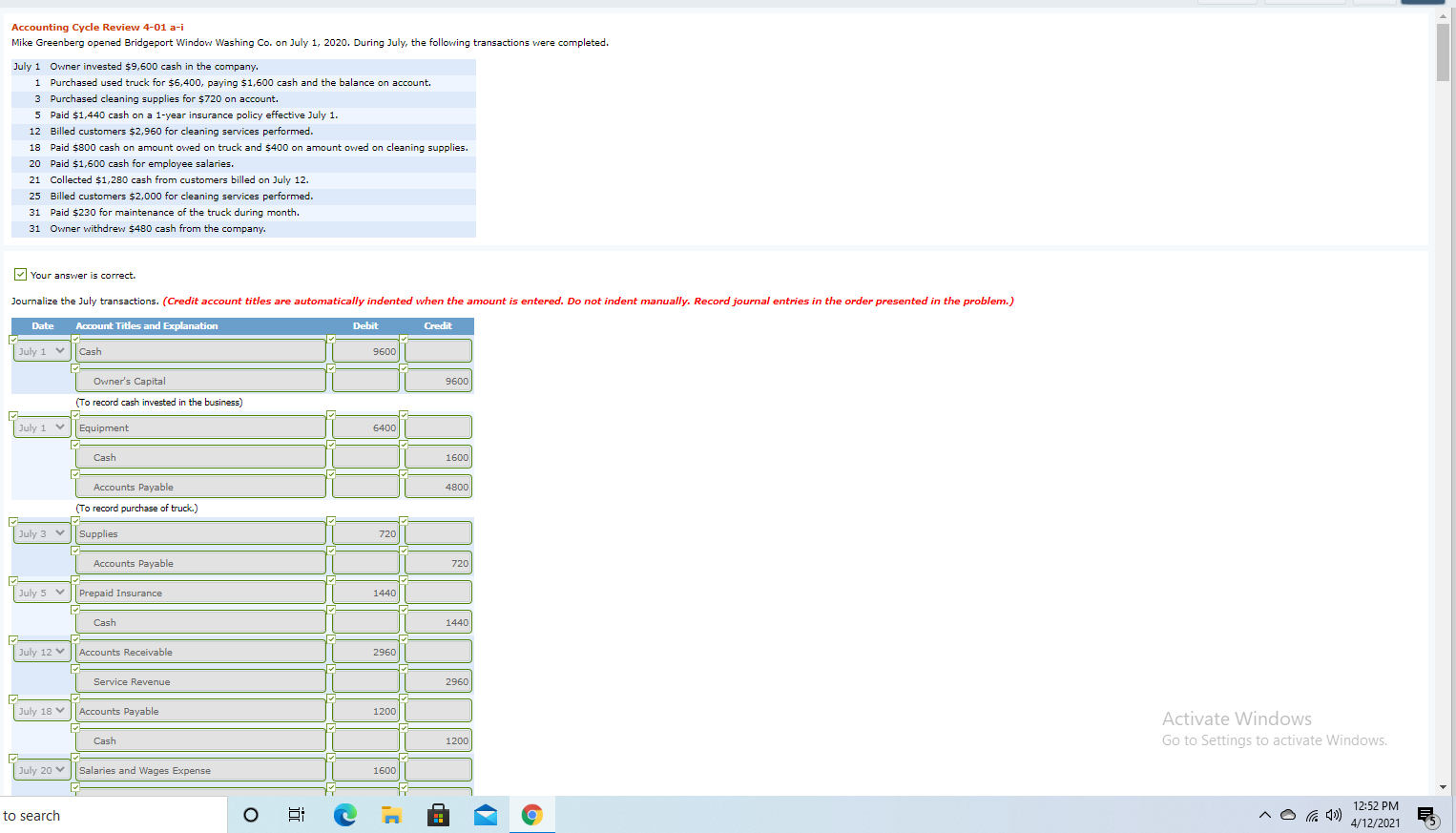

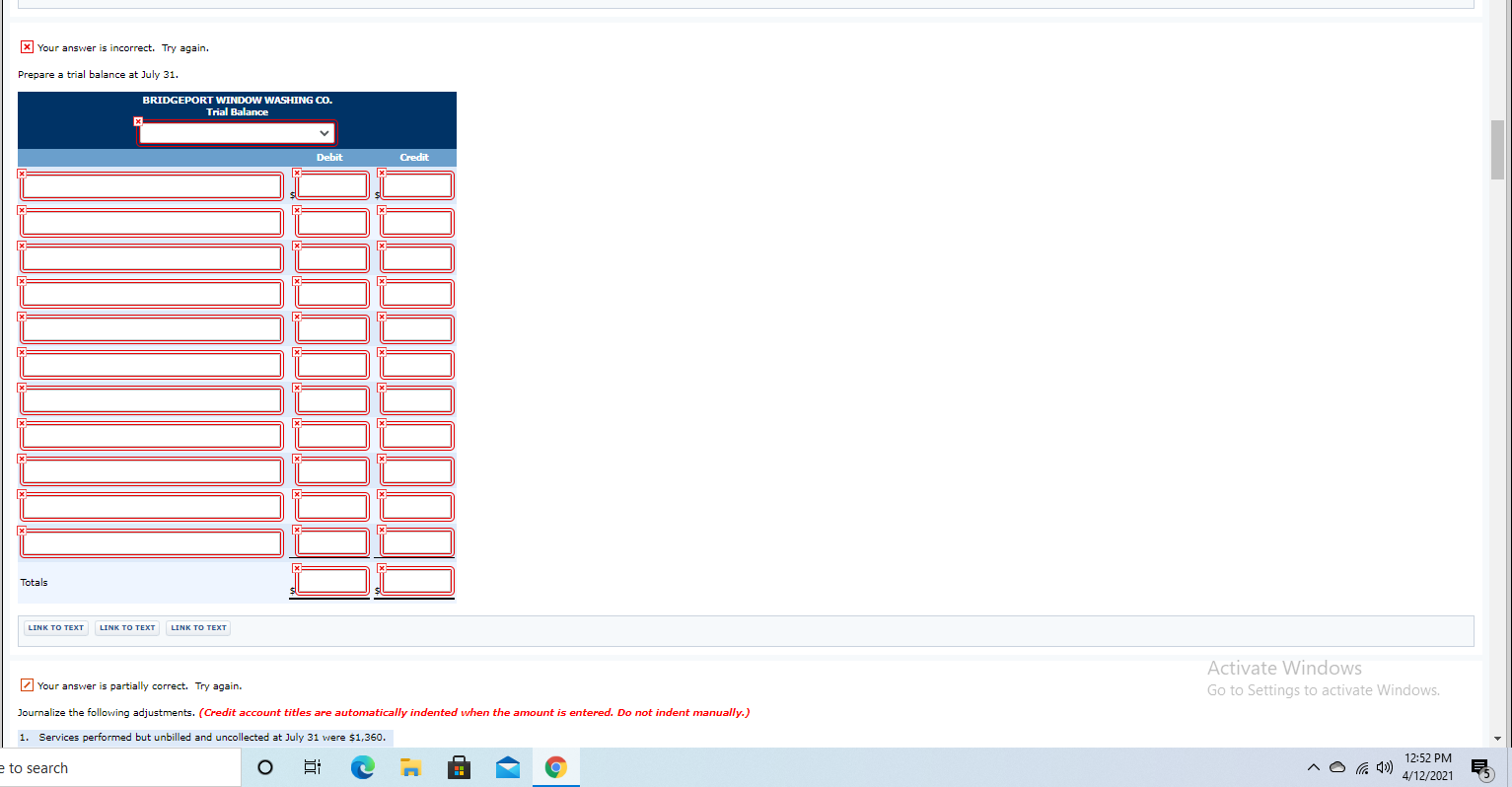

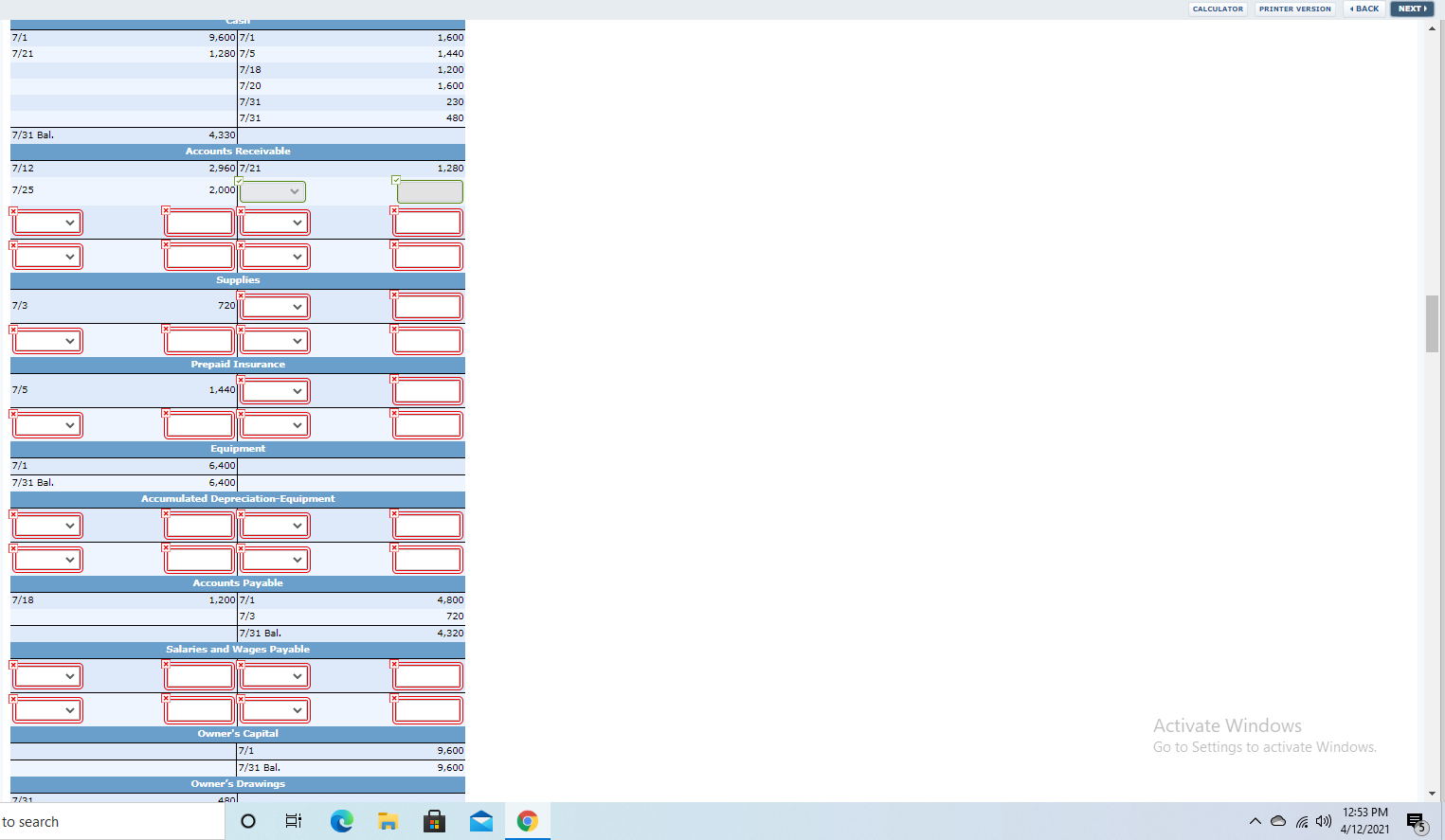

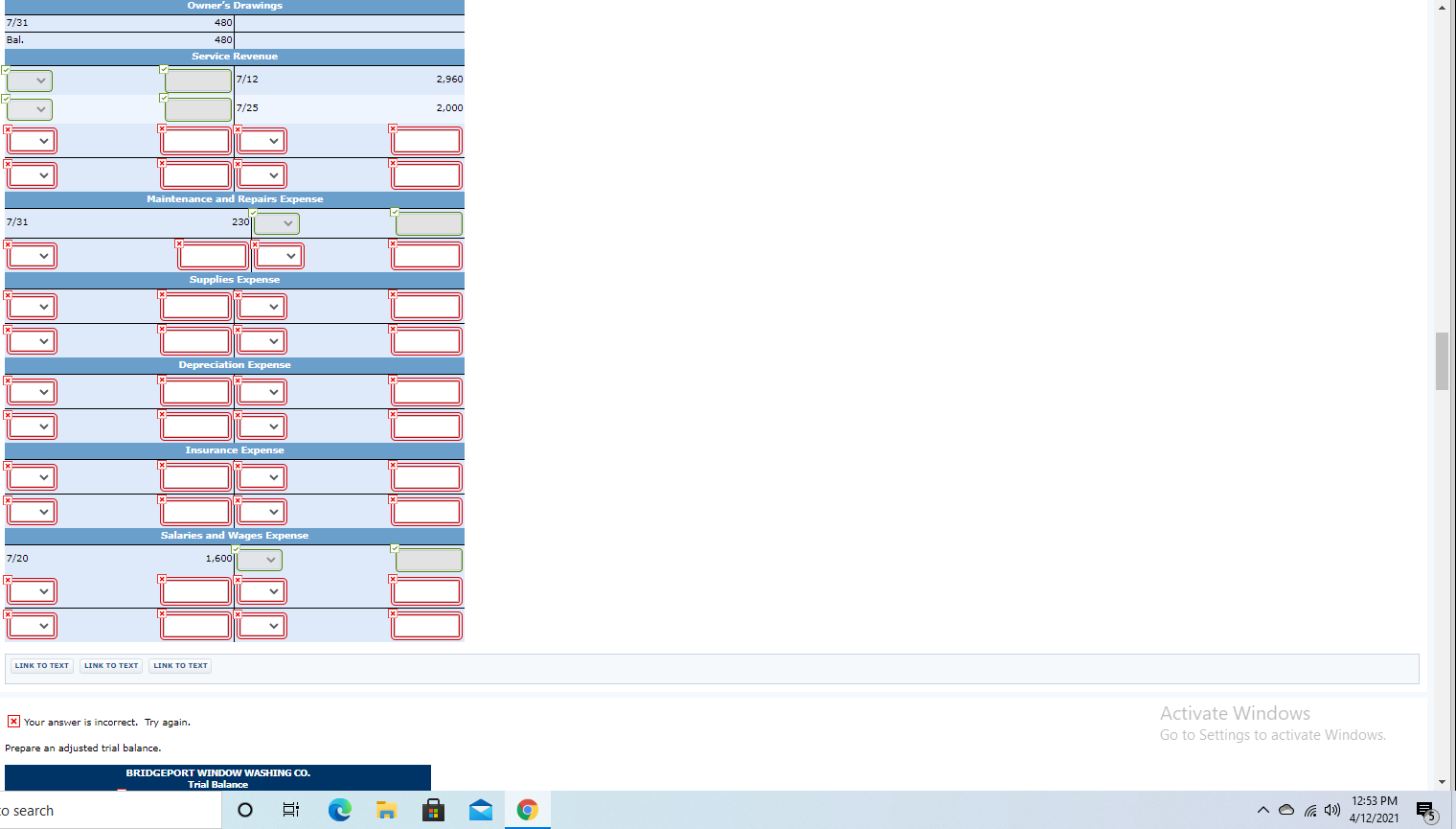

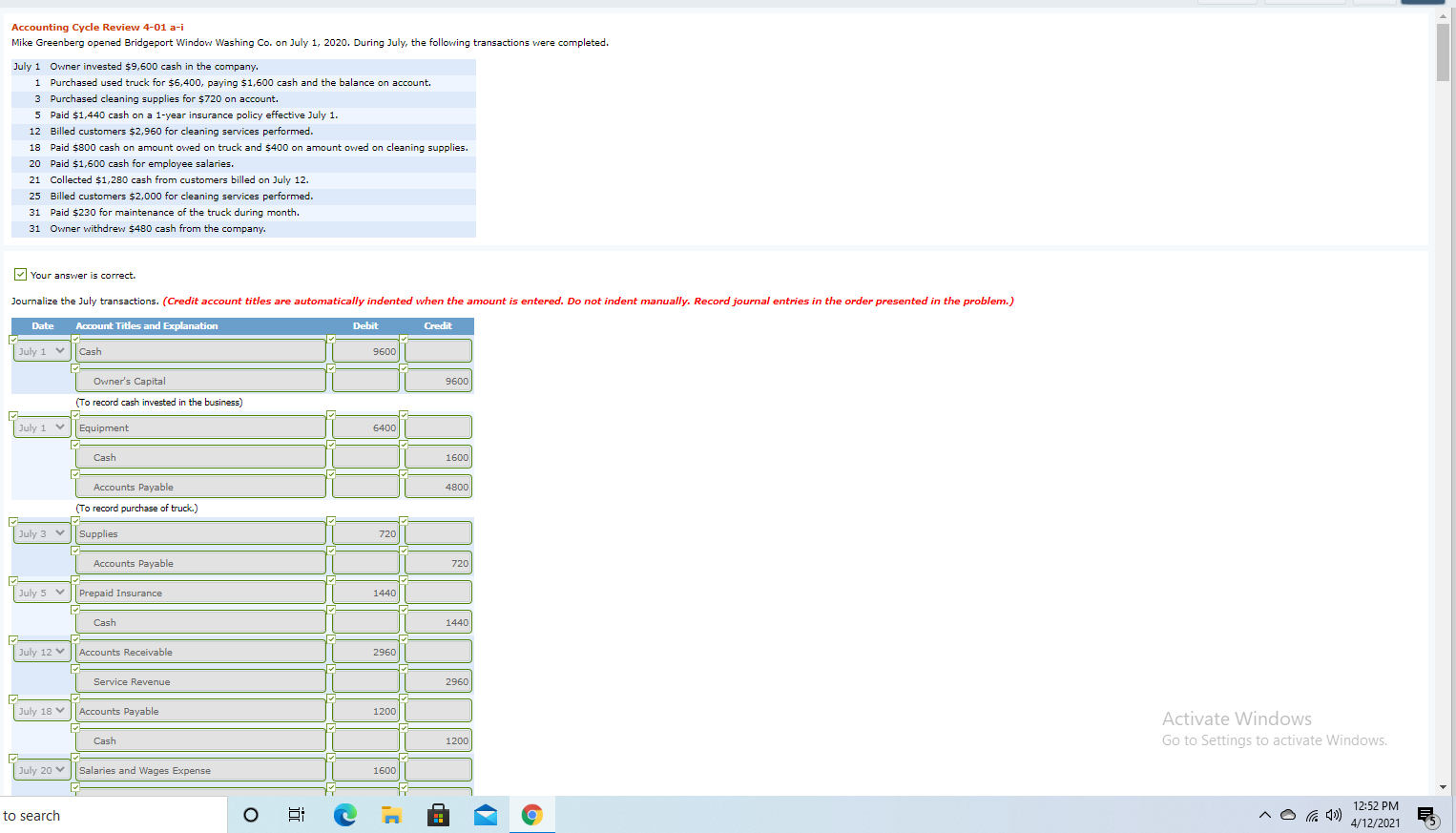

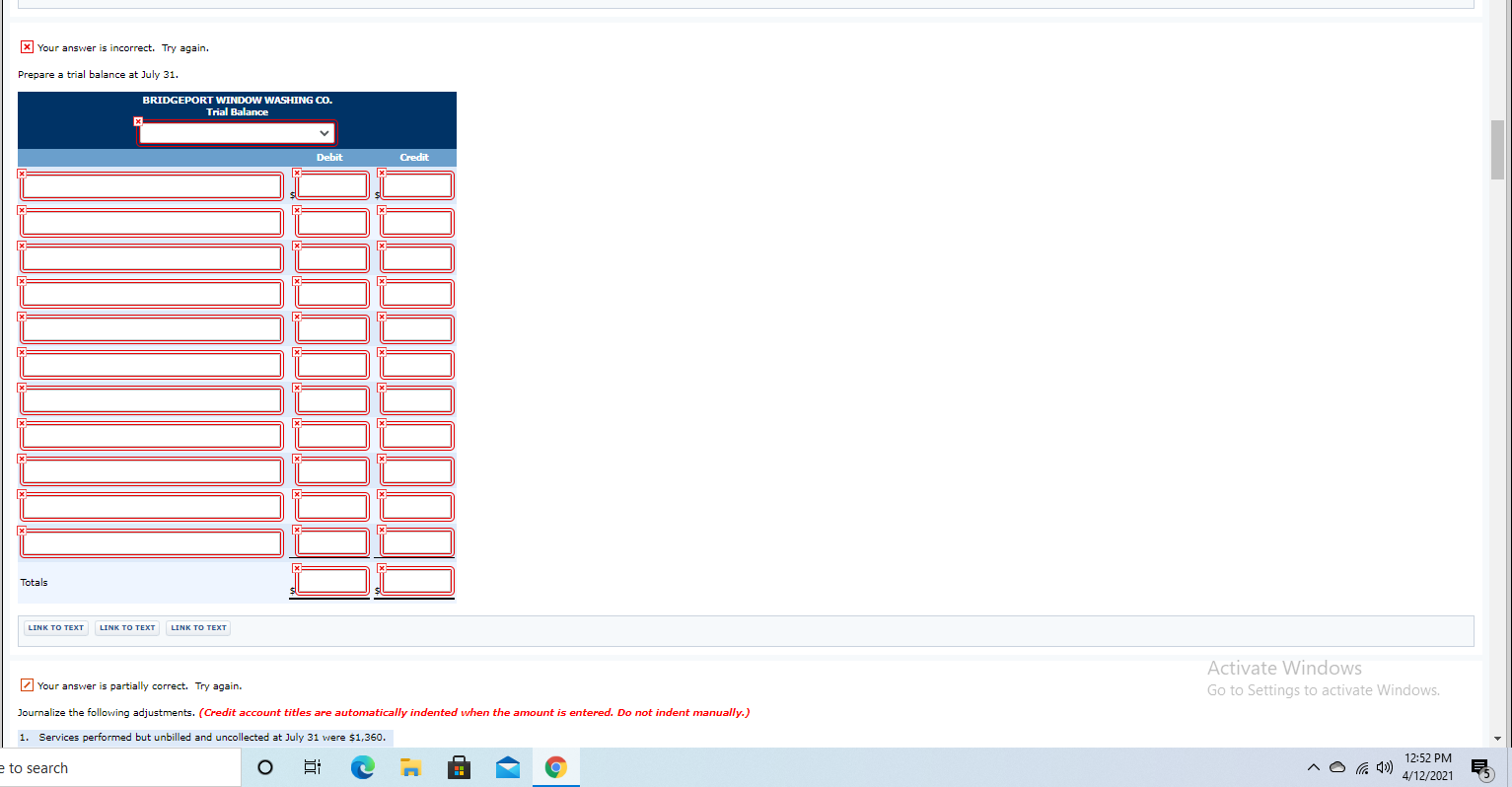

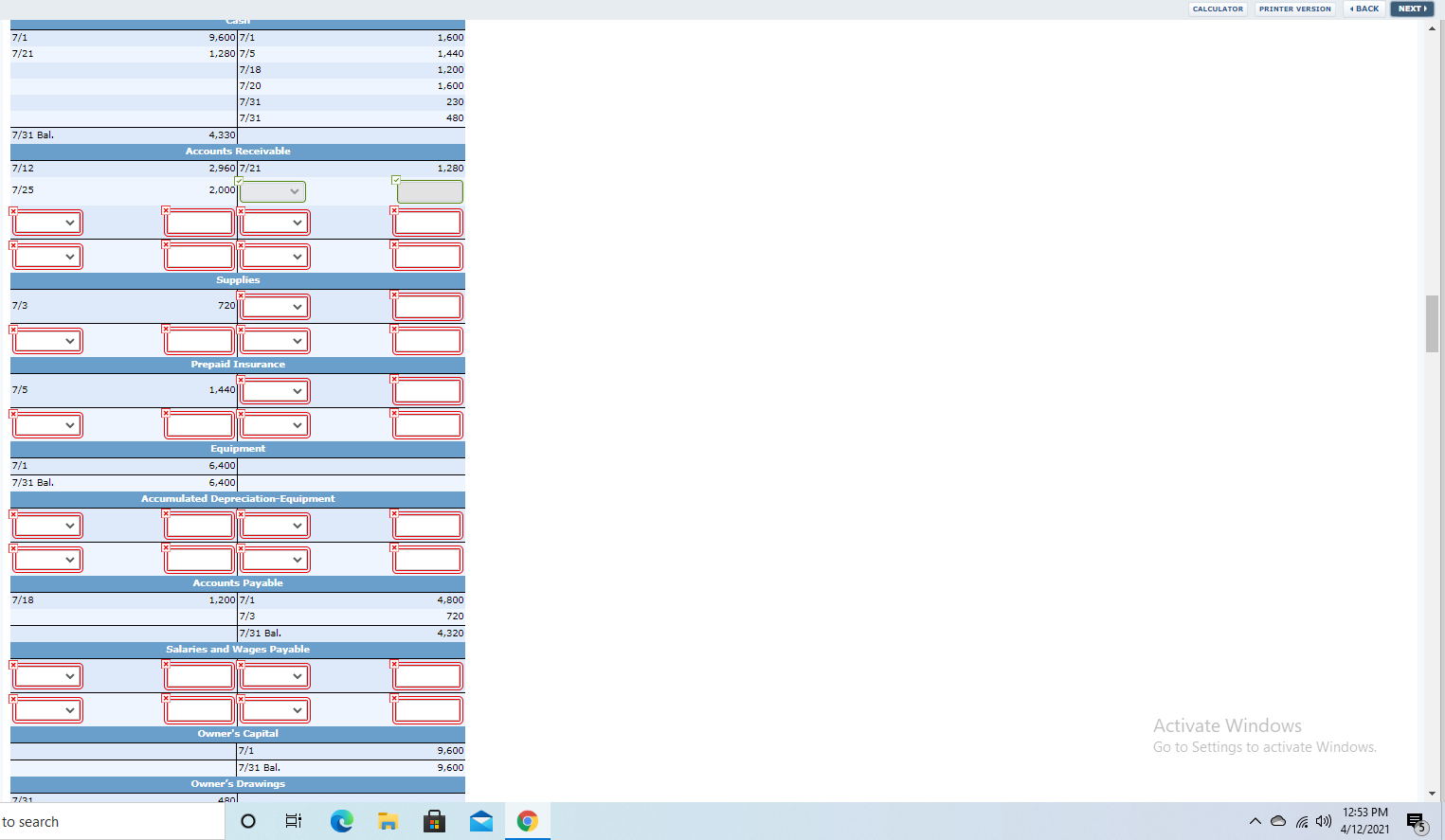

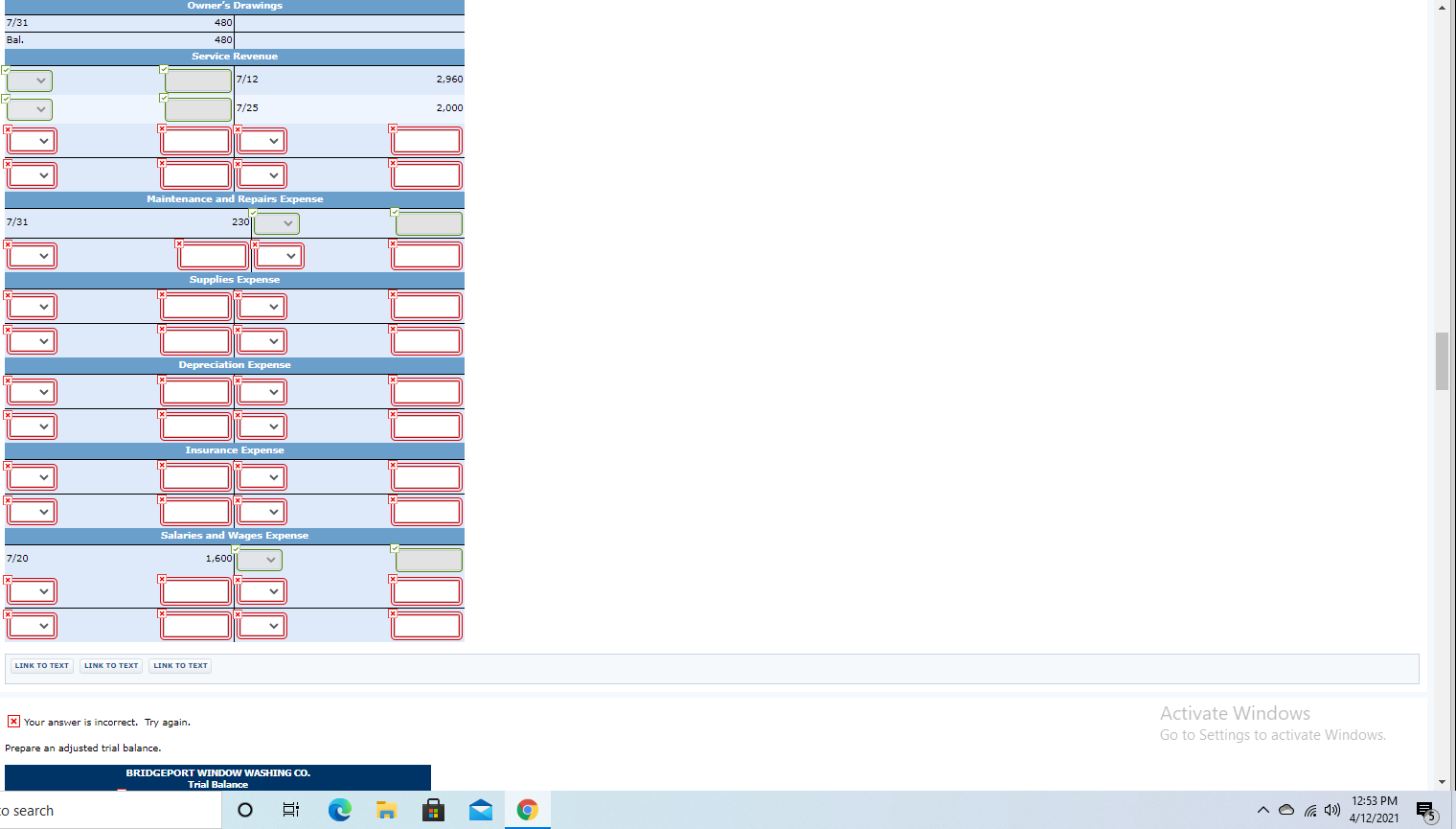

Accounting Cycle Review 4-01 a-i Mike Greenberg opened Bridgeport Window Washing Co. on July 1, 2020. During July, the following transactions were completed. July 1 Owner invested $9,600 cash in the company. . 