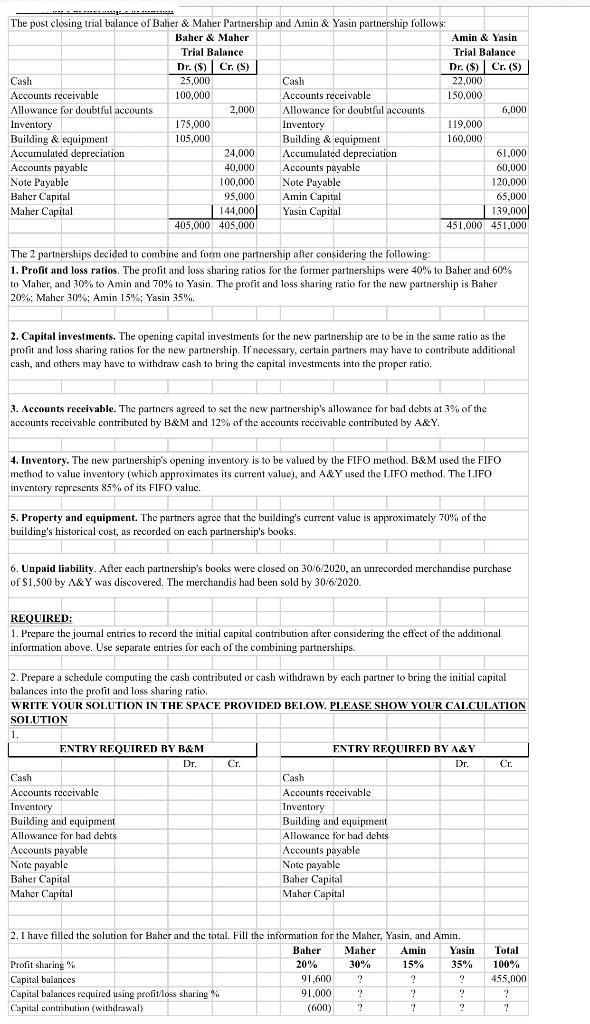

The post closing trial balance of Baher & Maher Partnership and Amin & Yasin partnership follows: Baher & Maher Amin & Yasin Trial Balance

The post closing trial balance of Baher & Maher Partnership and Amin & Yasin partnership follows: Baher & Maher Amin & Yasin Trial Balance Trial Balance Dr. (S) | Cr. (S) Dr. (S) | Cr. (S) Cash 25,000 Cash 22,000 Accounts receivable 100,000 Accounts receivable 150,000 Allowance for doubtful accounts 2,000 Allowance for doubtful accounts 6,000 175,000 Inventory Building & equipment Accumulated depreciation Accounts payable Note Payable Amin Capital Yasin Capital 119,000 Inventory Building & equipment Accumulated depreciation Accounts payable Note Payable Baher Capital Maher Capital 105,000 160,000 24,000 61.000 40,000 60,000 100,000 120,000 95,000 65,000 144,000 139,000 405,000 405,000 451.000 451.000 The 2 partnerships decided to combine and form one partnership alter considering the following: 1. Profit and loss ratios. The profit and loss sharing ratios for the former partnerships were 40% to Baher and 60% to Maher, and 30% to Amin and 70% to Yasin. The profit and loss sharing ratio for the new partnership is Baher 20%: Maher 30%: Amin 15%: Yasin 35%. 2. Capital investments. The opening capital investments for the new partnership are to be in the same ratio as the profit and loss sharing ratios for the new partnership. If'necessary, certain partners may have to contribute additional cash, and others may have to withdraw cash to bring the capital investments into the proper ratio. 3. Accounts receivable. The partners agreed to set the new partnership's allowance for bad debts at 3% of the accounts reccivable contributed by B&M and 12% of the accounts reccivable contributed by A&Y. 4. Inventory. The new partnership's opening inventory is to be valued by the FIFO method. B&M used the FIFO method to value inventory (which approximates its current value), and A&Y used the LIFO method. The L.IFO inventory represents 85% of its FIFO valuc. 5. Property and equipment. The partners agree that the building's current valuc is approximately 70% of the building's historical cost, as recorded on each partnership's books. 6. Unpaid liability. After each partnership's books were closed on 30/6/2020, an unrecorded merchandise purchase of $1,500 by A&Y was discovered. The merchandis had been sold by 30/6/2020. REQUIRED: 1. Prepare the journal entrics to record the initial capital contribution after considering the effect of the additional information above. Use separate entries for each of the combining partnerships. 2. Prepare a schedule computing the cash contributed or cash withdrawn by each partner to bring the initial capital balances into the profit and loss sharing ratio. WRITE YOUR SOLUTION IN THE SPACE PROVIDED BELOW. PLEASE SHOW YOUR CALCULATION SOLUTION 1. ENTRY REQUIRED BY B&M ENTRY REQUIRED BY A&Y Dr. Cr. Dr. Cr. Cash Cash Accounts receivable Accounts receivable Inventory Building and equipment Inventory Building and equipment Allowance for had debts Allowance for had debts Accounts payable Note payable Baher Capital Maher Capital Accounts payable Note payable Baher Capital Maher Capital 2. I have filled the solution for Baher and the total. Fill the information for the Maher, Yasin, and Amin. Baher Maher Amin Yasin Total Profit sharing % 20% 30% 15% 35% 100% Capital balunces 91,600 455,000 Capital balances required using profitloss sharing % 91,000 Capital contribution (withdrawal) (600)

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started