to some of the year-end adjusting entries. In order to find types/characteristics of year-end adjusting entries that are applicable and suitable for reversing entries, you need to understand all types of year-end adjusting entries first. Please familiar yourself with the types of adjusting entries below.

Types of year-end adjusting entries?

Basically, there are seven possible types of year-end adjusting entries as follows:

- Accrued revenue:

In a simple form, it means that revenue is recognized before cash is received. Revenues such as interests, rental, etc. are examples of accounts that will be accrued in the year-end adjustments.

- Accrued expense:

In a simple form, it means that expense is recognized before cash is paid. Expenses such as interests, rental, utilities, payroll, etc. are examples of accounts that will be accrued in the year-end adjustments.

- Deferred revenue:

In a simple form, it means that cash for a revenue account is received before the company performs and completes the revenue event (e.g., delivering the products or providing the services). Deposits/advances from customers or tenants are examples of revenues that will be deferred in the year-end adjustments.

- Deferred expense:

In a simple form, it means that cash for an expense is paid before the company uses it. Deposits or prepayments made by the company to utility/insurance companies or landlords are examples of expenses that will be deferred in the year-end adjustments.

- Changes in estimates/asset valuation adjustments/expirations:

There are estimates used for fixed and other assets (e.g., number of useful years, salvage value, etc.). The company may change estimates on their recording of depreciation, amortization, and depletion, as well as accounts receivable/bad debt. There are also asset valuation adjustments (Baskerville 2011) made to reflect values of assets according to GAAP (e.g., supplies, accounts receivable, inventory, fair

value reporting). In addition, there are expirations on certain assets and liabilities (FinanceReading.com), such as expirations on unearned revenues, prepaid insurance/rent, depreciation on assets, etc. So, these changes/adjustments/expirations will be made in the year-end adjustments. Their definitions may be overlapping and are not exclusive from each other.

- Changes in principle:

The company may want to change their ways of recording inventory (e.g., average cost to LIFO) and/or revenues from long-term contracts (e.g., completed-contract to percentage-of-completion). Thus the company needs to make an adjusting entry at the year-end.

- Corrections of errors

The company also needs to correct any errors in reporting in their year-end adjustments.

