Answered step by step

Verified Expert Solution

Question

1 Approved Answer

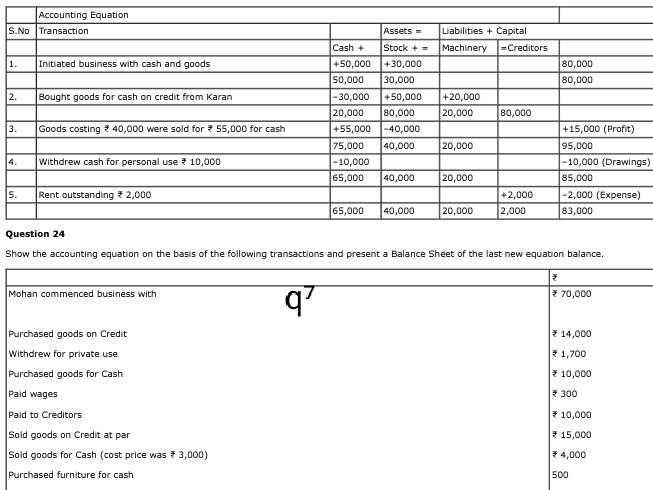

Accounting Equation S.No Transaction Assets = Liabilities + Capital Cash + Stock + - Machinery =Creditors 1. Initiated business with cash and goods +50,000 +30,000

Accounting Equation S.No Transaction Assets = Liabilities + Capital Cash + Stock + - Machinery =Creditors 1. Initiated business with cash and goods +50,000 +30,000 80,000 50,000 30,000 80,000 2. Bought goods for cash on credit from Karan -30,000 +50,000 +20,000 20,000 80,000 20,000 80,000 3. Goods costing 40,000 were sold for * 55,000 for cash +55,000 - 40,000 +15,000 (Profit) 75,000 40,000 20,000 95,000 4. Withdrew cash for personal use + 10,000 - 10,000 - 10,000 (Drawings) 65,000 40,000 20,000 85,000 5. Rent outstanding 2,000 +2,000 -2,000 (Expense) 65,000 40,000 20,000 2,000 83,000 Question 24 Show the accounting equation on the basis of the following transactions and present a Balance Sheet of the last new equation balance. Mohan commenced business with 70,000 97 14,000 * 1,700 2 10,000 300 Purchased goods on Credit Withdrew for private use Purchased goods for Cash Paid wages Paid to Creditors Sold goods on Credit at par Sold goods for Cash (cost price was 73,000) Purchased furniture for cash 10,000 15,000 4,000 500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started