accounting cycle project

please help

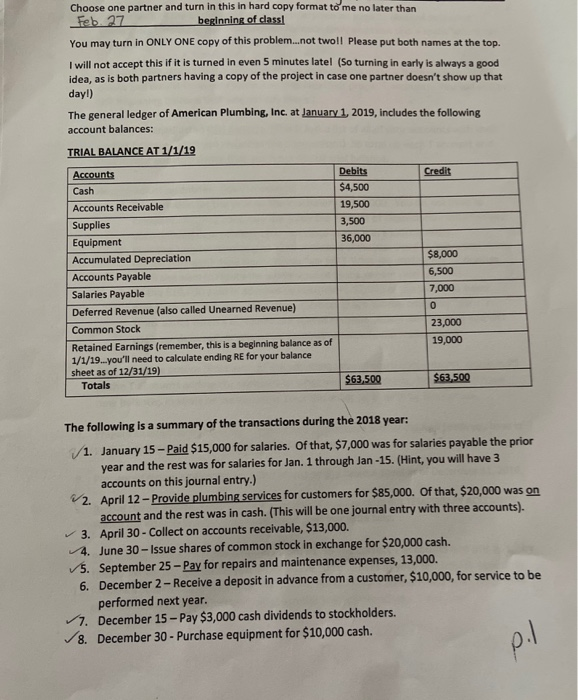

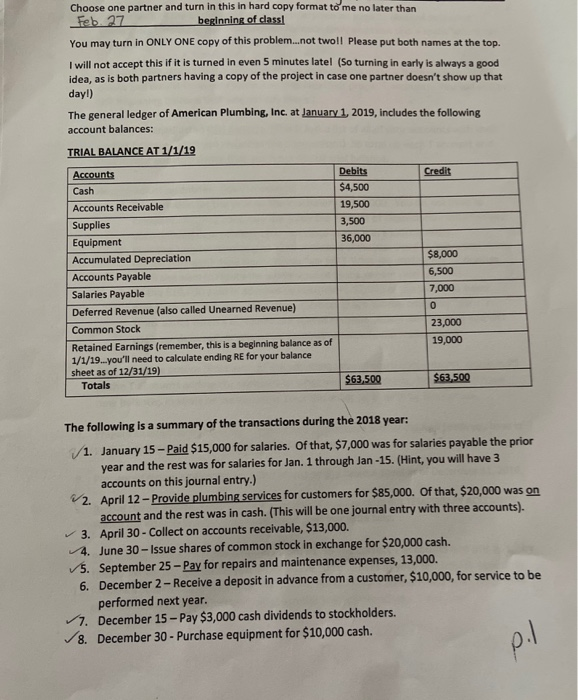

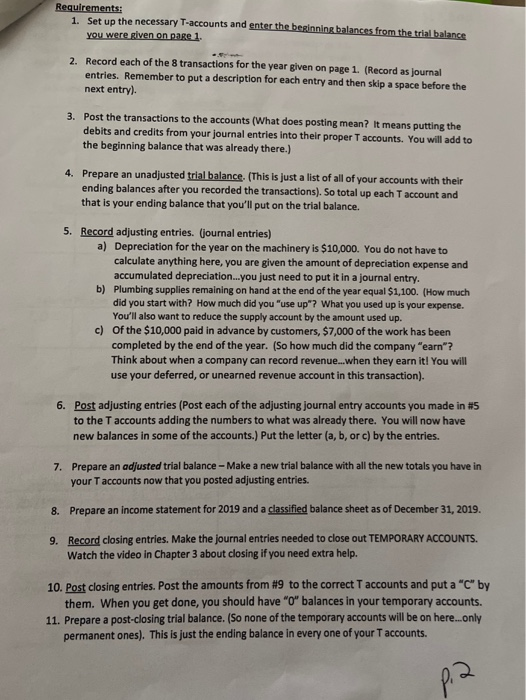

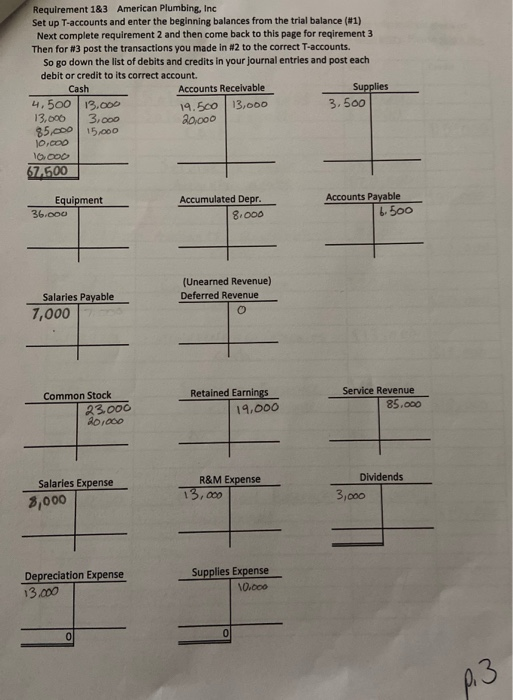

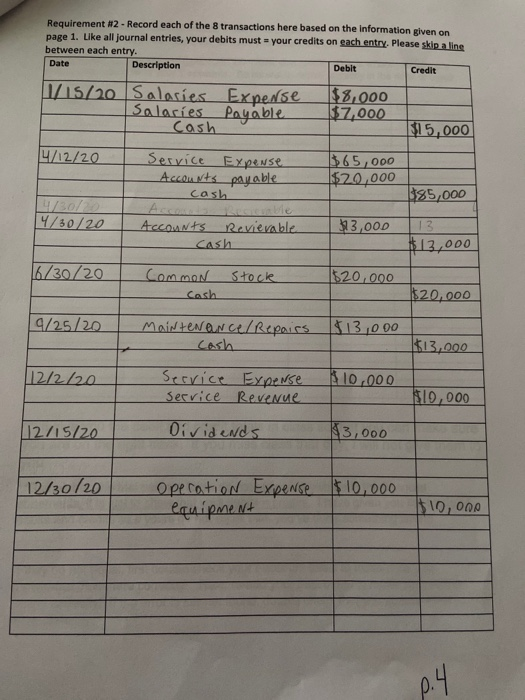

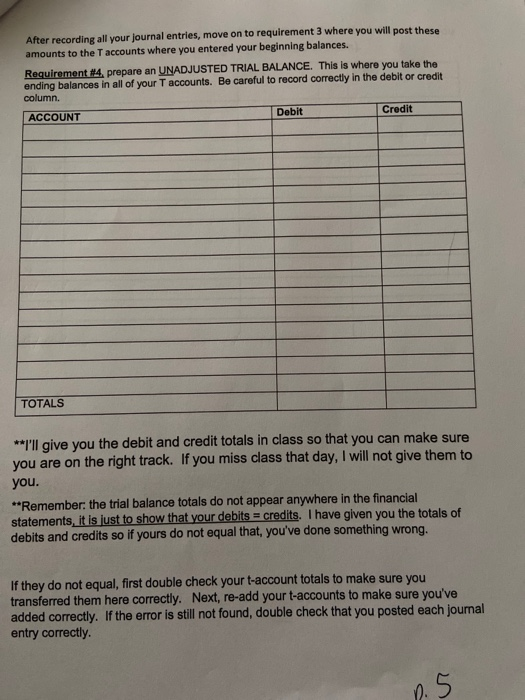

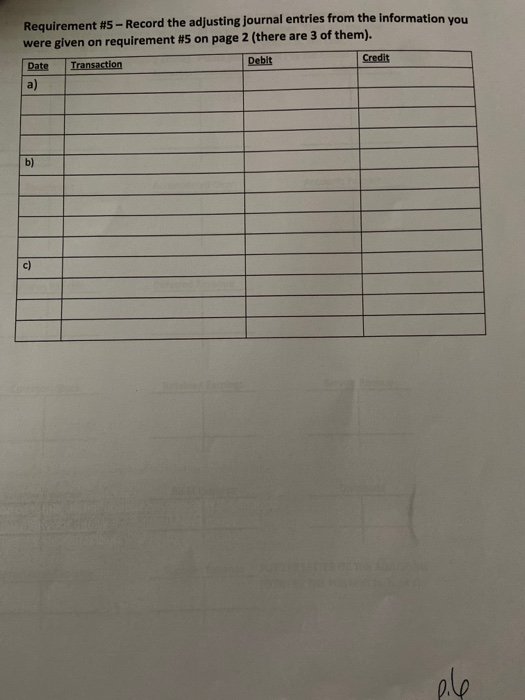

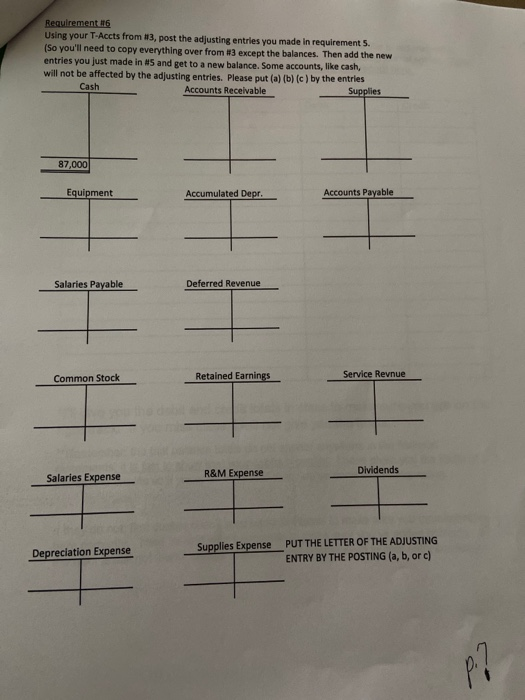

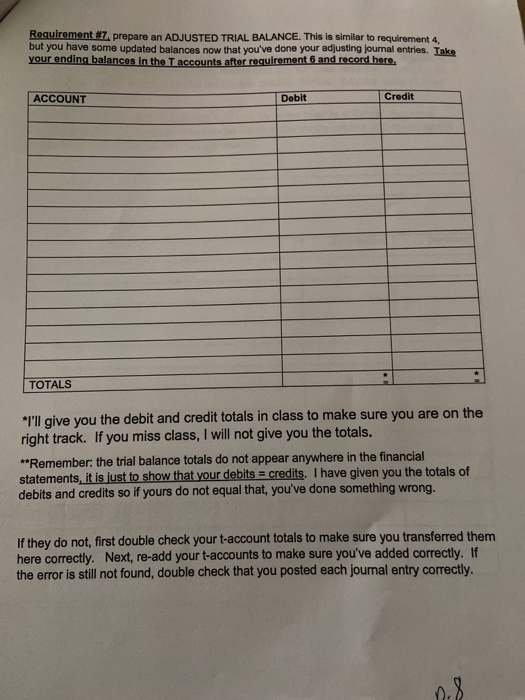

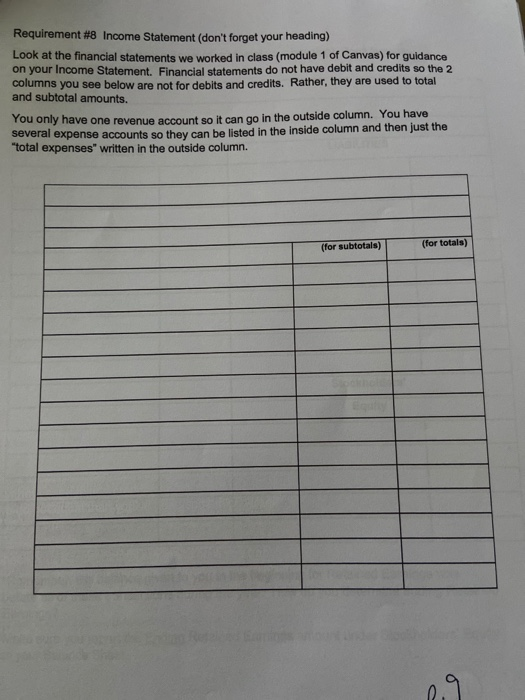

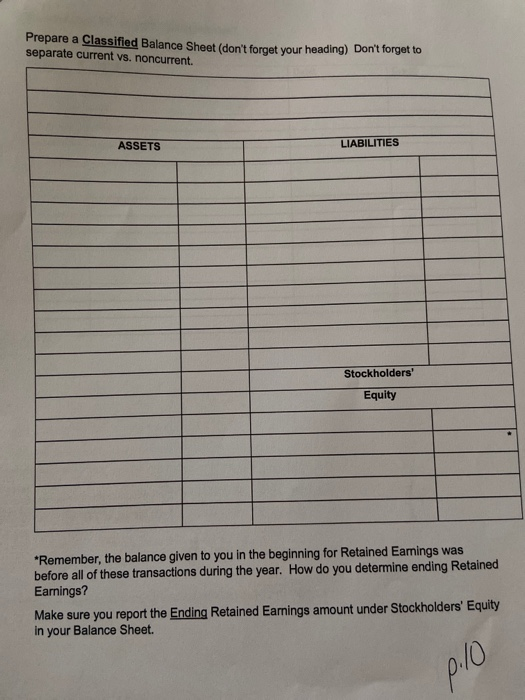

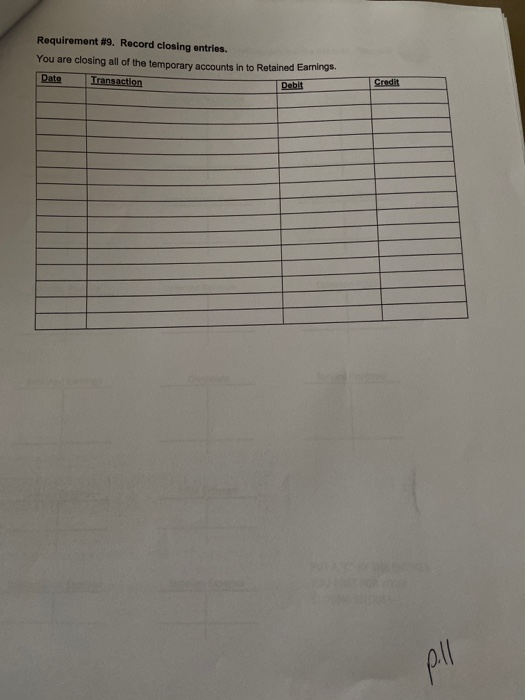

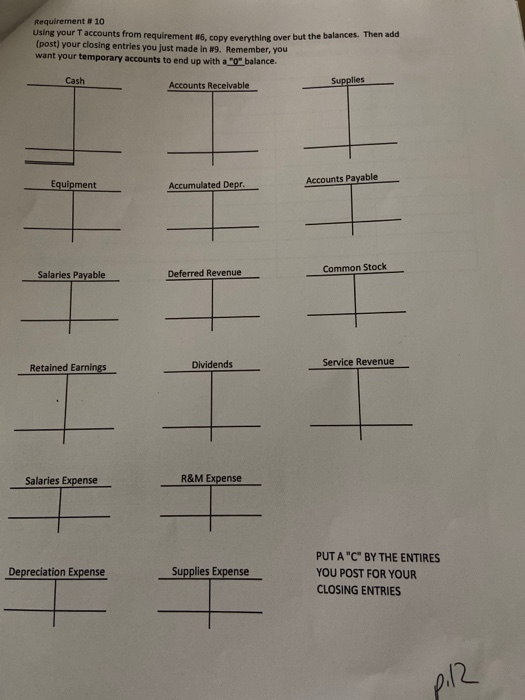

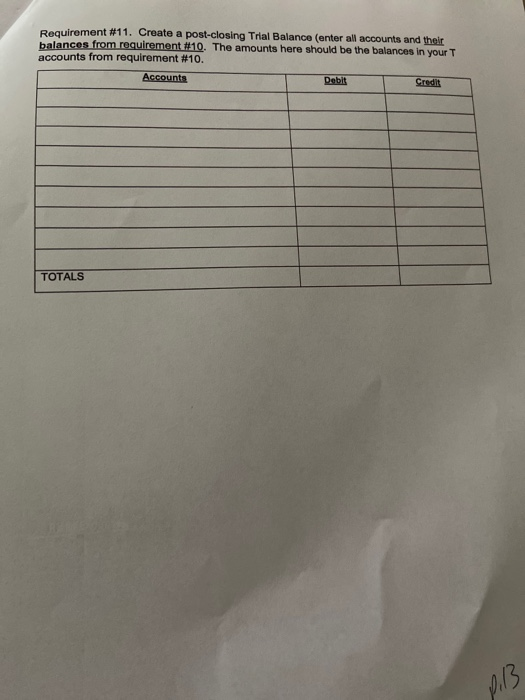

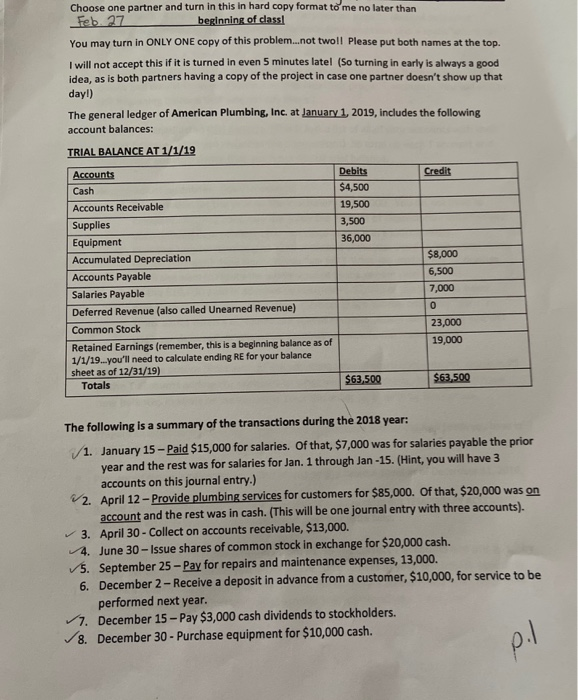

Choose one partner and turn in this in hard copy format to me no later than Feb. 27 beginning of class! You may turn in ONLY ONE copy of this problem...not two!! Please put both names at the top. I will not accept this if it is turned in even 5 minutes latel (So turning in early is always a good idea, as is both partners having a copy of the project in case one partner doesn't show up that day!) The general ledger of American Plumbing, Inc. at January 1, 2019, includes the following account balances: Credit Debits $4,500 19,500 3,500 36,000 19.500 TRIAL BALANCE AT 1/1/19 Accounts Cash Accounts Receivable Supplies Equipment Accumulated Depreciation Accounts Payable Salaries Payable Deferred Revenue (also called Unearned Revenue) Common Stock Retained Earnings (remember, this is a beginning balance as of 1/1/19...you'll need to calculate ending RE for your balance sheet as of 12/31/19) Totals $8,000 6,500 7,000 23,000 19,000 $63,500 $63,500 The following is a summary of the transactions during the 2018 year: 1. January 15 - Paid $15,000 for salaries. Of that, $7,000 was for salaries payable the prior year and the rest was for salaries for Jan. 1 through Jan-15. (Hint, you will have 3 accounts on this journal entry.) 2. April 12 - Provide plumbing services for customers for $85,000. Of that, $20,000 was on account and the rest was in cash. (This will be one journal entry with three accounts). 3. April 30 - Collect on accounts receivable, $13,000. 4. June 30 - Issue shares of common stock in exchange for $20,000 cash. 5. September 25- Pay for repairs and maintenance expenses, 13,000. 6. December 2- Receive a deposit in advance from a customer, $10,000, for service to be performed next year. 7. December 15- Pay $3,000 cash dividends to stockholders. 8. December 30 - Purchase equipment for $10,000 cash. Requirements: 1. Set up the necessary T-accounts and enter the beginning balances from the trial balance You were given on page 1. 2. Record each of the 8 transactions for the year given on page 1. (Record as journal entries. Remember to put a description for each entry and then skip a space before the next entry) 3. Post the transactions to the accounts (What does posting mean? It means putting the debits and credits from your journal entries into their proper T accounts. You will add to the beginning balance that was already there.) 4. Prepare an unadjusted trial balance. (This is just a list of all of your accounts with their ending balances after you recorded the transactions). So total up each Taccount and that is your ending balance that you'll put on the trial balance. 