Answered step by step

Verified Expert Solution

Question

1 Approved Answer

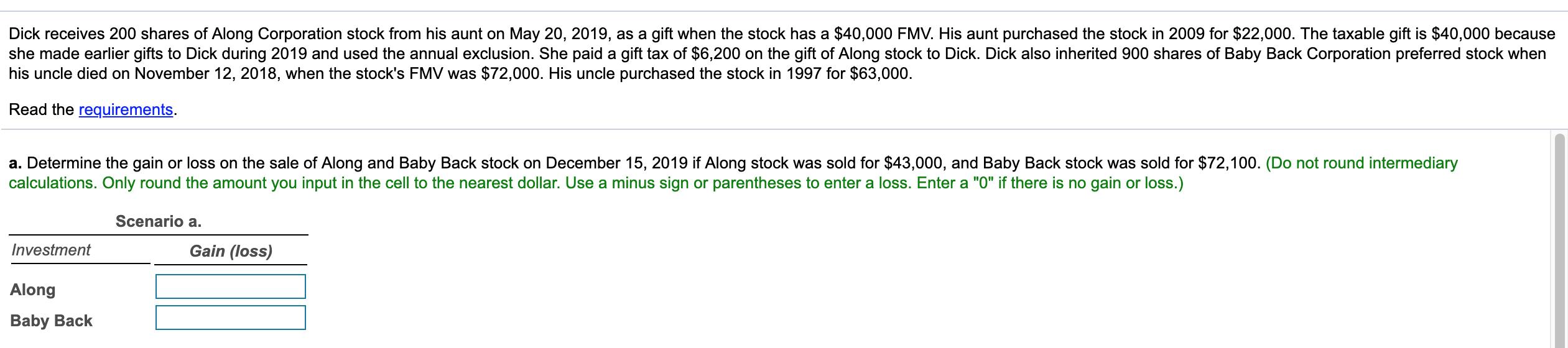

Image caption Dick receives 200 shares of Along Corporation stock from his aunt on May 20, 2019, as a gift when the stock has a

Image caption

Image caption

Dick receives 200 shares of Along Corporation stock from his aunt on May 20, 2019, as a gift when the stock has a $40,000 FMV. His aunt purchased the stock in 2009 for $22,000. The taxable gift is $40,000 because she made earlier gifts to Dick during 2019 and used the annual exclusion. She paid a gift tax of $6,200 on the gift of Along stock to Dick. Dick also inherited 900 shares of Baby Back Corporation preferred stock when his uncle died on November 12, 2018, when the stock's FMV was $72,000. His uncle purchased the stock in 1997 for $63,000. Read the requirements. a. Determine the gain or loss on the sale of Along and Baby Back stock on December 15, 2019 if Along stock was sold for $43,000, and Baby Back stock was sold for $72,100. (Do not round intermediary calculations. Only round the amount you input in the cell to the nearest dollar. Use a minus sign or parentheses to enter a loss. Enter a "0" if there is no gain or loss.) Scenario a. Investment Gain (loss) Along Baby Back

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Gain Loss on Sale of Along 43000220004000022000400006200 4300...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started