Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Dolce Singapura Pte Ltd (DSPL), a Singapore incorporated company, runs a very popular patisserie business in Singapore. It was incorporated on 15 December 2017

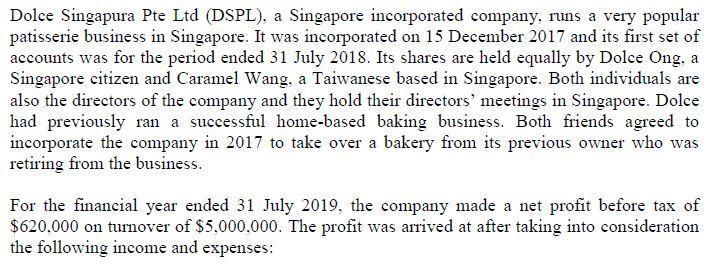

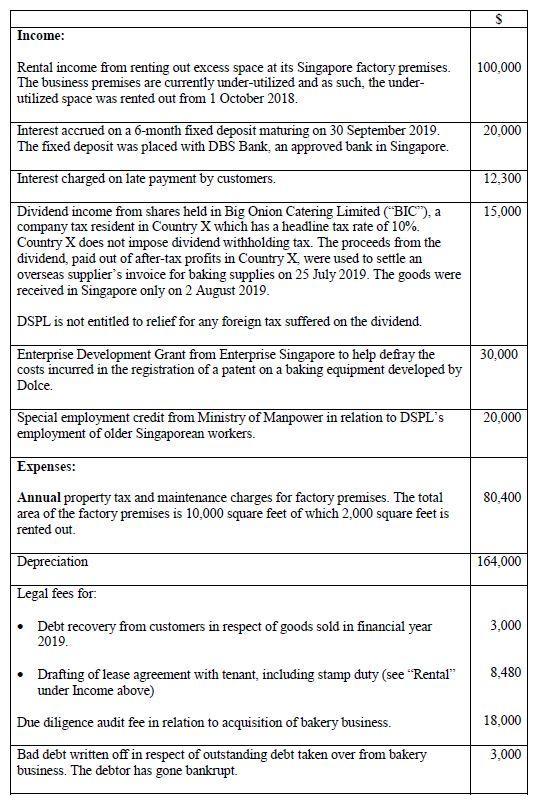

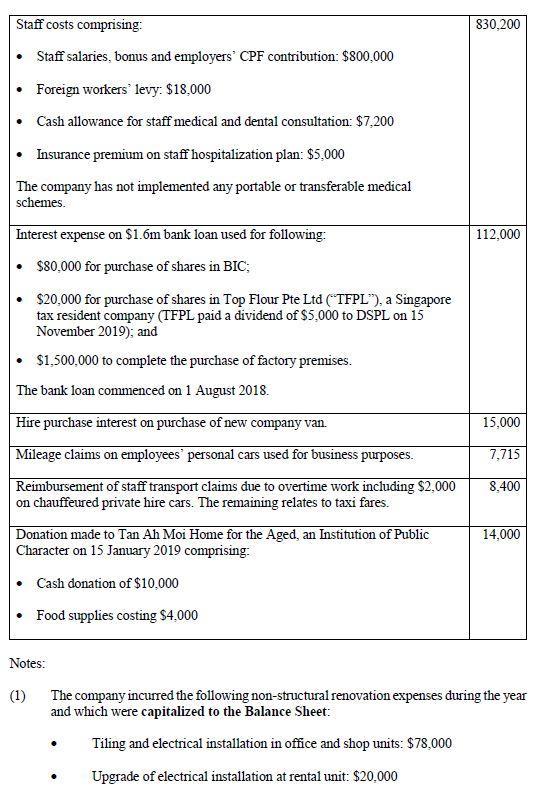

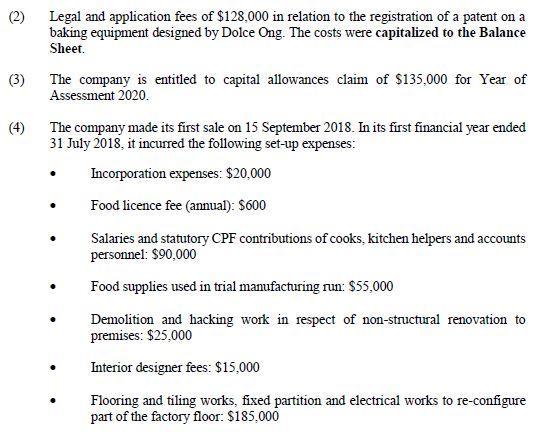

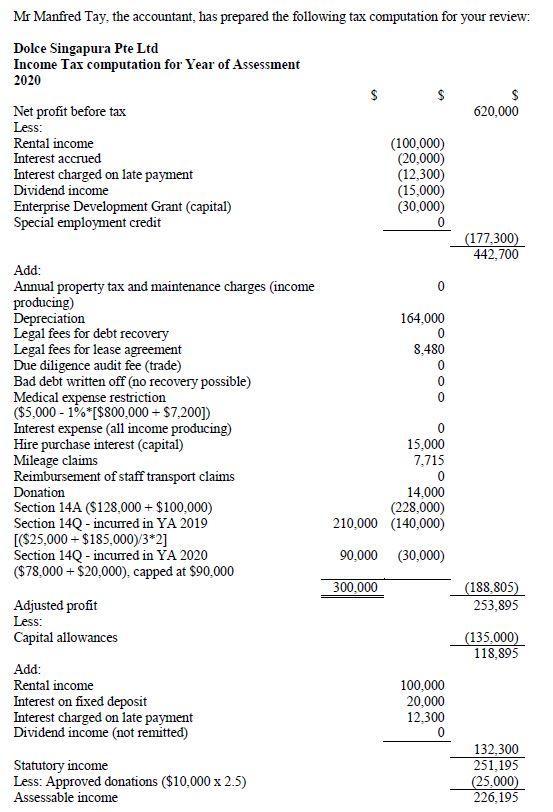

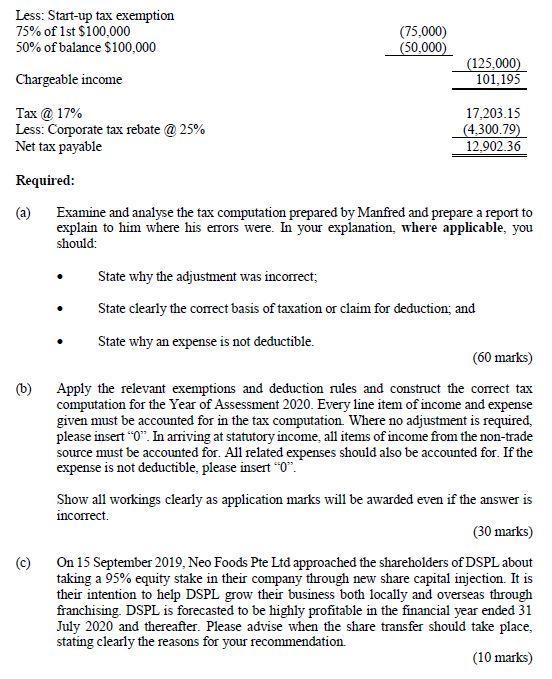

Dolce Singapura Pte Ltd (DSPL), a Singapore incorporated company, runs a very popular patisserie business in Singapore. It was incorporated on 15 December 2017 and its first set of accounts was for the period ended 31 July 2018. Its shares are held equally by Dolce Ong, a Singapore citizen and Caramel Wang, a Taiwanese based in Singapore. Both individuals are also the directors of the company and they hold their directors' meetings in Singapore. Dolce had previously ran a successful home-based baking business. Both friends agreed to incorporate the company in 2017 to take over a bakery from its previous owner who was retiring from the business. For the financial year ended 31 July 2019, the company made a net profit before tax of $620,000 on turnover of $5.000.000. The profit was arrived at after taking into consideration the following income and expenses: Income: Rental income from renting out excess space at its Singapore factory premises. The business premises are currently under-utilized and as such, the under- utilized space was rented out from 1 October 2018. Interest accrued on a 6-month fixed deposit maturing on 30 September 2019. The fixed deposit was placed with DBS Bank, an approved bank in Singapore. Interest charged on late payment by customers. Dividend income from shares held in Big Onion Catering Limited ("BIC"), a company tax resident in Country X which has a headline tax rate of 10%. Country X does not impose dividend withholding tax. The proceeds from the dividend, paid out of after-tax profits in Country X, were used to settle an overseas supplier's invoice for baking supplies on 25 July 2019. The goods were received in Singapore only on 2 August 2019. DSPL is not entitled to relief for any foreign tax suffered on the dividend. Enterprise Development Grant from Enterprise Singapore to help defray the costs incurred in the registration of a patent on a baking equipment developed by Dolce. Special employment credit from Ministry of Manpower in relation to DSPL's employment of older Singaporean workers. Expenses: Annual property tax and maintenance charges for factory premises. The total area of the factory premises is 10,000 square feet of which 2,000 square feet is rented out. Depreciation Legal fees for: . Debt recovery from customers in respect of goods sold in financial year 2019. Drafting of lease agreement with tenant, including stamp duty (see "Rental" under Income above) Due diligence