5. Record adjusting entries. (journal entries) a) Depreciation for the year on the machinery is $10,000. You do not have to calculate anything here, you are given the amount of depreciation expense and accumulated depreciation...you just need to put it in a journal entry. b) Plumbing supplies remaining on hand at the end of the year equal $1,100. (How much did you start with? How much did you "use up"? What you used up is your expense. You'll also want to reduce the supply account by the amount used up. c) Of the $10,000 paid in advance by customers, $7,000 of the work has been completed by the end of the year. (So how much did the company "earn"? Think about when a company can record revenue...when they earn it! You will use your deferred, or unearned revenue account in this transaction). 6. Post adjusting entries (Post each of the adjusting journal entry accounts you made in #5 to the T accounts adding the numbers to what was already there. You will now have new balances in some of the accounts.) Put the letter (a, b, or c) by the entries. 7. Prepare an adjusted trial balance - Make a new trial balance with all the new totals you have in your accounts now that you posted adjusting entries. 8. Prepare an income statement for 2019 and a classified balance sheet as of December 31, 2019. 9. Record closing entries. Make the journal entries needed to close out TEMPORARY ACCOUNTS. Watch the video in Chapter 3 about closing if you need extra help. 10. Post closing entries. Post the amounts from #9 to the correct T accounts and put a "C" by them. When you get done, you should have "0" balances in your temporary accounts. 