Answered step by step

Verified Expert Solution

Question

1 Approved Answer

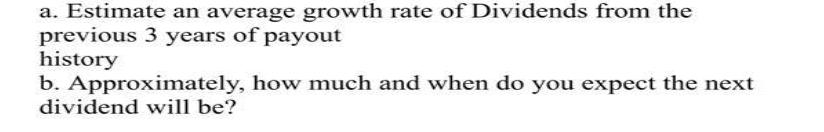

a. Estimate an average growth rate of Dividends from the previous 3 years of payout history b. Approximately, how much and when do you

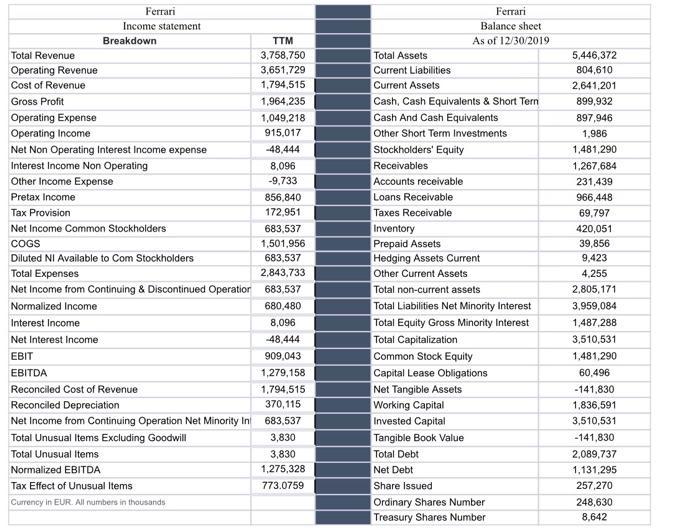

a. Estimate an average growth rate of Dividends from the previous 3 years of payout history b. Approximately, how much and when do you expect the next dividend will be? Total Revenue Operating Revenue Cost of Revenue. Gross Profit Ferrari Income statement Breakdown Operating Expense Operating Income Net Non Operating Interest Income expense Interest Income Non Operating Other Income Expense Pretax Income Tax Provision Net Income Common Stockholders COGS Diluted NI Available to Com Stockholders TTM 3,758,750 3,651,729 1,794,515 1,964,235 1,049,218 915,017 -48,444 8,096 -9,733 856,840 172,951 683,537 1,501,956 683,537 2,843,733 Total Expenses Net Income from Continuing & Discontinued Operation 683,537 Normalized Income 680,480 Interest Income 8,096 Net Interest Income -48,444 EBIT 909,043 EBITDA 1,279,158 Reconciled Cost of Revenue 1,794,515 Reconciled Depreciation 370,115 Net Income from Continuing Operation Net Minority In 683,537 Total Unusual Items Excluding Goodwill 3,830 Total Unusual Items 3,830 Normalized EBITDA 1,275,328 Tax Effect of Unusual Items 773.0759 Currency in EUR. All numbers in thousands Total Assets Current Liabilities Current Assets Cash, Cash Equivalents & Short Tern Cash And Cash Equivalents Other Short Term Investments Stockholders' Equity Receivables Ferrari Balance sheet As of 12/30/2019 Accounts receivable Loans Receivable. Taxes Receivable Inventory Prepaid Assets Hedging Assets Current Other Current Assets Total non-current assets Total Liabilities Net Minority Interest Total Equity Gross Minority Interest Total Capitalization. Common Stock Equity Capital Lease Obligations Net Tangible Assets Working Capital Invested Capital Tangible Book Value Total Debt Net Debt Share Issued Ordinary Shares Number Treasury Shares Number: 5,446,372 804,610 2,641,201 899,932 897,946 1,986 1,481,290 1,267,684 231,439 966,448 69,797 420,051 39,856 9,423 4,255 2,805,171 3,959,084 1,487,288 3,510,531 1,481,290 60,496 -141,830 1,836,591 3,510,531 -141,830 2,089,737 1,131,295 257,270 248,630 8,642

Step by Step Solution

★★★★★

3.39 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

a What is the compound growth rate of dividends based on the last five years of dividend...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started