audit fee in relation to acquisition of bakery business. Bad debt written off in respect of outstanding debt taken over from bakery business. The debtor has gone bankrupt. $ 100,000 20,000 12,300 15,000 30,000 20,000 80,400 164,000 3,000 8.480 18,000 3,000 Staff costs comprising: Staff salaries, bonus and employers' CPF contribution: $800,000 Foreign workers' levy: $18,000 Cash allowance for staff medical and dental consultation: $7,200 Insurance premium on staff hospitalization plan: $5,000 The company has not implemented any portable or transferable medical schemes. Interest expense on $1.6m bank loan used for following: $80,000 for purchase of shares in BIC; $20,000 for purchase of shares in Top Flour Pte Ltd (TFPL"), a Singapore tax resident company (TFPL paid a dividend of $5,000 to DSPL on 15 November 2019); and $1,500,000 to complete the purchase of factory premises. The bank loan commenced on 1 August 2018. Hire purchase interest on purchase of new company van. Mileage claims on employees' personal cars used for business purposes. Reimbursement of staff transport claims due to overtime work including $2,000 on chauffeured private hire cars. The remaining relates to taxi fares. Donation made to Tan Ah Moi Home for the Aged, an Institution of Public Character on 15 January 2019 comprising: Cash donation of $10,000 Food supplies costing $4,000 Notes: (1) 830,200 112,000 15,000 7,715 8,400 14,000 The company incurred the following non-structural renovation expenses during the year and which were capitalized to the Balance Sheet: Tiling and electrical installation in office and shop units: $78,000 Upgrade of electrical installation at rental unit: $20,000 (2) (3) Legal and application fees of $128,000 in relation to the registration of a patent on a baking equipment designed by Dolce Ong. The costs were capitalized to the Balance Sheet. The company is entitled to capital allowances claim of $135,000 for Year of Assessment 2020. The company made its first sale on 15 September 2018. In its first financial year ended 31 July 2018, it incurred the following set-up expenses: Incorporation expenses: $20,000 Food licence fee (annual): $600 Salaries and statutory CPF contributions of cooks, kitchen helpers and accounts personnel: $90,000 . Food supplies used in trial manufacturing run: $55,000 Demolition and hacking work in respect of non-structural renovation to premises: $25,000 Interior designer fees: $15,000 Flooring and tiling works, fixed partition and electrical works to re-configure part of the factory floor: $185,000 Mr Manfred Tay, the accountant, has prepared the following tax computation for your review: Dolce Singapura Pte Ltd Income Tax computation for Year of Assessment 2020 Net profit before tax Less: Rental income Interest accrued Interest charged on late payment Dividend income Enterprise Development Grant (capital) Special employment credit Add: Annual property tax and maintenance charges (income producing) Depreciation Legal fees for debt recovery Legal fees for lease agreement Due diligence audit fee (trade) Bad debt written off (no recovery possible) Medical expense restriction ($5,000-1% *[$800,000+ $7,200]) Interest expense (all income producing) Hire purchase interest (capital) Mileage claims Reimbursement of staff transport claims Donation Section 14A ($128,000+ $100,000) Section 14Q-incurred in YA 2019 [($25,000+ $185,000)/3*2] Section 14Q-incurred in YA 2020 ($78,000 + $20,000), capped at $90,000 Adjusted profit Less: Capital allowances Add: Rental income Interest on fixed deposit Interest charged on late payment Dividend income (not remitted) Statutory income Less: Approved donations ($10,000 x 2.5) Assessable income $ $ (100,000) (20,000) (12,300) (15,000) (30,000) 0 164,000 0 8.480 0 0 0 0 15,000 7,715 0 14,000 (228,000) 210,000 (140,000) 90,000 (30,000) 300,000 100,000 20,000 12,300 0 $ 620,000 (177,300) 442,700 (188,805) 253,895 (135,000) 118,895 132,300 251,195 (25,000) 226,195 Less: Start-up tax exemption 75% of 1st $100,000 50% of balance $100,000 Chargeable income Tax @ 17% Less: Corporate tax rebate @ 25% Net tax payable Required: (a) (b) (c) (75,000) (50,000) (125,000) 101,195 17,203.15 (4,300.79) 12.902.36 Examine and analyse the tax computation prepared by Manfred and prepare a report to explain to him where his errors were. In your explanation, where applicable, you should: State why the adjustment was incorrect; State clearly the correct basis of taxation or claim for deduction; and State why an expense is not deductible. (60 marks) Apply the relevant exemptions and deduction rules and construct the correct tax computation for the Year of Assessment 2020. Every line item of income and expense given must be accounted for in the tax computation. Where no adjustment is required, please insert "0". In arriving at statutory income, all items of income from the non-trade source must be accounted for. All related expenses should also be accounted for. If the expense is not deductible, please insert "0". Show all workings clearly as application marks will be awarded even if the answer is incorrect. (30 marks) On 15 September 2019, Neo Foods Pte Ltd approached the shareholders of DSPL about taking a 95% equity stake in their company through new share capital injection. It is their intention to help DSPL grow their business both locally and overseas through franchising. DSPL is forecasted to be highly profitable in the financial year ended 31 July 2020 and thereafter. Please advise when the share transfer should take place, stating clearly the reasons for your recommendation (10 marks)

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a 1 The adjustment for Section 14A was incorrect as the total amount of expenses incurred in relatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started