11. Prepare a post-closing trial balance. (So none of the temporary accounts will be on here...only permanent ones). This is just the ending balance in every one of your Taccounts. Requirement 1&3 American Plumbing, Inc Set up T-accounts and enter the beginning balances from the trial balance (81) Next complete requirement and then come back to this page for regirement 3 Then for 3 post the transactions you made in #2 to the correct T-accounts. So go down the list of debits and credits in your journal entries and post each debit or credit to its correct account. Accounts Receivable Supplies 4.500 13.000 19.500 (13,000 13.000 3.000 20,000 85.000 15.000 10.CO 10000 67.500 Cash 3.500 Equipment 36.000 Accumulated Depr. 8.000 Accounts Payable | 6.500 (Unearned Revenue) Deferred Revenue Salaries Payable 7,000 HHAHH UNHH M Common Stock Retained Earnings 19.000 Service Revenue 85.000 23000 Dividends Salaries Expense 3,000 R&M Expense 13,000 3,000 Depreciation Expense 13000 Supplies Expense 10.000 Requirement #2 - Record each of the 8 transactions here based on the information given on page 1. Like all journal entries, your debits must your credits on each entry. Please sklonline between each entry. Date Description Debit Credit 15/20 Salaries Expense Salaries Payable I Cash $8,000 $7,000 $15,000 14/12/20 Service Expense Accounts payable cash 365,000 $20,000 - 1185,000 4/30/20 Accounts Revievable cash $3,000 313000 16/30/20 Common Cash stock 820,000 $20,000 19/25/20 Maintenance/ Repairs Cash $13,000 13.000 112/2/20 $10,000 Service