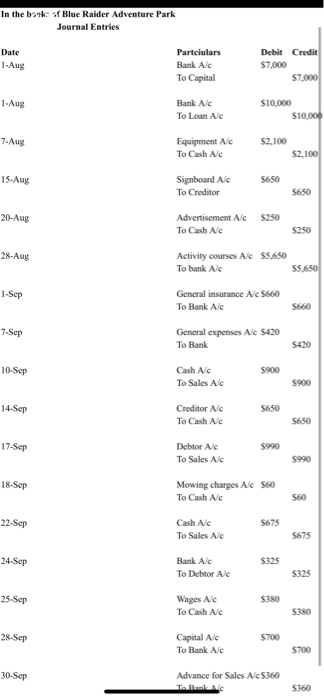

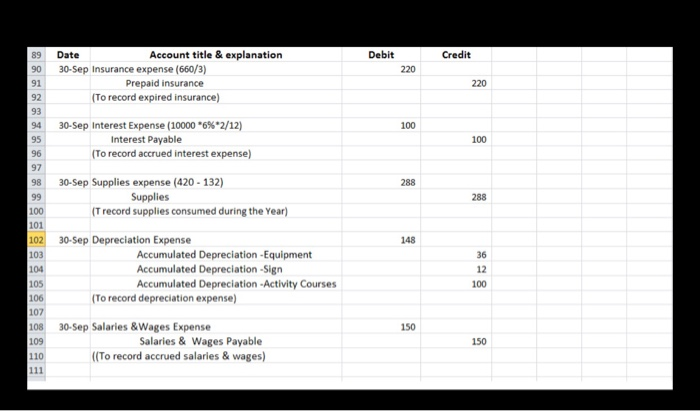

ACCOUNTING CYCLE STEP 6: Recalculate the general ledger account balances for all accounts affected by the adjusting entries, if you haven't already done so, and then develop another trial balance consistent with the format of your unadjusted trial balance. This new trial balance is identified as an adjusted trial balance to reflect the fact that the account balances now include the effect of all adjusting entries. No working papers have been provided for this step, so you may either handwrite your solution or prepare it electronically. If you prepare your solution electronically, be sure to bring a hardcopy to class. Helpful Hints Remember to list your accounts in financial statement order, just as you did for your unadjusted trial balance. Check Figure: Debits and credits must each equal $20,743. ACCOUNTING CYCLE STEP 7: Use the accounts and balances on the adjusted trial balance to prepare financial statements. Refer to Exhibit 3.14 in your textbook for an illustration of how the numbers from an adjusted trial balance flow to the financial statements. No working papers have been provided for this step, so you may either handwrite your solution or prepare it electronically. If you prepare your solution electronically, be sure to bring a hardcopy to class. Helpful Hints The income statement is always prepared first because we need the output of the income statement (net income) to prepare the second financial statement, the statement of owner's equity. The statement of owner's equity must be prepared second because we need the output of the statement of owner's equity (the ending capital account balance) to prepare the third financial statement, the balance sheet. The fact that all three financial statements tie together in this way is referred to as articulation. Recall that the accounts on the adjusted trial balance are listed in financial statement order (assets, liabilities, owner's equity, revenues, and expenses). so the accounts you need for each statement are effectively grouped together. Each account is reported on only ONE financial statement. Specifically note the difference between the format of a trial balance and a balance sheet. Many beginning accounting students frequently confuse these two due to the naming similarity, but they are two very distinct documents! Check Figures: Net income = $1,024 Total Assets = $18,354 In the book of Blue Raider Adventure Park Journal Entries Credit Date 1-Aug Partciulars Bank Ac To Capital Debit $7.000 57.000 1.Aug Bank Ac To Lean Alc $10,000 $10,000 7. Aug Equipment Ac To Cash Ac 52.100 15-Aug Signboard Ale To Creditor 20-Aug Advertisement Ac To Cash Ac $250 28-Aug Activity courses A c 55,650 To bank Alc 1-Sep General insurance Ac 5660 To Bank A/C 7.Sep General expenses Ale 5420 To Bank 10-Sep Cash Ac To Sales Alc 14-Sep Creditor Ac To Cash Ac 17-Sep Debtor AC To Sales Ac 18-5cp Mowing charges AC To Cash Ac 22-Sep Cash Alc To Sales Alc 24-Sep Bank Alc To Debtor AC 25-Sep Wages Ac To Cash Alc 28-Sep Capital Alc To Bank Alc 30-Sep Advance for Sales Ac5360 TRA Debit Credit 89 90 220 Date Account title & explanation 30-Sep Insurance expense (660/3) Prepaid insurance (To record expired insurance) 100 30-Sep Interest Expense (10000 6%2/12) Interest Payable (To record accrued interest expense) 288 30-Sep Supplies expense (420 - 132) Supplies (T record supplies consumed during the Year) 148 30-Sep Depreciation Expense Accumulated Depreciation Equipment Accumulated Depreciation - Sign Accumulated Depreciation - Activity Courses (To record depreciation expense) 30-Sep Salaries & Wages Expense Salaries & Wages