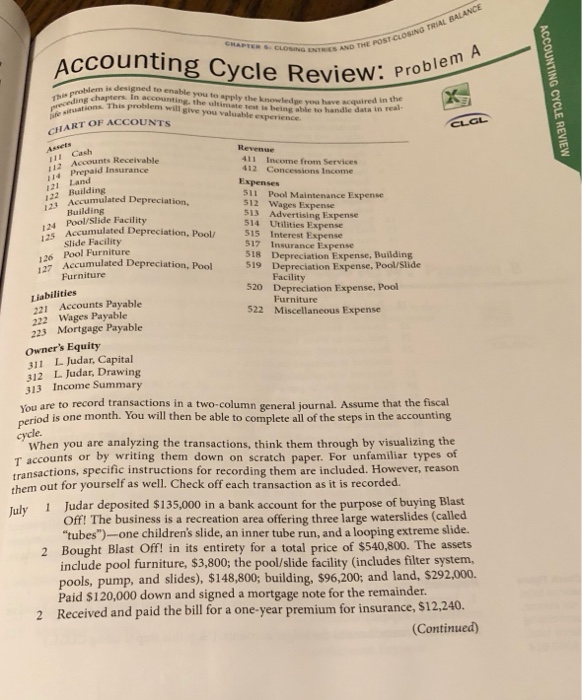

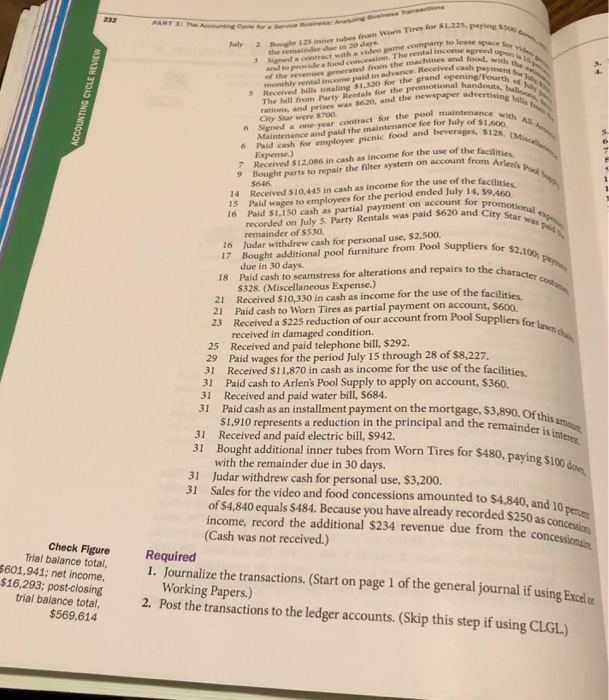

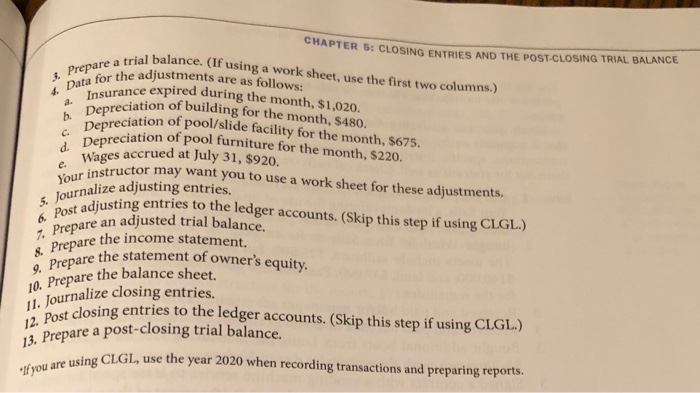

Accounting Cycle Review: probtn AND THE POST CLOSING TRIAL This problem is nThis problem will give you valuable esperience ART OF ACCOUNTS In accounting, the ultimate test is being able to han you have acquired in the real- 2 111 Cash 411 Income from Services 412 Concessions Income 121 122 Building 511 Pool Maintenance Expense 512 Wages Expense 513 Advertising Expense 514 Utilities Expense 515 Interest Expense 517 Insurance Expense 518 Depreciation Expense, Building 19Depreciation Expense, Pool/Slide ionn. 123 Building 124 Pool/Slide Facility mulated Depreciation, Pool/ Slide Facility 126 Pool Furniture 2 Accumulated Depreciation, Pool Furniture Facility Depreciation Expense, Pool 520 221 Accounts Payable 222 Wages Payable 223 Mortgage Payable 522 Miscellaneous Expense Owner's Equity 311 L Judar, Capital 312 L. Judar, Drawing 313 Income Summary You are to record transactions in a two-column general journal. Assume that the fiscal od is one month. You will then be able to complete all of the steps in the accounting peri When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well . Check off each transaction as it is recorded. Judar deposited $135,000 in a bank account for the purpose of buying Blast Off! The business is a recreation area offering three large waterslides (called July 1 tubes")-one children's slide, an inner tube run, and a looping extreme slide. 2 Bought Blast Off! in its entirety for a total price of $540,800. The assets include pool furniture, $3,800; the pool/slide facility (includes filter system, pools, pump, and slides), $148,800; building, $96,200; and land, $292,000. Paid $120,000 down and signed a mortgage note for the remainder 2 Received and paid the bill for a one-year premium for insurance, $12,240 Continued) Accounting Cycle Review: probtn AND THE POST CLOSING TRIAL This problem is nThis problem will give you valuable esperience ART OF ACCOUNTS In accounting, the ultimate test is being able to han you have acquired in the real- 2 111 Cash 411 Income from Services 412 Concessions Income 121 122 Building 511 Pool Maintenance Expense 512 Wages Expense 513 Advertising Expense 514 Utilities Expense 515 Interest Expense 517 Insurance Expense 518 Depreciation Expense, Building 19Depreciation Expense, Pool/Slide ionn. 123 Building 124 Pool/Slide Facility mulated Depreciation, Pool/ Slide Facility 126 Pool Furniture 2 Accumulated Depreciation, Pool Furniture Facility Depreciation Expense, Pool 520 221 Accounts Payable 222 Wages Payable 223 Mortgage Payable 522 Miscellaneous Expense Owner's Equity 311 L Judar, Capital 312 L. Judar, Drawing 313 Income Summary You are to record transactions in a two-column general journal. Assume that the fiscal od is one month. You will then be able to complete all of the steps in the accounting peri When you are analyzing the transactions, think them through by visualizing the T accounts or by writing them down on scratch paper. For unfamiliar types of transactions, specific instructions for recording them are included. However, reason them out for yourself as well . Check off each transaction as it is recorded. Judar deposited $135,000 in a bank account for the purpose of buying Blast Off! The business is a recreation area offering three large waterslides (called July 1 tubes")-one children's slide, an inner tube run, and a looping extreme slide. 2 Bought Blast Off! in its entirety for a total price of $540,800. The assets include pool furniture, $3,800; the pool/slide facility (includes filter system, pools, pump, and slides), $148,800; building, $96,200; and land, $292,000. Paid $120,000 down and signed a mortgage note for the remainder 2 Received and paid the bill for a one-year premium for insurance, $12,240 Continued)