Expense Service Revenue $10,000 112/15/20 Dividends $3,000 [12/30/20 Operation Expense Couipment $10,000 $10,000 After recording all your journal entries, move on to requirement 3 where you will post these amounts to the T accounts where you entered your beginning balances. Requirement 84prepare an UNADJUSTED TRIAL BALANCE. This is where you take the ending balances in all of your T accounts. Be careful to record correctly in the debitor credit column. ACCOUNT Dobit Credit TOTALS **I'll give you the debit and credit totals in class so that you can make sure you are on the right track. If you miss class that day, I will not give them to you. **Remember the trial balance totals do not appear anywhere in the financial statements, it is just to show that your debits = credits. I have given you the totals of debits and credits so if yours do not equal that, you've done something wrong. If they do not equal, first double check your t-account totals to make sure you transferred them here correctly. Next, re-add your t-accounts to make sure you've added correctly. If the error is still not found, double check that you posted each journal entry correctly. Requirement #5 - Record the adjusting journal entries from the information you were given on requirement #5 on page 2 (there are 3 of them). Date Transaction Debit Credit a) Requirement 116 Using your T-Accts from #3, post the adjusting entries you made in requirement 5. (So you'll need to copy everything over from #3 except the balances. Then add the new entries you just made in #5 and get to a new balance. Some accounts, like cash, will not be