1 Purchased used truck for $6,400, paying $1,600 cash and the balance on account. 3 Purchased cleaning supplies for $720 on account. 5 Paid $1,440 cash on a 1-year insurance policy effective July 1. 12 Billed customers $2,960 for cleaning services performed. 18 Paid $800 cash on amount owed on truck and $400 on amount owed on cleaning supplies. 20 Paid $1,600 cash for employee salaries. 21 Collected $1,280 cash from customers billed on July 12. 25 Billed customers $2,000 for cleaning services performed. 31 Paid $230 for maintenance of the truck during month. 31 Owner withdrew $480 cash from the company. Your answer is correct. Journalize the July transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit July 1 Cash 9600 Owner's Capital 9600 (To record cash invested in the business) July 1 Equipment 6400 Cash 1600 4800 Accounts Payable (To record purchase of truck.) July 3 y Supplies 720 Accounts Payable 720 July 5 Prepaid Insurance 1440 Cash 1440 July 12 Accounts Receivable 2960 Service Revenue 2960 July 18 Accounts Payable 1200 Activate Windows Go to Settings to activate Windows. Cash 1200 July 20 V Salaries and Wages Expense 1600 to search e 12:52 PM 4/12/2021 15 Accounts Payable 7/18 1200||| 7/1 4800 7/3 720 7/31 Bal. 4320 ex Owner's Capital Owner's Drawings Service Revenue Maintenance and Repairs Expense Salaries and Wages Expense LINK TEXT LINK TO TEXT LINK TEXT X Your answer is incorrect. Try again. Prepare a trial balance at July 31. Activate Windows Go to Settings to activate Windows. BRIDGEPORT WINDOW WASHING CO. Trial Balance here to search o E e 12:52 PM 4/12/2021 x Your answer is incorrect. Try again. Prepare a trial balance at