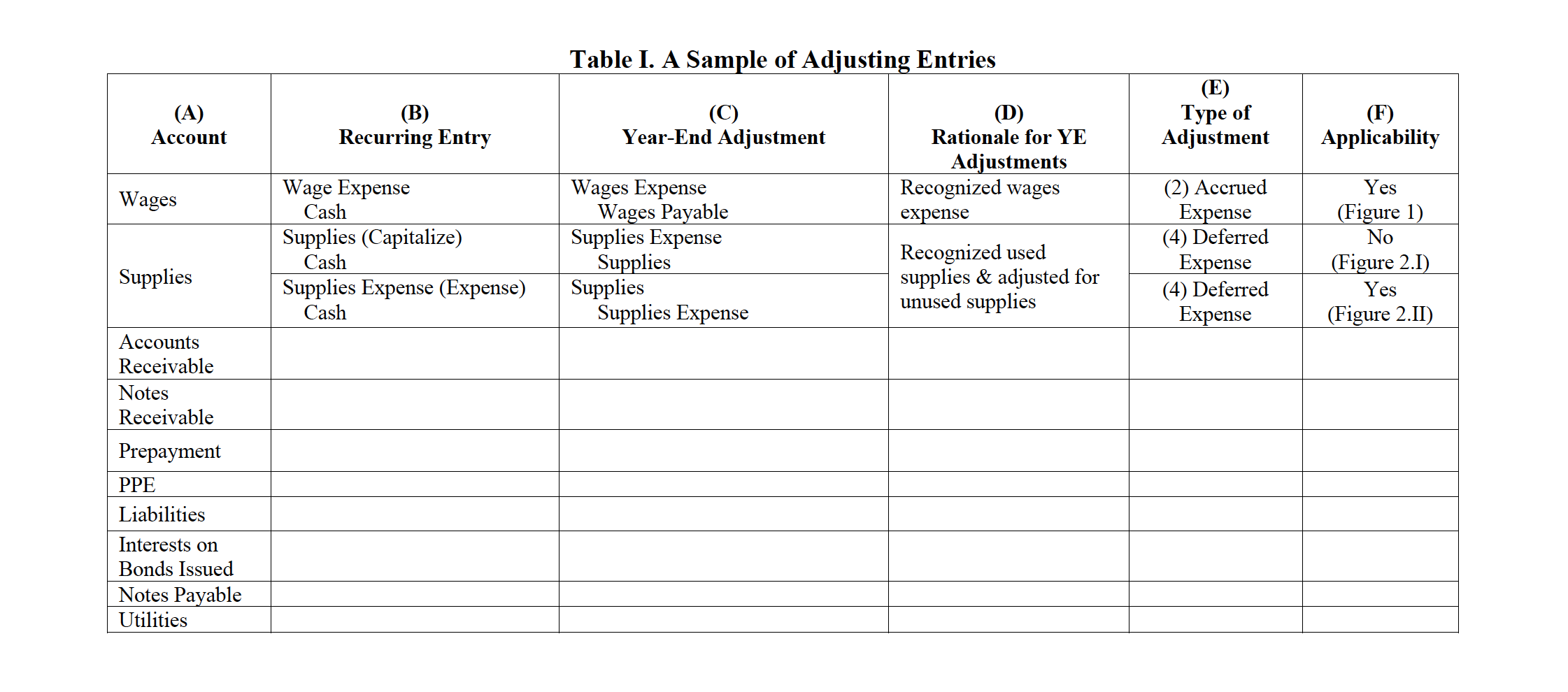

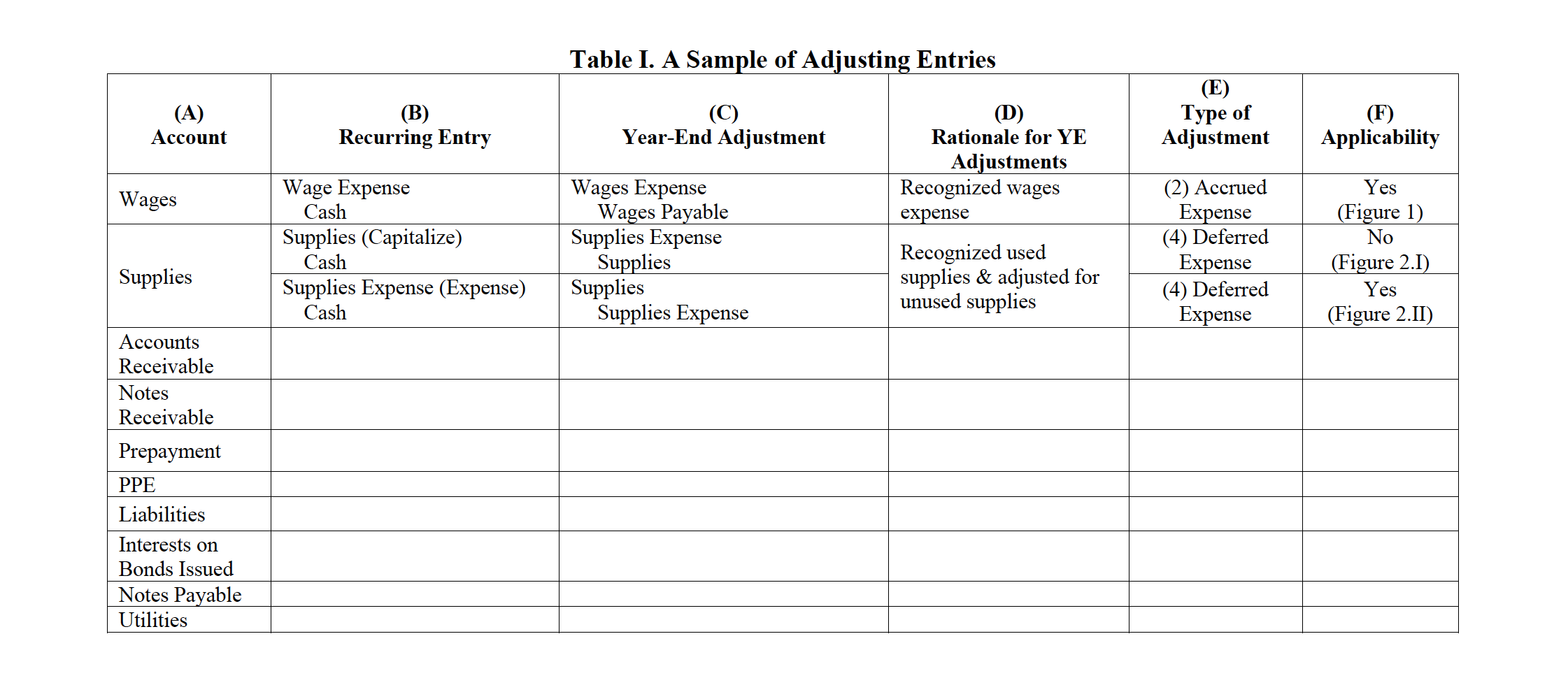

Table I provides a sample list of accounts which may be subjected to the year-end adjusting entries. You have learned about these adjustments from Intermediate Accounting courses. Along with each Account (Column A), Recurring Entry (Column B), and Year-End Adjustment (Column C), Table I also provides its Rationale (Column D), Type of Adjustments (Column E), and Applicability of a reversing entry (Column F).

You are required to apply your general understanding of reversing entries acquired from previous step to these recurring entries and year-end adjusting entries by filling out Columns B-F. You need to come up with the recurring and year-end adjusting entries, provide the rationale of the year-end adjusting entries, identify the type of each year-end adjusting entry, and determine if a reversing entry is applicable or not given your understanding of the reversing entries from Step 1 of the exercise. Please be aware that you may apply different ways of recording a recurring entry, e.g., capitalization or expense.

