Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. At the organizational meeting of AIID, Inc., Ashley, lan, and Dallas, acting in their capacity as the Board of Directors, approved the issuance of

.

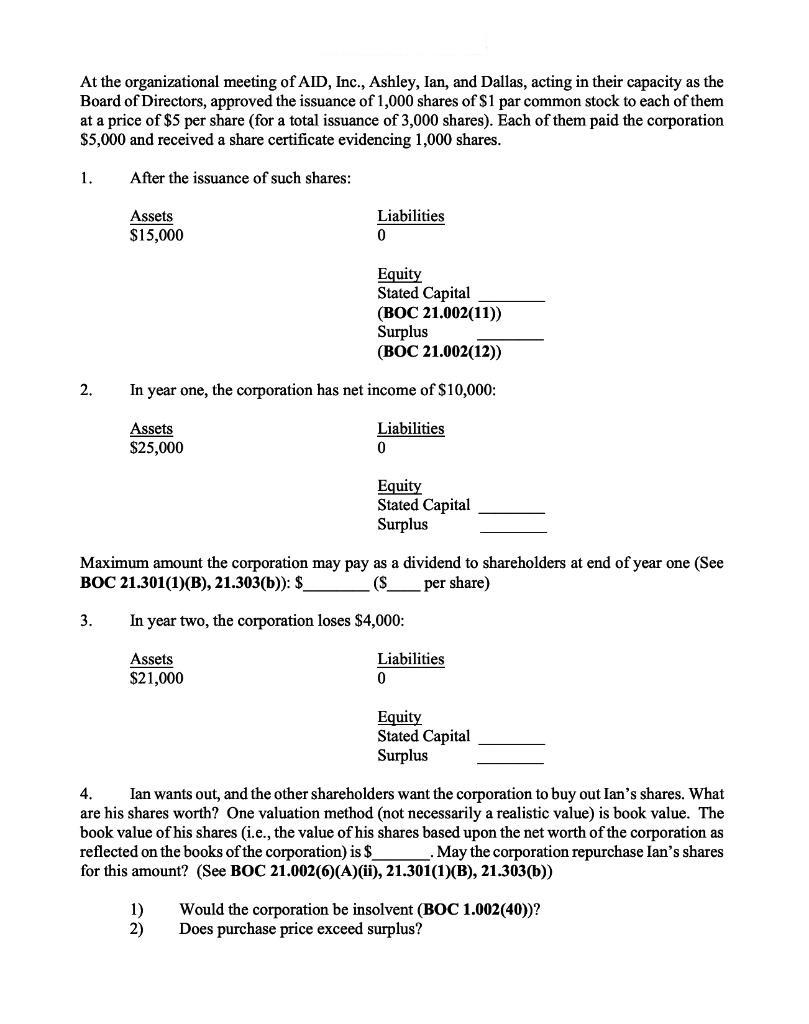

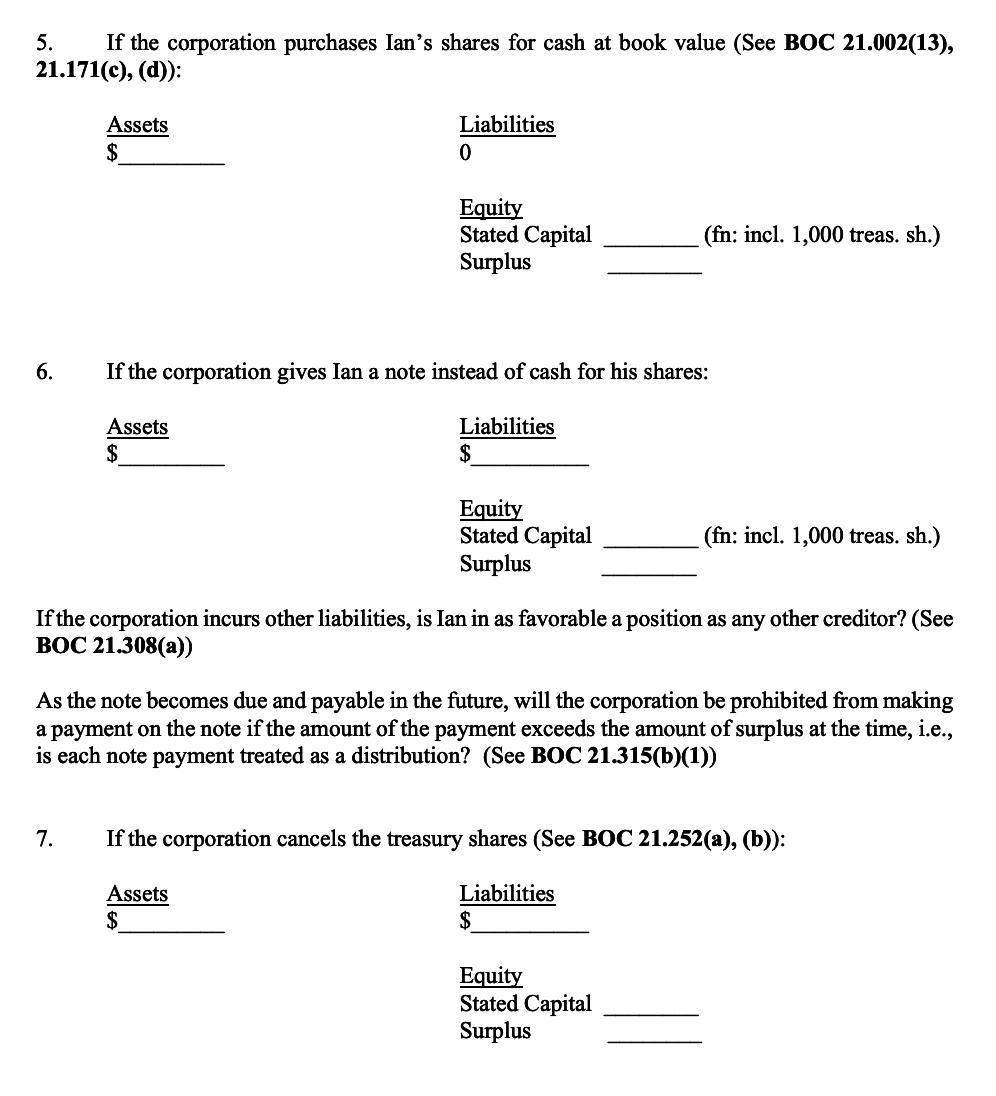

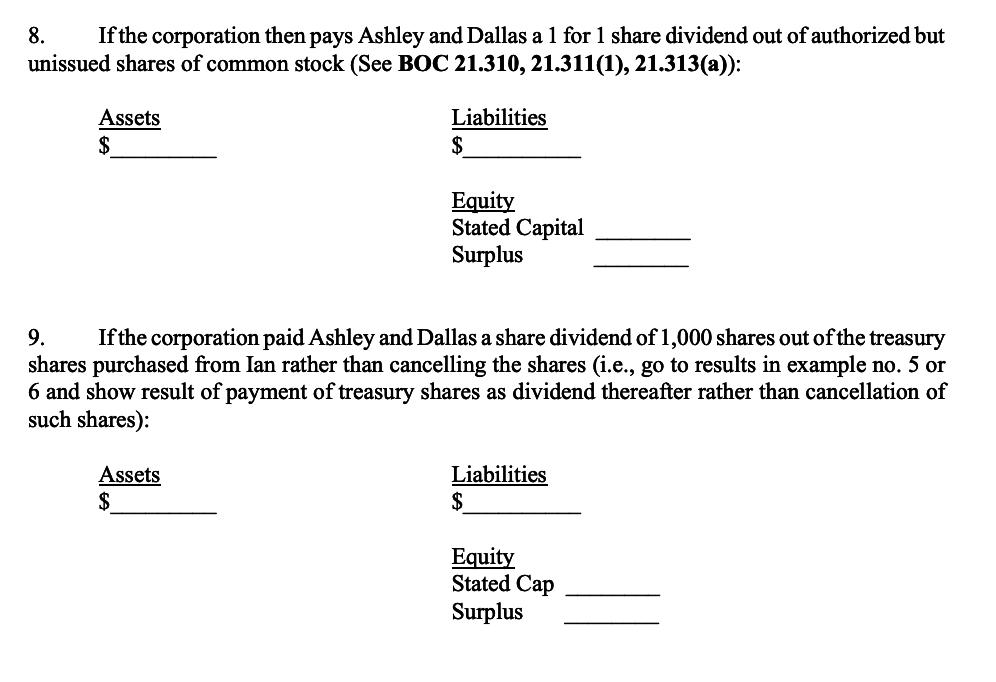

At the organizational meeting of AIID, Inc., Ashley, lan, and Dallas, acting in their capacity as the Board of Directors, approved the issuance of 1,000 shares of $1 par common stock to each of them at a price of $5 per share (for a total issuance of 3,000 shares). Each of them paid the corporation $5,000 and received a share certificate evidencing 1,000 shares. 1. After the issuance of such shares: Liabilities Assets $15,000 Equity Stated Capital (BOC 21.002(11)) Surplus (BOC 21.002(12)) 2. In year one, the corporation has net income of $10,000: Assets $25,000 Liabilities Equity Stated Capital Surplus Maximum amount the corporation may pay as a dividend to shareholders at end of year one (See BOC 21.301(1)(B), 21.303(b)): $ (S per share) 3. In year two, the corporation loses $4,000: Assets Liabilities $21,000 Equity Stated Capital Surplus 4. Ian wants out, and the other shareholders want the corporation to buy out Ian's shares. What are his shares worth? One valuation method (not necessarily a realistic value) is book value. The book value of his shares (i.e., the value of his shares based upon the net worth of the corporation as reflected on the books of the corporation) is $ for this amount? (See BOC 21.002()(A)(i), 21.301(1)(B), 21.303(b)) May the corporation repurchase lan's shares 1) 2) Would the corporation be insolvent (BOC 1.002(40))? Does purchase price exceed surplus?

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started