July 31. BRIDGEPORT WINDOW WASHING CO. Trial Balance Debit Credit X X Totals LINK TO TEXT LINK TO TEXT LINK TO TEXT Your answer is partially correct. Try again. Activate Windows Go to Settings to activate Windows. Journalize the following adjustments. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) 1. Services performed but unbilled and uncollected at July 31 were $1,360. o e to search O 12:52 PM 4/12/2021 Your answer is partially correct. Try again. Journalize the following adjustments. (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) 1. Services performed but unbilled and uncollected at July 31 were $1,360. 2. Depreciation on equipment for the month was $140. 3. One-twelfth of the insurance expired. 4. A count shows $260 of cleaning supplies on hand at July 31. 5. Accrued but unpaid employee salaries were $320. Sr. Date Account Titles and Explanation Debit Credit 1. July 31 Accounts Receivable 1360 Service Revenue 1360 2. July 31 Depreciation Expense 140 acc 140 X 3. July 31 Insurance Expense 199 Prepaid Insurance 199 4. July 31 Supplies 260 Supplies Expense 260 5. July 31 Salaries and Wages Expense 320 Salaries and Wages Payable 320 LINK TO TEXT LINK TO TEXT LINK TO TEXT CALCULATOR PRINTER VERSION 4 BACK NEXT 7/1 7/21 1,600 1,440 1,200 1,600 Last 9,600 7/1 1,2807/5 7/18 7/20 7/31 7/31 4,330 Accounts Receivable 2,960 7/21 230 480 7/31 Bal. 7/12 1,280 7/25 2,0001 V V Supplies 7/3 7201 Prepaid Insurance 7/5 1,440|| 7/1 7/31 Bal. Equipment 6,400 6,400 Accumulated Depreciation Equipment 7/18 4,800 Accounts Payable 1,2007/1 7/3 7/31 Bal. Salaries and Wages Payable 720 4,320 Activate Windows Go to Settings to activate Windows. 9,600 Owner's Capital 7/1 7/31 Bal. Owner's Drawings ART 9,600 7/21 O to search 12:53 PM 4/12/2021 Owner's Drawings 480 7/31 Bal. 480 Service Revenue 7/12 2.960 7/25 2,000 X Maintenance and Repairs Expense 7/31 2301 Supplies Expense . Depreciation Expense Insurance Expense Salaries and Wages Expense 7/20 1,6001 X LINK TO TEXT LINK TO TEXT LINK TO TEXT * Your answer is incorrect. Try again. Activate Windows Go to Settings to activate Windows Prepare an adjusted trial balance. BRIDGEPORT WINDOW WASHING CO. Trial Balance o co search g 12:53 PM 4/12/2021