Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Division I PARTNERSHIP TAXATION Part A FORMATION OF A PARTNERSHIP PROBLEM IP Brice Dunesborough (Brice), since quitting his job as Information Officer at the

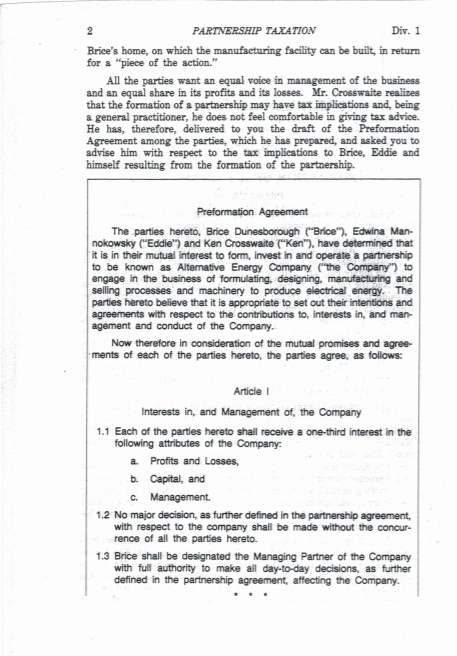

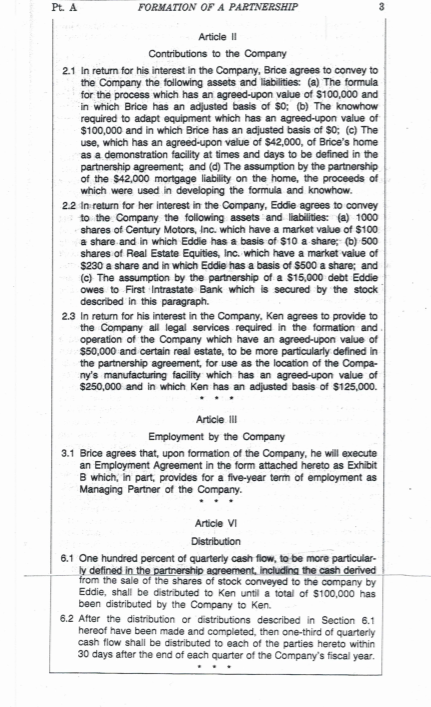

Division I PARTNERSHIP TAXATION Part A FORMATION OF A PARTNERSHIP PROBLEM IP Brice Dunesborough (Brice), since quitting his job as Information Officer at the U.S. Consulate in a South Pacific nation, has barely supported his spouse and children through his earnings as a patio contractor. While in the South Pacific, he observed individuals creating electrostatic charges by exposing a mixture of certain plant extracts and water to highly magnified sunlight. Being concerned about the environ- ment and the high cost of fossil fuels, he became intrigued with the idea of using this process to create electric current. Since returning to the United States he has spent every free moment attempting to adapt equipment and to devise a proper formulation of the process in order to create, store and transmit electric current. He finally succeeded in achieving his goal, which he calls the Dunesborough Machine. It has cost him every cent he has in addition to funds derived from a mortgage on his home. He has "written-off," for tax purposes, all of his costs as research and development expenses. He has fully adapted his home to use the electric current generated by the Machine. Edwina Mannokowsky (Eddie), a friend of Brice and one whom some would call a financial wizard because of the fortune she has amassed through shrewd investments, has visited Brice's home and observed the Machine in operation. Eddie believes the idea has great commercial possibilities and is prepared to provide the funds necessary to: (1) if possible, secure a mechanical patent on the adaptation of the equipment and a process patent for the formulation of the process; and (2) provide the working capital, production machinery and manufacturing facility necessary to manufacture the Machine. All Eddie wants in return is the repayment of her funds, as soon as the manufacturing operation be- comes profitable, and a "piece of the action." After Eddie and Brice had some discussions with respect to combin- ing Brice's Machine with Eddie's money, they visited with Ken Cross- waite (Ken), a local lawyer, about setting up a partnership. Mr. Cross- waite, who also dabbles in real estate, was enthusiastic about the Machine and offered to do all the legal work required for, and by, the partnership and to convey to it a parcel of real estate he owns near 1 2 PARTNERSHIP TAXATION Div. 1 Brice's home, on which the manufacturing facility can be built, in return for a "piece of the action." All the parties want an equal voice in management of the business and an equal share in its profits and its losses. Mr. Crosswaite realizes that the formation of a partnership may have tax implications and, being a general practitioner, he does not feel comfortable in giving tax advice. He has, therefore, delivered to you the draft of the Preformation Agreement among the parties, which he has prepared, and asked you to advise him with respect to the tax implications to Brice, Eddie and himself resulting from the formation of the partnership. Preformation Agreement The parties hereto, Brice Dunesborough ("Brice"), Edwina Man- nokowsky ("Eddie") and Ken Crosswaite ("Ken"), have determined that it is in their mutual interest to form, invest in and operate a partnership to be known as Alternative Energy Company ("the Company") to engage in the business of formulating, designing, manufacturing and selling processes and machinery to produce electrical energy. The parties hereto believe that it is appropriate to set out their intentions and agreements with respect to the contributions to, interests in, and man- agement and conduct of the Company. Now therefore in consideration of the mutual promises and agree- ments of each of the parties hereto, the parties agree, as follows: Article 1 Interests in, and Management of, the Company 1.1 Each of the parties hereto shall receive a one-third interest in the following attributes of the Company: a. Profits and Losses, b. Capital, and c. Management. 