Answered step by step

Verified Expert Solution

Question

1 Approved Answer

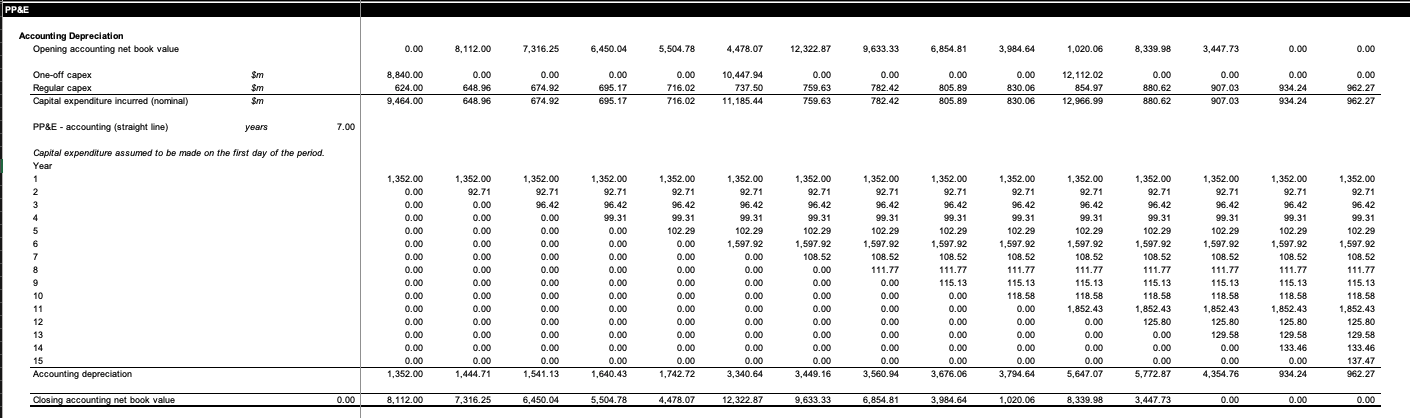

Accounting Depreciation Opening accounting net book value 0.00 8,112.00 7,316.25 6,450.04 5,504.78 4,478.07 12,322.87 9,633.33 6,854.81 3,984.64 1,020.06 8,339.98 3,447.73 0.00 0.00 One-off capex $m

| Accounting Depreciation | ||||||||||||||||||

| Opening accounting net book value | 0.00 | 8,112.00 | 7,316.25 | 6,450.04 | 5,504.78 | 4,478.07 | 12,322.87 | 9,633.33 | 6,854.81 | 3,984.64 | 1,020.06 | 8,339.98 | 3,447.73 | 0.00 | 0.00 | |||

| One-off capex | $m | 8,840.00 | 0.00 | 0.00 | 0.00 | 0.00 | 10,447.94 | 0.00 | 0.00 | 0.00 | 0.00 | 12,112.02 | 0.00 | 0.00 | 0.00 | 0.00 | ||

| Regular capex | $m | 624.00 | 648.96 | 674.92 | 695.17 | 716.02 | 737.50 | 759.63 | 782.42 | 805.89 | 830.06 | 854.97 | 880.62 | 907.03 | 934.24 | 962.27 | ||

| Capital expenditure incurred (nominal) | $m | 9,464.00 | 648.96 | 674.92 | 695.17 | 716.02 | 11,185.44 | 759.63 | 782.42 | 805.89 | 830.06 | 12,966.99 | 880.62 | 907.03 | 934.24 | 962.27 | ||

| PP&E - accounting (straight line) | years | 7.00 | ||||||||||||||||

| Capital expenditure assumed to be made on the first day of the period. | ||||||||||||||||||

| Year | ||||||||||||||||||

| 1 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | 1,352.00 | |||

| 2 | 0.00 | 92.71 | 92.71 | 92.71 | 92.71 | 92.71 | 92.71 | 92.71 | 92.71 | 92.71 | 92.71 | 92.71 | 92.71 | 92.71 | 92.71 | |||

