Accounting

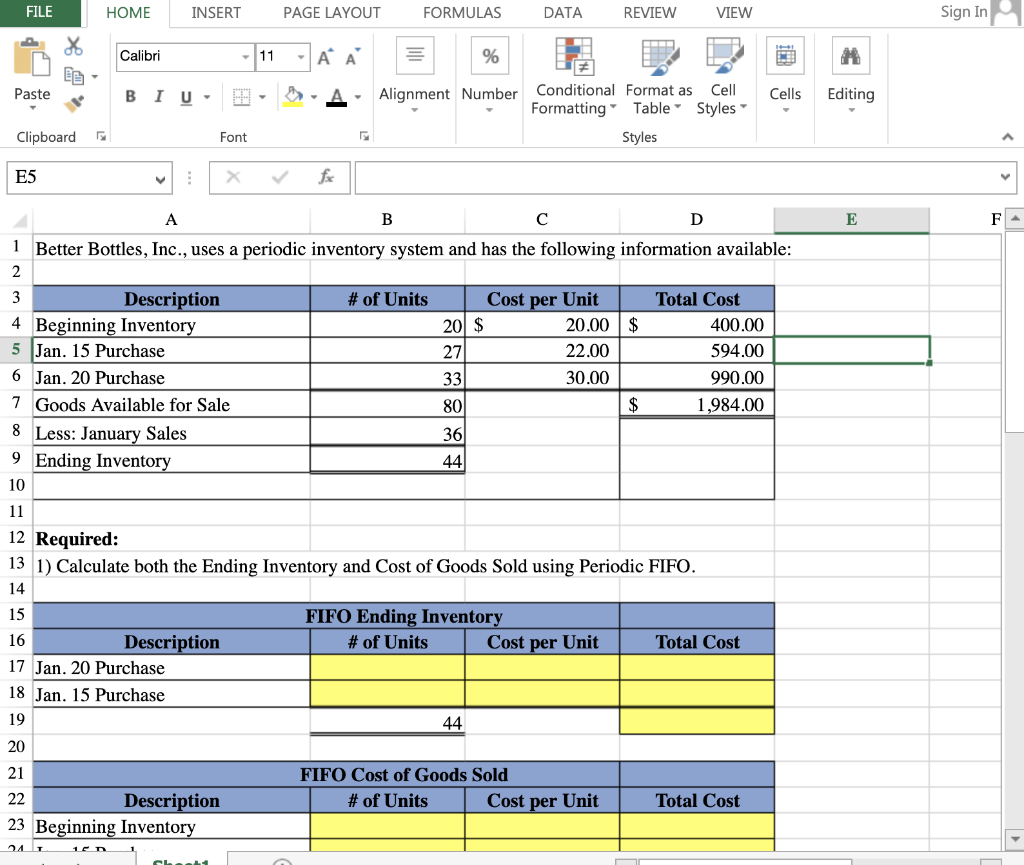

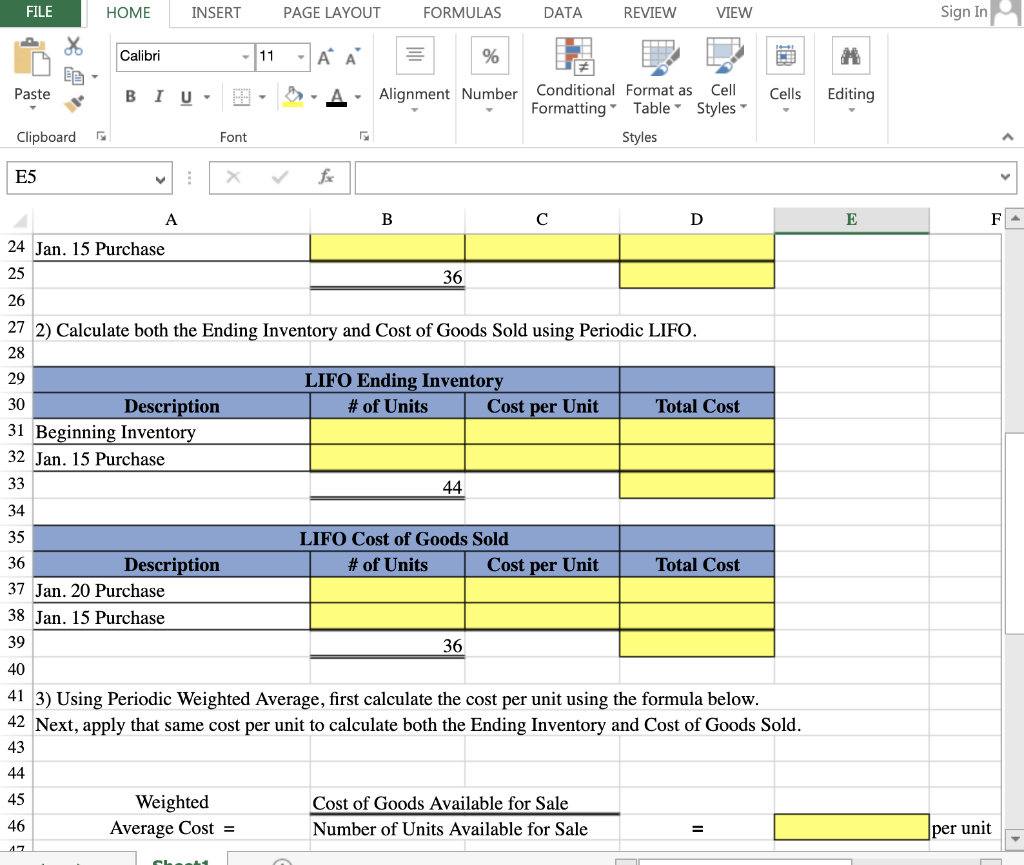

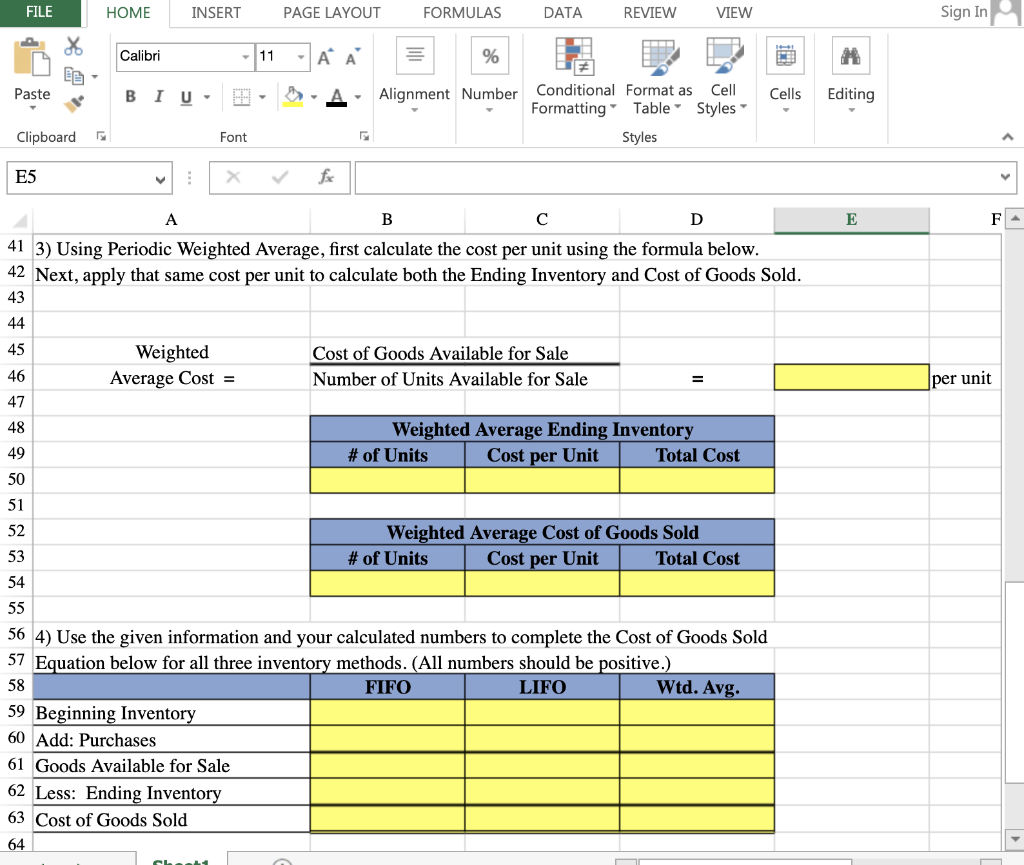

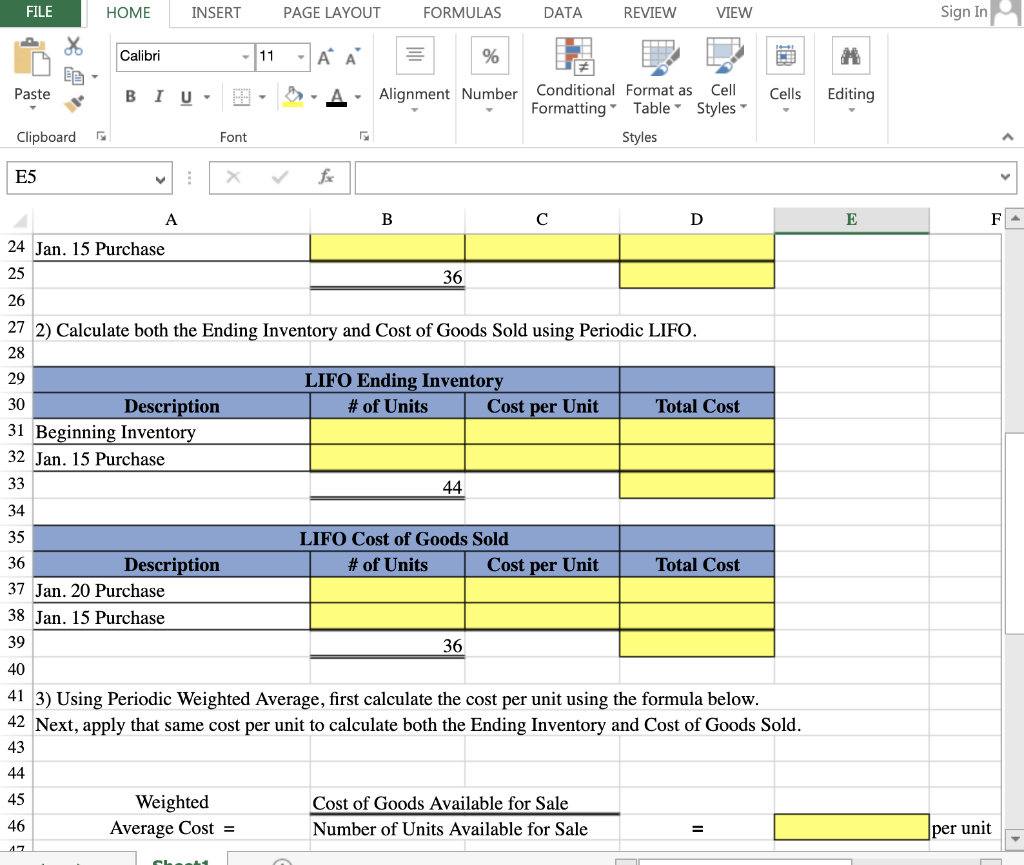

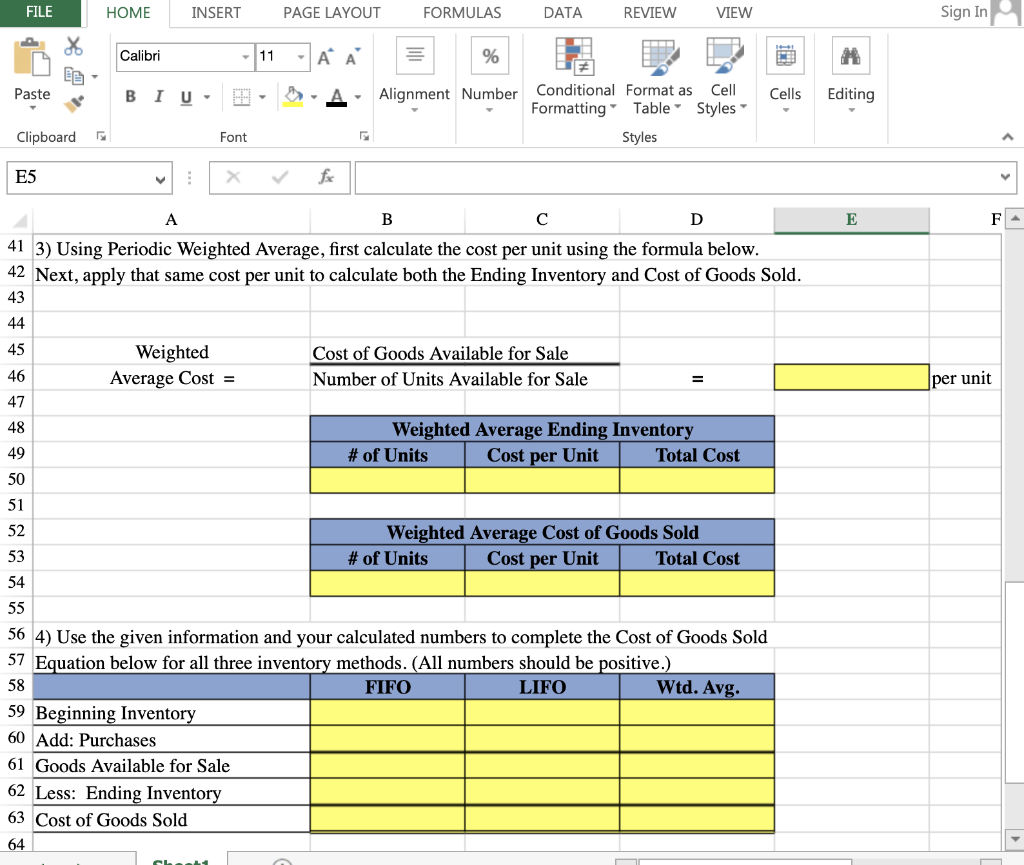

FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In X Calibri 11 -A A % Paste BIU- Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A E5 E F A B D 1 Better Bottles, Inc., uses a periodic inventory system and has the following information available: 2 3 Description # of Units Cost per Unit Total Cost 4 Beginning Inventory 20 $ 20.00 $ 400.00 5 Jan. 15 Purchase 27 22.00 594.00 6 Jan. 20 Purchase 33 30.00 990.00 7 Goods Available for Sale 80 $ 1,984.00 8 Less: January Sales 361 9 Ending