1.2 No major decision, as further defined in the partnership agreement, with respect to the company shall be made without the concur- rence of all the parties hereto. 1.3 Brice shall be designated the Managing Partner of the Company with full authority to make all day-to-day decisions, as further defined in the partnership agreement, affecting the Company. Pt. A FORMATION OF A PARTNERSHIP Article II Contributions to the Company 2.1 In return for his interest in the Company, Brice agrees to convey to the Company the following assets and liabilities: (a) The formula for the process which has an agreed-upon value of $100,000 and in which Brice has an adjusted basis of $0; (b) The knowhow required to adapt equipment which has an agreed-upon value of $100,000 and in which Brice has an adjusted basis of $0; (c) The use, which has an agreed-upon value of $42,000, of Brice's home as a demonstration facility at times and days to be defined in the partnership agreement; and (d) The assumption by the partnership of the $42,000 mortgage liability on the home, the proceeds of which were used in developing the formula and knowhow. 2.2 In return for her interest in the Company, Eddie agrees to convey to the Company the following assets and liabilities: (a) 1000 shares of Century Motors, Inc. which have a market value of $100 a share and in which Eddie has a basis of $10 a share; (b) 500 shares of Real Estate Equities, Inc. which have a market value of $230 a share and in which Eddie has a basis of $500 a share; and (c) The assumption by the partnership of a $15,000 debt Eddie owes to First Intrastate Bank which is secured by the stock described in this paragraph. 2.3 In return for his interest in the Company, Ken agrees to provide to the Company all legal services required in the formation and. operation of the Company which have an agreed-upon value of $50,000 and certain real estate, to be more particularly defined in the partnership agreement, for use as the location of the Compa- ny's manufacturing facility which has an agreed-upon value of $250,000 and in which Ken has an adjusted basis of $125,000. Article III Employment by the Company 3.1 Brice agrees that, upon formation of the Company, he will execute an Employment Agreement in the form attached hereto as Exhibit B which, in part, provides for a five-year term of employment as Managing Partner of the Company. Article VI Distribution 6.1 One hundred percent of quarterly cash flow, to be more particular- ly defined in the partnership agreement, including the cash derived from the sale of the shares of stock conveyed to the company by Eddie, shall be distributed to Ken until a total of $100,000 has been distributed by the Company to Ken. 6.2 After the distribution or distributions described in Section 6.1 hereof have been made and completed, then one-third of quarterly cash flow shall be distributed each of the parties hereto within 30 days after the end of each quarter of the Company's fiscal year.

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

the parties involved are Brice Dunesborough Brice Edwina Mannokowsky Eddie and Ken Crosswaite Ken They are interested in forming a partnership called ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started