| 3 | 0.00 | 0.00 | 96.42 | 96.42 | 96.42 | 96.42 | 96.42 | 96.42 | 96.42 | 96.42 | 96.42 | 96.42 | 96.42 | 96.42 | 96.42 | |||

| 4 | 0.00 | 0.00 | 0.00 | 99.31 | 99.31 | 99.31 | 99.31 | 99.31 | 99.31 | 99.31 | 99.31 | 99.31 | 99.31 | 99.31 | 99.31 | |||

| 5 | 0.00 | 0.00 | 0.00 | 0.00 | 102.29 | 102.29 | 102.29 | 102.29 | 102.29 | 102.29 | 102.29 | 102.29 | 102.29 | 102.29 | 102.29 | |||

| 6 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1,597.92 | 1,597.92 | 1,597.92 | 1,597.92 | 1,597.92 | 1,597.92 | 1,597.92 | 1,597.92 | 1,597.92 | 1,597.92 | |||

| 7 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 108.52 | 108.52 | 108.52 | 108.52 | 108.52 | 108.52 | 108.52 | 108.52 | 108.52 | |||

| 8 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 111.77 | 111.77 | 111.77 | 111.77 | 111.77 | 111.77 | 111.77 | 111.77 | |||

| 9 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 115.13 | 115.13 | 115.13 | 115.13 | 115.13 | 115.13 | 115.13 | |||

| 10 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 118.58 | 118.58 | 118.58 | 118.58 | 118.58 | 118.58 | |||

| 11 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1,852.43 | 1,852.43 | 1,852.43 | 1,852.43 | 1,852.43 | |||

| 12 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 125.80 | 125.80 | 125.80 | 125.80 | |||

| 13 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 129.58 | 129.58 | 129.58 | |||

| 14 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 133.46 | 133.46 | |||

| 15 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 137.47 | |||

| Accounting depreciation | 1,352.00 | 1,444.71 | 1,541.13 | 1,640.43 | 1,742.72 | 3,340.64 | 3,449.16 | 3,560.94 | 3,676.06 | 3,794.64 | 5,647.07 | 5,772.87 | 4,354.76 | 934.24 | 962.27 | |||

| Closing accounting net book value | 0.00 | 8,112.00 | 7,316.25 | 6,450.04 | 5,504.78 | 4,478.07 | 12,322.87 | 9,633.33 | 6,854.81 | 3,984.64 | 1,020.06 | 8,339.98 | 3,447.73 | 0.00 | 0.00 | 0.00 | ||

| Taxation Depreciation | ||||||||||||||||||

| Opening tax net book value | 0.00 | 8,112.00 | 7,316.25 | 6,450.04 | 5,504.78 | 4,478.07 | 12,322.87 | 9,633.33 | 6,854.81 | 3,984.64 | 1,020.06 | 8,339.98 | 3,447.73 | 0.00 | 0.00 | |||

| Capital expenditure incurred | 9,464.00 | 648.96 | 674.92 | 695.17 | 716.02 | 11,185.44 | 759.63 | 782.42 | 805.89 | 830.06 | 12,966.99 | 880.62 | 907.03 | 934.24 | 962.27 | |||

| Tax depreciation | 1,892.80 | 1,752.19 | 1,598.23 | 1,429.04 | 1,244.16 | 3,132.70 | 2,616.50 | 2,083.15 | 1,532.14 | 962.94 | 2,797.41 | 1,844.12 | 870.95 | 186.85 | 192.45 | |||

| Closing tax net book value | 0.00 | 7,571.20 | 7,008.77 | 6,392.94 | 5,716.17 | 4,976.64 | 12,530.81 | 10,466.00 | 8,332.60 | 6,128.56 | 3,851.76 | 11,189.64 | 7,376.48 | 3,483.81 | 747.40 | 769.82 | ||

Question 5

Analyst comment: Our accounting specialist thinks our year 15 closing net book value (from an accounting perspective) is understated [Error(s) in Calculations!91:120]

What is the closing accounting net book value ($m) in the Year ending June 2030?

-

6,211.04

-

6,211.14

-

6,211.27

-

6,211.39

-

6,211.57

-

6,211.62

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started