Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting Education Ltd provides tutoring services for students who plan to complete the Association of Chartered Certified Accountants program. Accounting Education Ltd has two

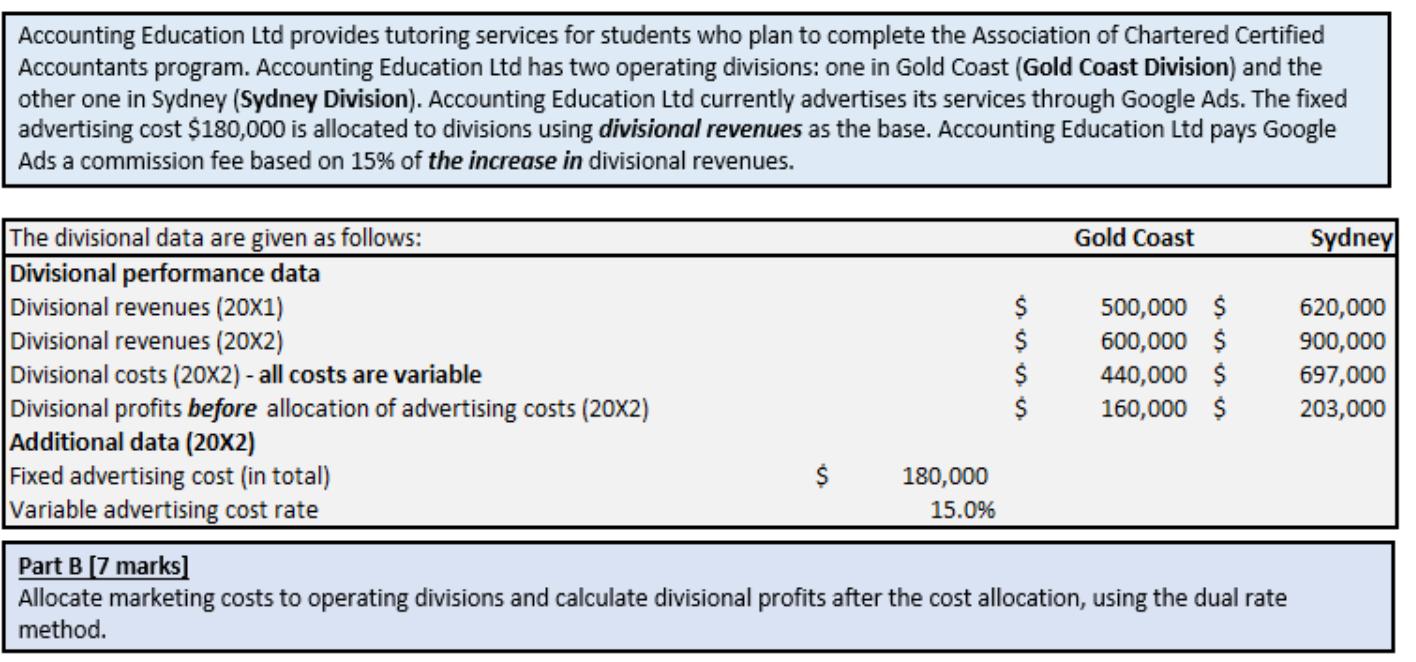

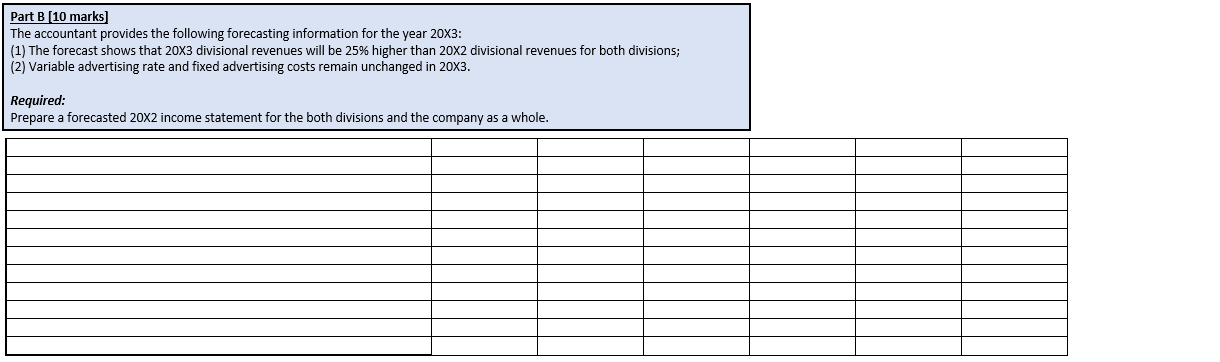

Accounting Education Ltd provides tutoring services for students who plan to complete the Association of Chartered Certified Accountants program. Accounting Education Ltd has two operating divisions: one in Gold Coast (Gold Coast Division) and the other one in Sydney (Sydney Division). Accounting Education Ltd currently advertises its services through Google Ads. The fixed advertising cost $180,000 is allocated to divisions using divisional revenues as the base. Accounting Education Ltd pays Google Ads a commission fee based on 15% of the increase in divisional revenues. The divisional data are given as follows: Divisional performance data Gold Coast Sydney Divisional revenues (20X1) Divisional revenues (20X2) Divisional costs (20X2) - all costs are variable Divisional profits before allocation of advertising costs (20X2) SSSS $ 500,000 $ 620,000 $ 600,000 $ 900,000 $ 440,000 $ 697,000 $ 160,000 $ 203,000 Additional data (20X2) Fixed advertising cost (in total) $ 180,000 15.0% Variable advertising cost rate Part B [7 marks] Allocate marketing costs to operating divisions and calculate divisional profits after the cost allocation, using the dual rate method. Part B [10 marks] The accountant provides the following forecasting information for the year 20X3: (1) The forecast shows that 20X3 divisional revenues will be 25% higher than 20X2 divisional revenues for both divisions; (2) Variable advertising rate and fixed advertising costs remain unchanged in 20X3. Required: Prepare a forecasted 20X2 income statement for the both divisions and the company as a whole. Part C [3 marks] What is the key benefit of using a dual rate method to allocate costs with respect to keep-or-drop decisions? Explain briefly. Your Answer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started