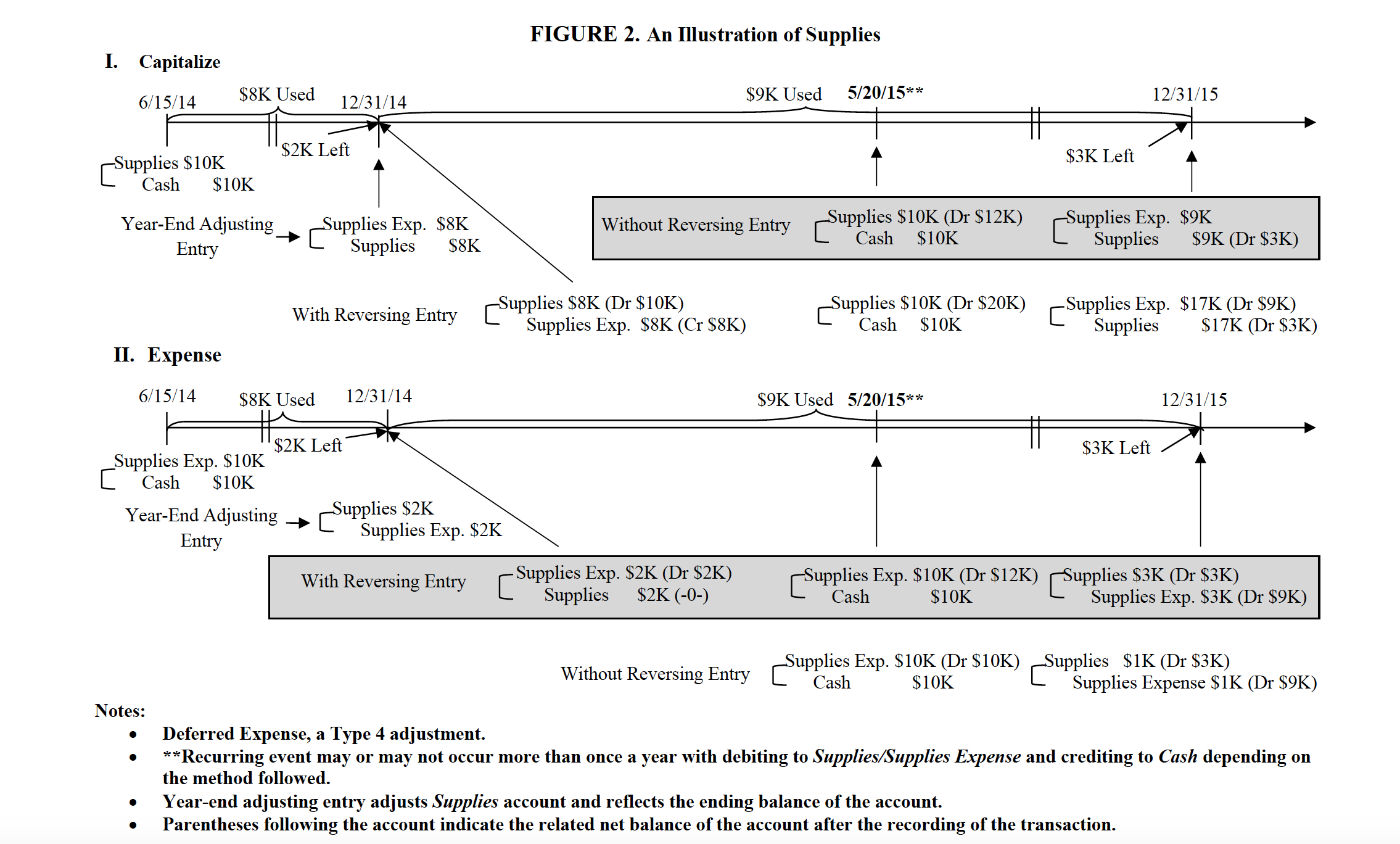

You are provided with an additional example, i.e., Supplies (see Appendix A & Figure 2). Remember to create a similar diagram as Figure 1 or Figure 2 for each account. You are required to submit these diagrams.

Step 3: Summarize Your Findings

At the end of Step 2, you should have a comprehensive understanding of the concepts, such as accruals and deferrals, types of adjusting entries, the processes of year-end adjusting entries and closing, and application of reversing entries. However, you may not be able to come up with the types/characteristics of year-end adjusting entries that are applicable and suitable for reversing entries yet, i.e., the solution of the exercise. Therefore, you will need to observe and find patterns from your work.