affected by the adjusting entries. Please put (a) (b) (c) by the entries Cash Accounts Receivable Supplies 87,000 Equipment Accumulated Depr. Accounts Payable Salaries Payable Deferred Revenue HHHHHH Retained Earnings Common Stock Service Revnue R&M Expense Dividends Salaries Expense Depreciation Expense Supplies Expense PUT THE LETTER OF THE ADJUSTING ENTRY BY THE POSTING (a, b, or c) Requirement prepare an ADJUSTED TRIAL BALANCE. This is similar to requirement 4 but you have some updated balances now that you've done your adjusting journal entries. Take your ending balances in the Taccounts after requirement and record here ACCOUNT Debit Credit TOTALS "I'll give you the debit and credit totals in class to make sure you are on the right track. If you miss class, I will not give you the totals. **Remember the trial balance totals do not appear anywhere in the financial statements, it is just to show that your debits = credits. I have given you the totals of debits and credits so if yours do not equal that, you've done something wrong. If they do not, first double check your t-account totals to make sure you transferred them here correctly. Next, re-add your t-accounts to make sure you've added correctly. If the error is still not found, double check that you posted each journal entry correctly. Requirement #8 Income Statement (don't forget your heading) Look at the financial statements we worked in class (module 1 of Canvas) for guidance on your Income Statement. Financial statements do not have debit and credits so the 2 columns you see below are not for debits and credits. Rather, they are