Payable ((To record accrued salaries & wages) ACCOUNTING CYCLE STEP 6: Recalculate the general ledger account balances for all accounts affected by the adjusting entries, if you haven't already done so, and then develop another trial balance consistent with the format of your unadjusted trial balance. This new trial balance is identified as an adjusted trial balance to reflect the fact that the account balances now include the effect of all adjusting entries. No working papers have been provided for this step, so you may either handwrite your solution or prepare it electronically. If you prepare your solution electronically, be sure to bring a hardcopy to class. Helpful Hints Remember to list your accounts in financial statement order, just as you did for your unadjusted trial balance. Check Figure: Debits and credits must each equal $20,743. ACCOUNTING CYCLE STEP 7: Use the accounts and balances on the adjusted trial balance to prepare financial statements. Refer to Exhibit 3.14 in your textbook for an illustration of how the numbers from an adjusted trial balance flow to the financial statements. No working papers have been provided for this step, so you may either handwrite your solution or prepare it electronically. If you prepare your solution electronically, be sure to bring a hardcopy to class. Helpful Hints The income statement is always prepared first because we need the output of the income statement (net income) to prepare the second financial statement, the statement of owner's equity. The statement of owner's equity must be prepared second because we need the output of the statement of owner's equity (the ending capital account balance) to prepare the third financial statement, the balance sheet. The fact that all three financial statements tie together in this way is referred to as articulation. Recall that the accounts on the adjusted trial balance are listed in financial statement order (assets, liabilities, owner's equity, revenues, and expenses). so the accounts you need for each statement are effectively grouped together. Each account is reported on only ONE financial statement. Specifically note the difference between the format of a trial balance and a balance sheet. Many beginning accounting students frequently confuse these two due to the naming similarity, but they are two very distinct documents! Check Figures: Net income = $1,024 Total Assets = $18,354 In the book of Blue Raider Adventure Park Journal Entries Credit Date 1-Aug Partciulars Bank Ac To Capital Debit $7.000 57.000 1.Aug Bank Ac To Lean Alc $10,000 $10,000 7. Aug Equipment Ac To Cash Ac 52.100 15-Aug Signboard Ale To Creditor 20-Aug Advertisement Ac To Cash Ac $250 28-Aug Activity courses A c 55,650 To bank Alc 1-Sep General insurance Ac 5660 To Bank A/C 7.Sep General expenses Ale 5420 To Bank 10-Sep Cash Ac To Sales Alc 14-Sep Creditor Ac To Cash Ac 17-Sep Debtor AC To Sales Ac 18-5cp Mowing charges AC To Cash Ac 22-Sep Cash Alc To Sales Alc 24-Sep Bank Alc To Debtor AC 25-Sep Wages Ac To Cash Alc 28-Sep Capital Alc To Bank Alc 30-Sep Advance for Sales Ac5360 TRA Debit Credit 89 90 220 Date Account title & explanation 30-Sep Insurance expense (660/3) Prepaid insurance (To record expired insurance) 100 30-Sep Interest Expense (10000 6%2/12) Interest Payable (To record accrued interest expense) 288 30-Sep Supplies expense (420 - 132) Supplies (T record supplies consumed during the Year) 148 30-Sep Depreciation Expense Accumulated Depreciation Equipment Accumulated Depreciation - Sign Accumulated Depreciation - Activity Courses (To record depreciation expense) 30-Sep Salaries & Wages Expense Salaries & Wages Payable ((To record accrued salaries & wages)