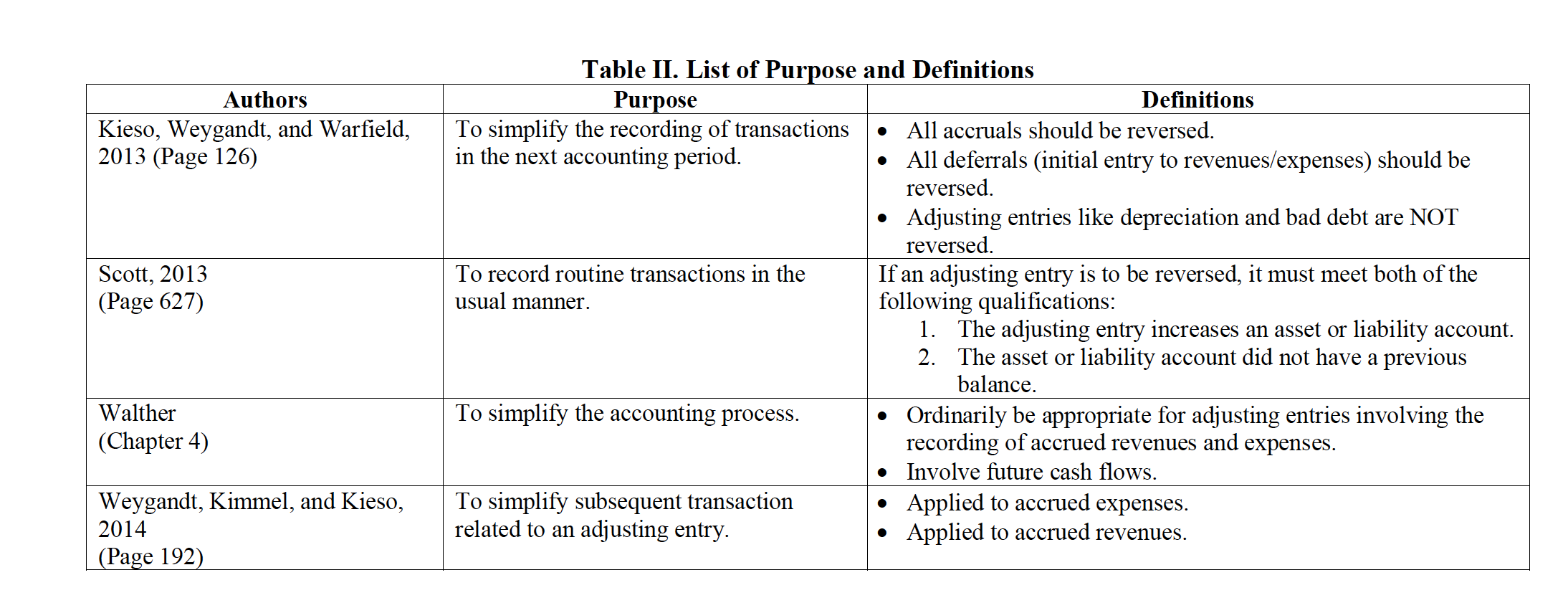

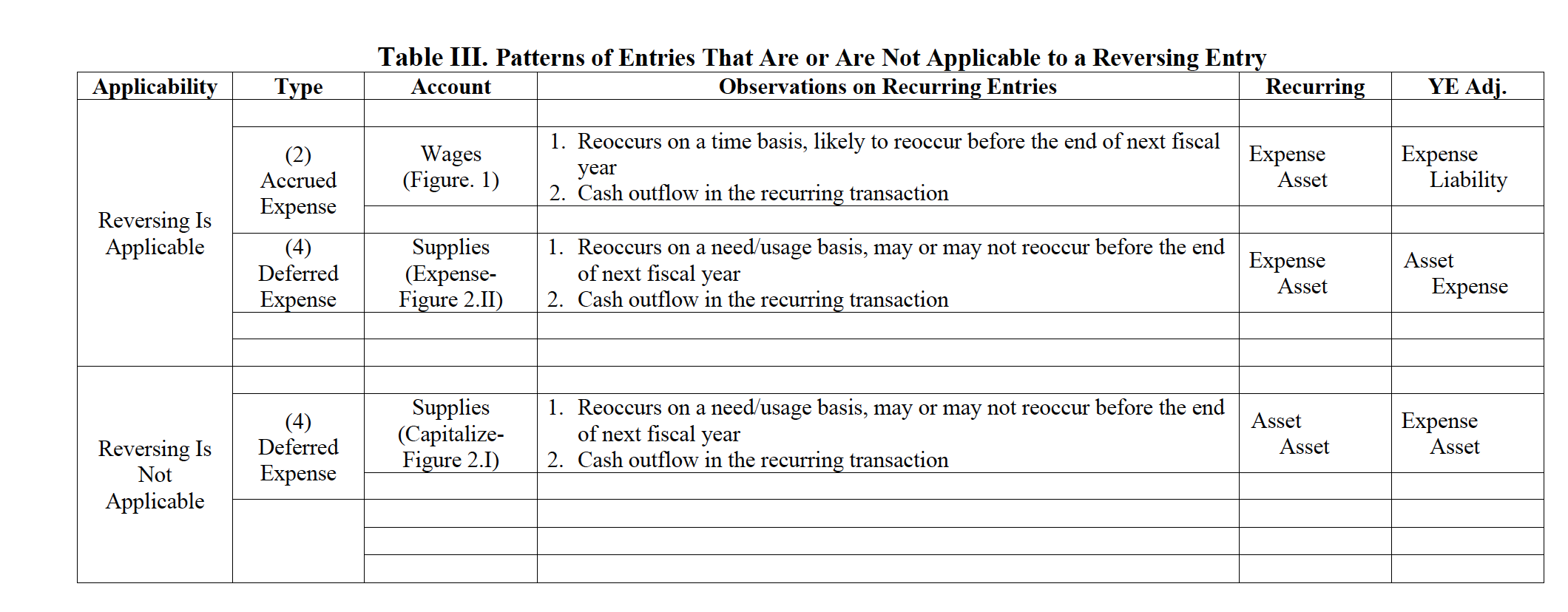

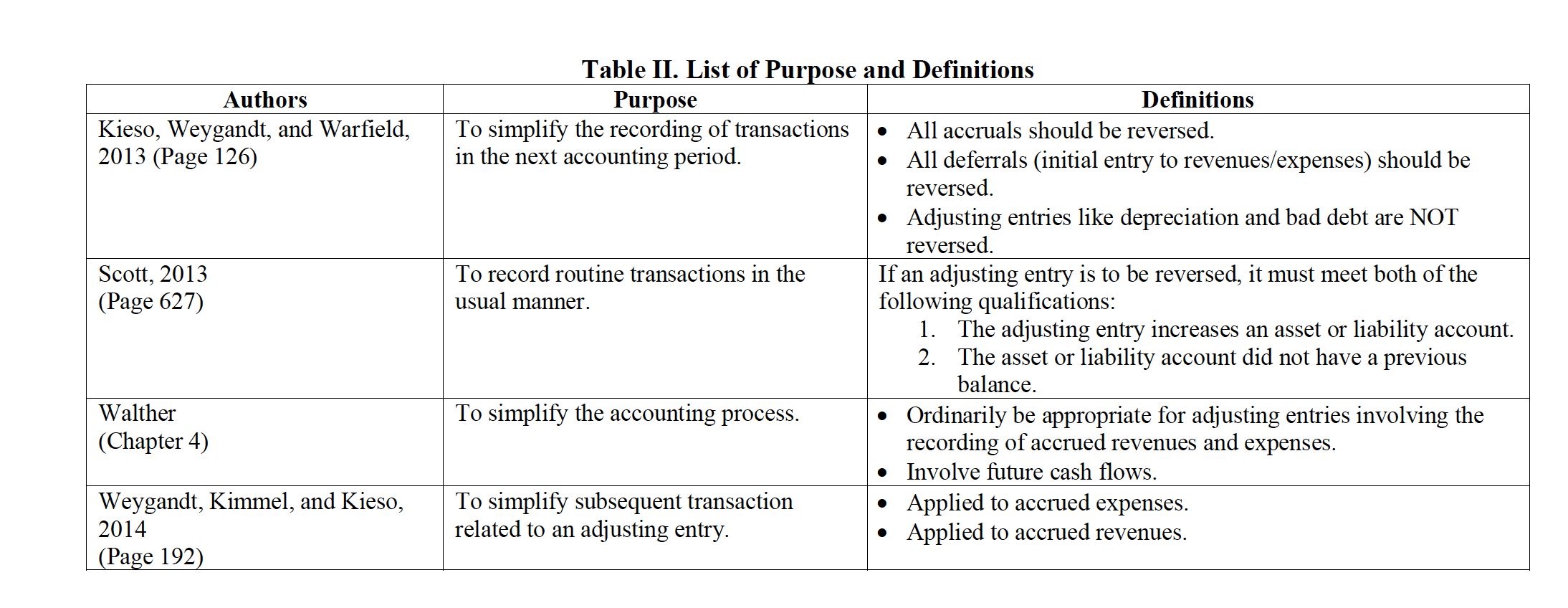

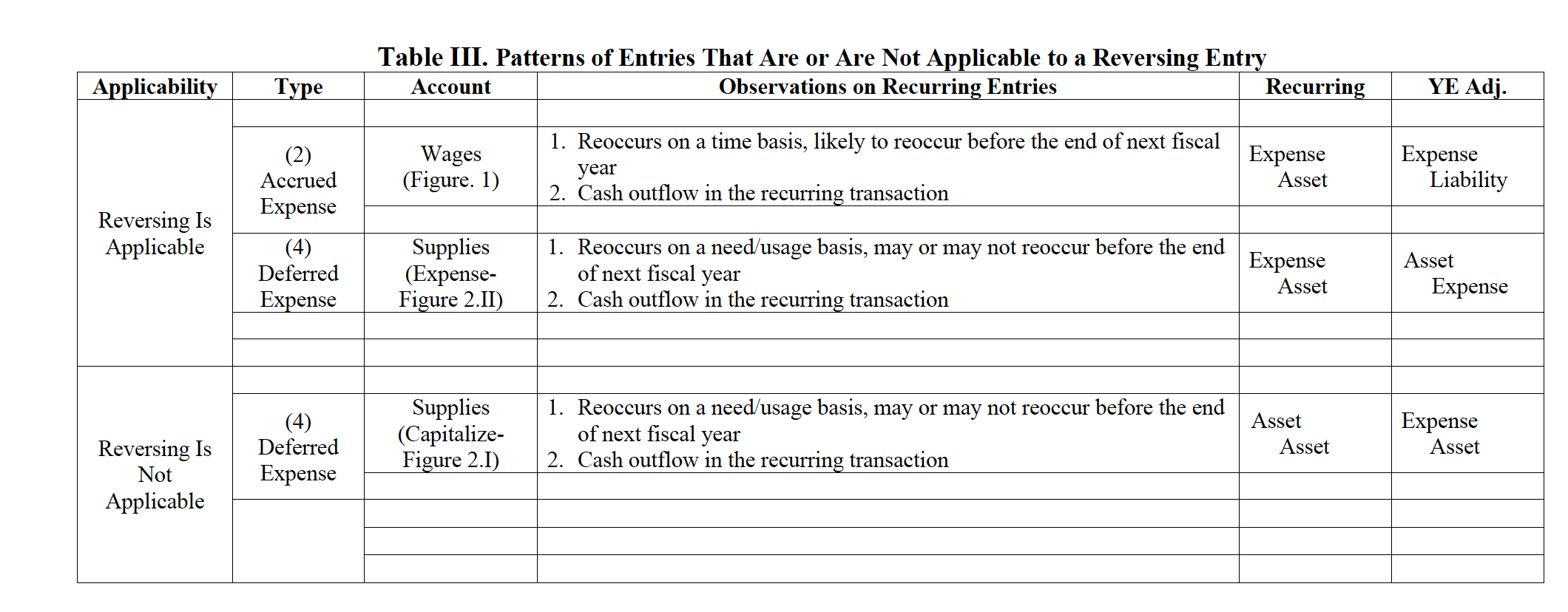

In this step, you will try to figure out patterns from the diagrams that you created from Step 2 and come up with your answers. First, you can try to see if the definitions from the textbooks authors will be helpful to you or not (see Table II). In addition, you may want to gather and organize your work from Step 2 such as the type of recurring entry, the basis of its recurring, the frequency of recurring, type of year-end adjusting entry, whether cash flow is involved, and/or others, etc., along with the applicability of reversing entry. Table III shows an example of patterns in which observations can be gathered together based on (1) if reversing entry is applicable and (2) type of adjusting entry. You may come up with different patterns/categories and gather things differently, which is perfectly alright.

You should try to come up with something even if it may not be a solution for the exercise. You are scuss/defend/debate your thoughts/findings with others. Try to utilize your work from

Step 2 and Step 3 to form a basis.

APPENDIX A

Supplement of A Supplies Example

Supplies (see Figure 2)