Inventory 44 10 11 12 Required: 13 1) Calculate both the Ending Inventory and Cost of Goods Sold using Periodic FIFO. 14 15 FIFO Ending Inventory 16 Description # of Units Cost per Unit Total Cost 17 Jan. 20 Purchase 18 Jan. 15 Purchase 19 44 20 21 FIFO Cost of Goods Sold 22 Description # of Units Cost per Unit Total Cost 23 Beginning Inventory 12 FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In X Calibri 11 -A % Paste BIU- Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A E5 fx A B D E F 24 Jan. 15 Purchase 25 36 26 27 2) Calculate both the Ending Inventory and Cost of Goods Sold using Periodic LIFO. 28 29 LIFO Ending Inventory 30 Description # of Units Cost per Unit Total Cost 31 Beginning Inventory 32 Jan. 15 Purchase 33 44 34 35 LIFO Cost of Goods Sold 36 Description # of Units Cost per Unit Total Cost 37 Jan. 20 Purchase 38 Jan. 15 Purchase 39 36 40 41 3) Using Periodic Weighted Average, first calculate the cost per unit using the formula below. 42 Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold. 43 44 45 Weighted Average Cost = Cost of Goods Available for Sale Number of Units Available for Sale 46 per unit FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In X Calibri 11 -A A % Paste BIU- Alignment Number Cells Editing Conditional Format as Cell Formatting Table Styles Styles Clipboard Font A E5 X fx A B D E F 41 3) Using Periodic Weighted Average, first calculate the cost per unit using the formula below. 42 Next, apply that same cost per unit to calculate both the Ending Inventory and Cost of Goods Sold. 43 44 45 Weighted Average Cost = Cost of Goods Available for Sale Number of Units Available for Sale per unit 46 47 48 49 Weighted Average Ending Inventory # of Units Cost per Unit Total Cost 50 51 52 Weighted Average Cost of Goods Sold 53 # of Units Cost per Unit Total Cost 54 55 56 4) Use the given information and your calculated numbers to complete the Cost of Goods Sold 57 Equation below for all three inventory methods. (All numbers should be positive.) 58 FIFO LIFO Wtd. Avg. 59 Beginning Inventory 60 Add: Purchases 61 Goods Available for Sale 62 Less: Ending Inventory 63 Cost of Goods Sold 64