Accounting Entry and Reversing Entry Problems

- Based on the File "Rosenberg Question" attached below, use that information to journalize the transactions based on the "Rosenberg Solutions Template Below

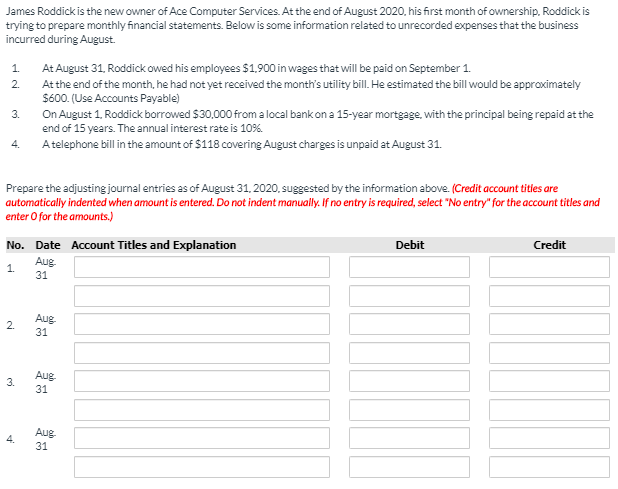

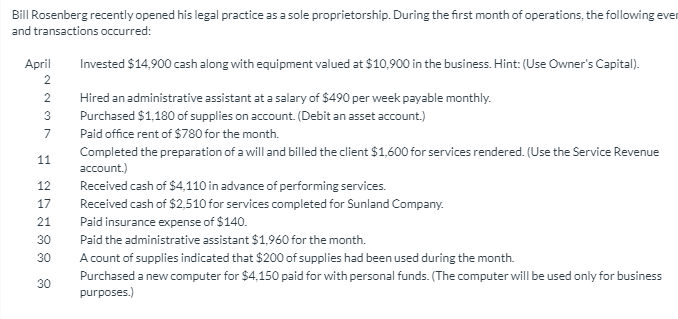

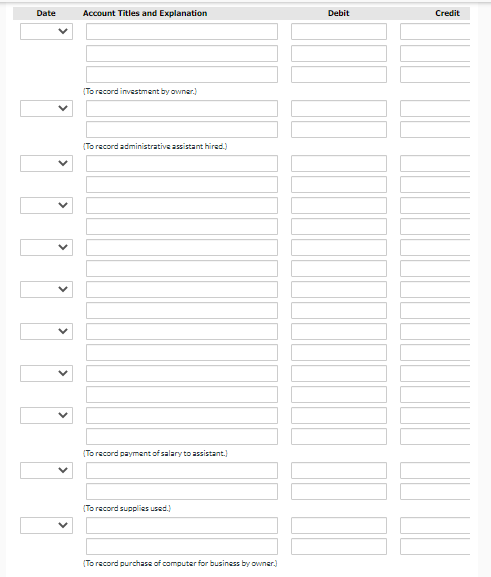

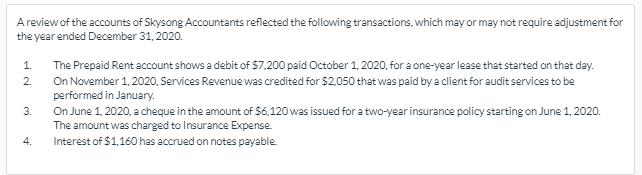

James Roddick is the new owner of Ace Computer Services. At the end of August 2020, his first month of ownership, Roddick is trying to prepare monthly financial statements. Below is some information related to unrecorded expenses that the business incurred during August. 1. At August 31, Roddick owed his employees $1.900 in wages that will be paid on September 1. 2 At the end of the month, he had not yet received the month's utility bill. He estimated the bill would be approximately $600. (Use Accounts Payable) 3. On August 1, Roddick borrowed $30,000 from a local bank on a 15-year mortgage, with the principal being repaid at the end of 15 years. The annual interest rate is 10%. 4. A telephone bill in the amount of $118 covering August charges is unpaid at August 31. Prepare the adjusting journal entries as of August 31, 2020, suggested by the information above. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) No. Date Account Titles and Explanation Debit Credit 1. Aug 31 2. Aug 31 3. Aug 31 4 Aug 31Bill Rosenberg recently opened his legal practice as a sole proprietorship. During the first month of operations, the following eve and transactions occurred: April Invested $14,900 cash along with equipment valued at $10,900 in the business. Hint: (Use Owner's Capital). 2 Hired an administrative assistant at a salary of $490 per week payable monthly. 3 Purchased $1,180 of supplies on account. (Debit an asset account.) Paid office rent of $780 for the month. 11 Completed the preparation of a will and billed the client $1,600 for services rendered. (Use the Service Revenue account.) 12 Received cash of $4,110 in advance of performing services. 17 Received cash of $2,510 for services completed for Sunland Company. 21 Paid insurance expense of $140. 30 Paid the administrative assistant $1,960 for the month. 30 A count of supplies indicated that $200 of supplies had been used during the month. 30 Purchased a new computer for $4,150 paid for with personal funds. (The computer will be used only for business purposes.)Date Account Titles and Explanation Debit Credit [To record investment by owner.) (To record administrative assistant hired.) (To record payment of salary to assistant.} (To record supplies used.) (To record purchase of computer for business by owner.]A review of the accounts of Skysong Accountants reflected the following transactions, which may or may not require adjustment for the year ended December 31, 2020. 1. The Prepaid Rent account shows a debit of $7.200 paid October 1, 2020, for a one-year lease that started on that day. 2. On November 1, 2020, Services Revenue was credited for $2.050 that was paid by a client for audit services to be performed in January. 3. On June 1, 2020, a cheque in the amount of $6.120 was issued for a two-year insurance policy starting on June 1, 2020. The amount was charged to Insurance Expense 4. Interest of $1,160 has accrued on notes payable