Question

ACCOUNTING CYCLE MONOPOLY Complete accounting cycle include ten columns trial balances using data from journal entries Mechanics and Assumptions: Each player taking one turn (excluding

ACCOUNTING CYCLE MONOPOLY

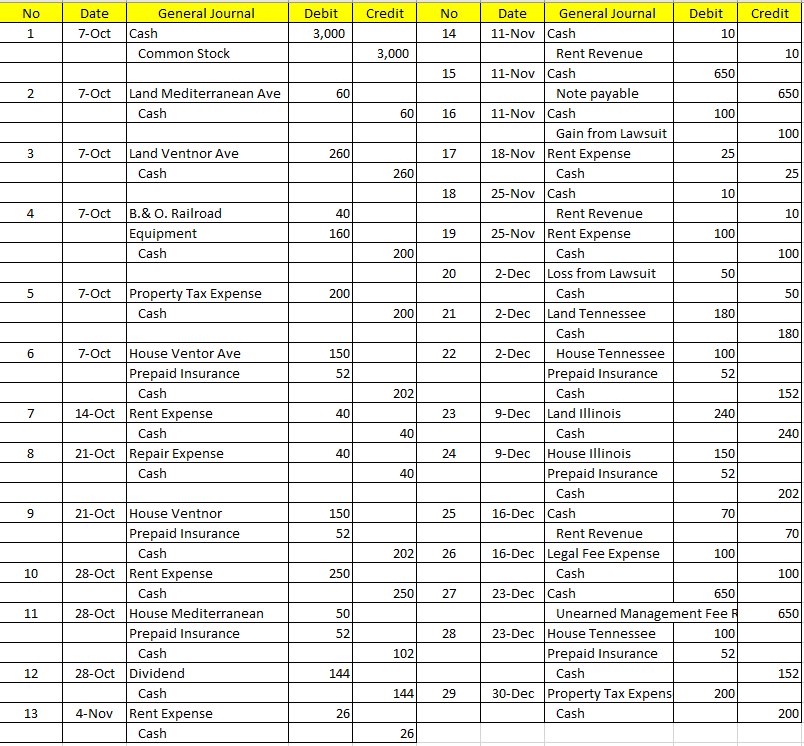

Complete accounting cycle include ten columns trial balances using data from journal entries

Mechanics and Assumptions:

- Each player taking one turn (excluding doubles) constitutes one week. All transactions occur on Monday of each week. One quarter is 13 weeks.

- The person that takes the first turn of the new week should loudly and clearly announce which week it is, reminding all players to change the week in their accounting records.

- If you roll doubles, you should move and roll again. If you roll doubles three times, do NOT go to jailinstead pay a fine of $100 to the bank and record it as Legal Fees Expense. Your turn is now complete.

- Record all entries using proper general journal format, dated by week. Adjusting entries must include explanations and supporting calculations.

- You may NOT declare bankruptcy. If you cannot pay bills or simply wish additional funds, you may borrow in $1000 increments at 15% interest. All such loans are one year in length and may not be paid off early. Any interest due on loans will be paid in cash on the first day of next quarter (the quarter following the game play).

- Cash must be reconciled periodically. See more info below.

Passing GO:

Each time you pass GO, you will receive $650 cash. Cash received the first time you pass GO should be considered a loan from the bank and be recorded as a Note Payable. The loan is a 6 month, 5% loan. Loans may not be paid off early. See item (e) above for information regarding interest.

The second time and anytime thereafter that you pass GO and receive $650, it should be recorded as Unearned Management Fee Revenue. Fees are earned evenly over a 13 week period, starting with the week you received it. By the end of the game, if anyone has not passed GO a second time, immediately advance to GO and collect the $650.

Depreciation Information:

Depreciation must be calculated to the nearest week. In other words, if you buy a house in week 5 and you are recording depreciation for the quarter, you would record 9 weeks of depreciation (week 5,6,7,8,9,10,11,12,13). Assume 52 weeks in a year. Use the following information to calculate depreciation:

| Asset | Life | Depreciation Method | Salvage |

| House RR Equip Utility Equip |

7 yr | Straight-line Double declining balance Double declining balance | 20% of cost 10% of cost 10% of cost |

Taxes:

Whenever a square or community chest or chance card requires payment of any type of

tax , increase the Property Tax Expense ac count. If you land on the In co me Tax Square, do not take the time to calculate your net worth; simply pay $200 and record it as Property Tax Expense.

Calculate and accrue corporate income tax expense at the end of the 13 weeks. The corporate tax rate is 25%. If you have a net loss, calculate a tax credit and record it as a Deferred Tax Asset. Hint: This should be your final adjusting journal entry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started