Answered step by step

Verified Expert Solution

Question

1 Approved Answer

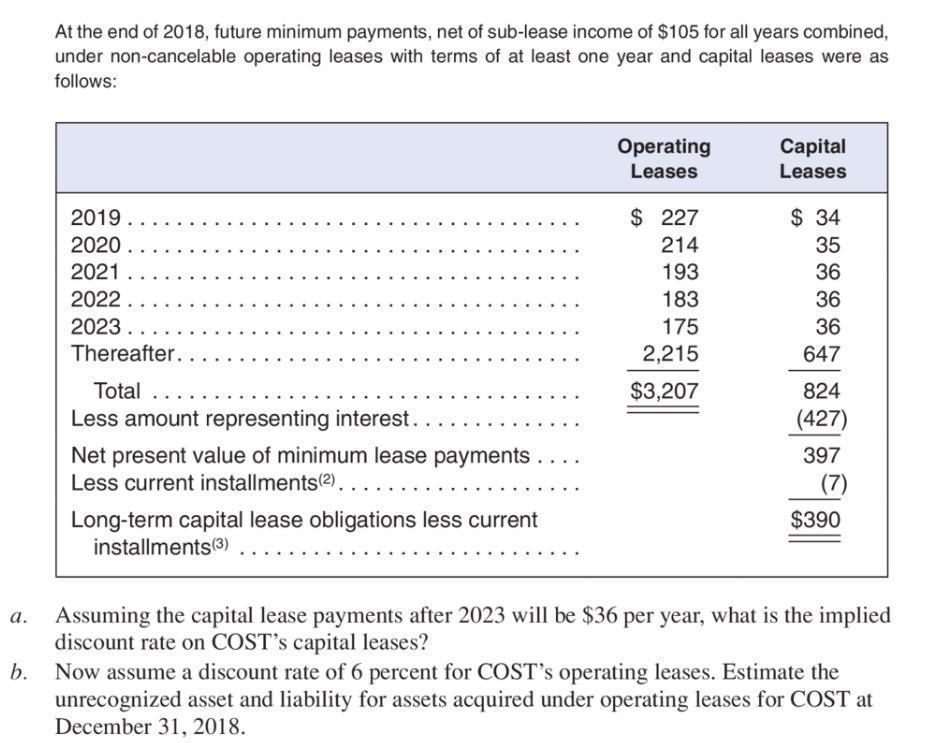

a. At the end of 2018, future minimum payments, net of sub-lease income of $105 for all years combined, under non-cancelable operating leases with

a. At the end of 2018, future minimum payments, net of sub-lease income of $105 for all years combined, under non-cancelable operating leases with terms of at least one year and capital leases were as follows: 2019.... 2020.... 2021 .. 2022.. 2023.. .... Thereafter..... Total .. Less amount representing interest. ... Net present value of minimum lease payments. Less current installments(2). Long-term capital lease obligations less current installments (3) Operating Leases $227 214 193 183 175 2,215 $3,207 Capital Leases $34 35 36 36 36 647 824 (427) 397 (7) $390 Assuming the capital lease payments after 2023 will be $36 per year, what is the implied discount rate on COST's capital leases? b. Now assume a discount rate of 6 percent for COST's operating leases. Estimate the unrecognized asset and liability for assets acquired under operating leases for COST at December 31, 2018.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Assuming the capital lease payments after 20 23 will be 36 per year what is the implied discount r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started