Answered step by step

Verified Expert Solution

Question

1 Approved Answer

e-considers investing into two stocks which are listed on the All Pacific Islands Stock Exchange (APIX). He thinks that Pacifict (stock C) and Casinos

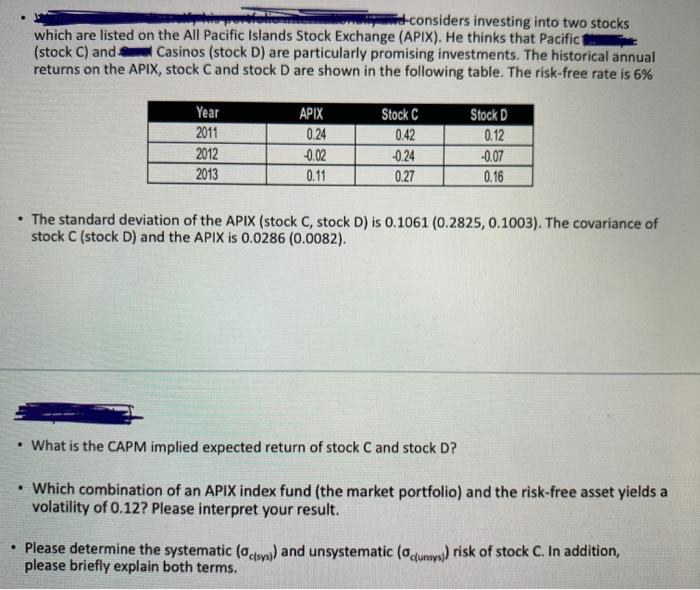

e-considers investing into two stocks which are listed on the All Pacific Islands Stock Exchange (APIX). He thinks that Pacifict (stock C) and Casinos (stock D) are particularly promising investments. The historical annual returns on the APIX, stock C and stock D are shown in the following table. The risk-free rate is 6% . Year 2011 2012 2013 APIX 0.24 -0.02 0.11 Stock C 0.42 -0.24 0.27 Stock D 0.12 -0.07 0.16 The standard deviation of the APIX (stock C, stock D) is 0.1061 (0.2825, 0.1003). The covariance of stock C (stock D) and the APIX is 0.0286 (0.0082). What is the CAPM implied expected return of stock C and stock D? . Which combination of an APIX index fund (the market portfolio) and the risk-free asset yields a volatility of 0.12? Please interpret your result. Please determine the systematic (0)) and unsystematic (oc(unsys)) risk of stock C. In addition, please briefly explain both terms.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer calcuation of capm Ret...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started