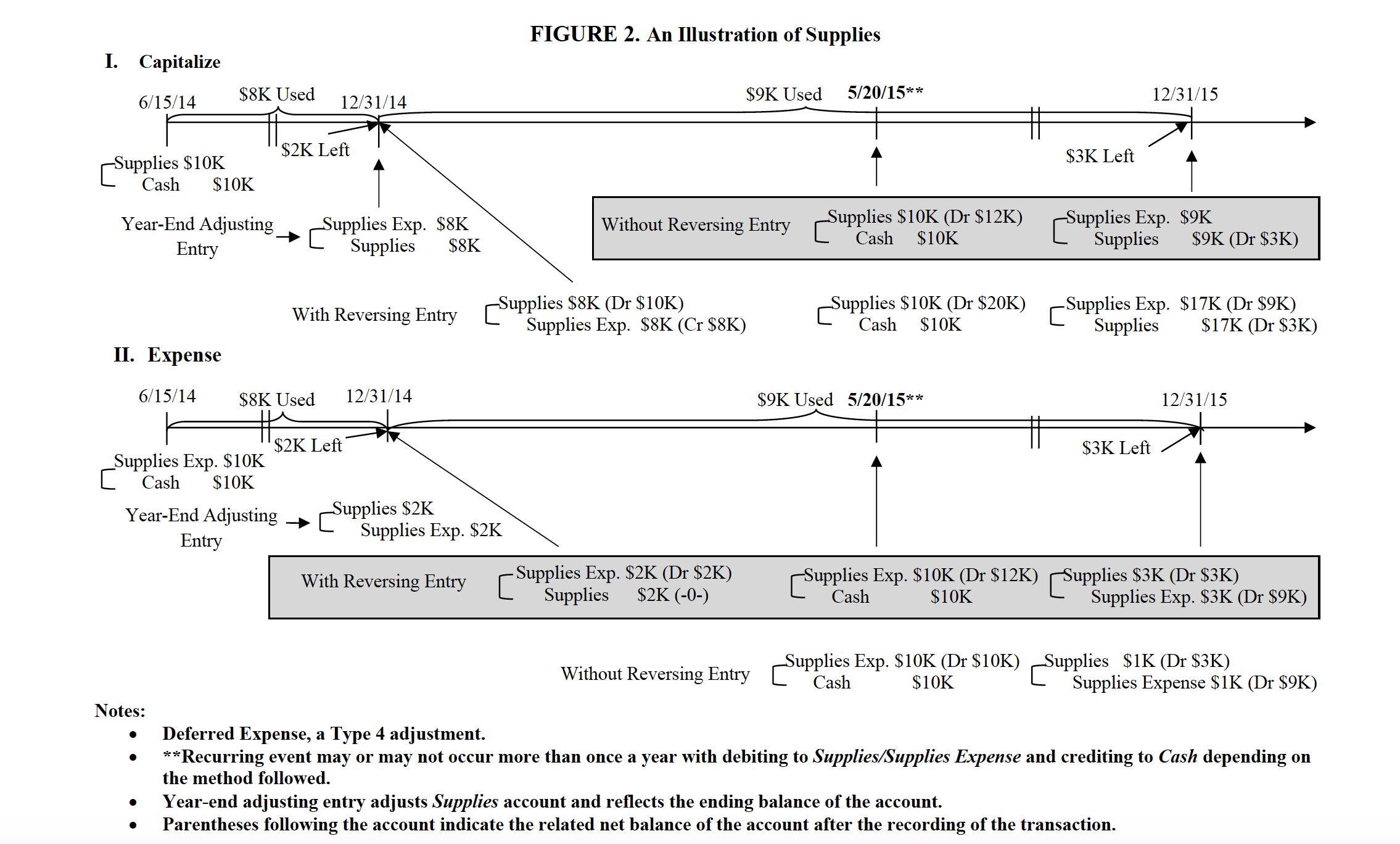

Figure 2 shows two illustrations involving supplies. There are two ways that accountants can record supplies, i.e., capitalization or expense. In Figure 2.I, we can see that the original or recurring entry was a debit to the asset, i.e., supplies, following the capitalization method (or deferred expense). At the end of the year, we record the use of supplies (or recognize unused supplies) by debiting Supplies Expense and crediting Supplies in the year-end adjustment (a Type 4 adjustment?deferred expense). In this example, there are $8K of supplies used and $2K of supplies left at the end of 12/31/14. Without making a reversing entry, we need to record the same entry as 6/15/14 when we purchase additional $10K of supplies on 5/20/15. Since the $8K supplies expense has been closed on 12/31/2014, we will accumulate supplies to $12K after a purchase on 5/20/2015. In the year-end adjustment on 12/31/15, we will recognize for the supplies used and disclose for the amount that is left, e.g., $9K and $3K, by debiting Supplies Expense and crediting Supplies the amount of $9K. So, we will keep recording the same way when we (1) purchase additional supplies and (2) make adjustments at the end of the year, i.e., recording the actual usage of the supplies and offsetting the amount of stock in supplies.

If we will be making reversing entries in this case, we will offset the recording of the usage of supplies in the Supplies account while leaving supply inventories to the original amount that was purchased last year. Thus, after the reversing entry, the remaining balance in Supplies account becomes

$10k at the beginning of 2015. In the year-end adjustment on 12/31/15, we have to debit the sum of the amount of supplies used in previous year (2014) and the amount used in the current year (2015), i.e.,

$8k+$9k), to the Supplies Expense account. We will also need to adjust the supplies account by offsetting the amount of used supplies from the total supplies that we purchased in these years (i.e., $10K + $10K -

$3K). As a result, reversing entry is not applicable in this situation since we will have to do more calculations in the year-end adjustment if we make a reversing entry.

On the other hand, when we expense the supplies, i.e., debiting Supplies Expense as we purchase, the reversing entry will ease the recording (see Figure 2.II). In this case, we can see that we will record the same entries in the recurring entries and in the adjustments on 12/31/14 and 12/31/15, i.e., recording the amount of supplies purchased and left. If we do not make a reversing entry, we will have to do additional calculations, either subtracting the actual usage of supplies from the purchase or subtracting the actual supplies level left from the one we retained earlier in the previous year, in the adjustment on 12/31/15.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started