used to total and subtotal amounts. You only have one revenue account so it can go in the outside column. You have several expense accounts so they can be listed in the inside column and then just the "total expenses written in the outside column. (for subtotals) (for totals) Prepare a classified Balance Sheet (don't forget your heading) Don't forget to separate current vs. noncurrent. ASSETS LIABILITIES Stockholders' Equity *Remember, the balance given to you in the beginning for Retained Earings was before all of these transactions during the year. How do you determine ending Retained Earnings? Make sure you report the Ending Retained Earnings amount under Stockholders' Equity in your Balance Sheet. p./0 Requirement #9. Record closing entries. You are closing all of the temporary accounts in to Retained Earnings. Date Transaction Debit Credit Requirement & 10 Using your T accounts from requirement 6 copy everything over but the balances. Then add (post) your closing entries you just made in #9. Remember, you want your temporary accounts to end up with a "0" balance. Accounts Receivable Supplies Equipment Accumulated Depr. Accounts Payable Common Stock HHHH Salaries Payable Deferred Revenue HHHHHH Retained Earnings Dividends Service Revenue Salaries Expense R&M Expense Depreciation Expense Supplies Expense PUT A "C" BY THE ENTIRES YOU POST FOR YOUR CLOSING ENTRIES pil2 Pequirement #11. Create a post-closing Trial Balance (enter all accounts and their balances from requirement 1.10. The amounts here should be the balances in your T accounts from requirement #10. Accounts Debit Credit TOTALS