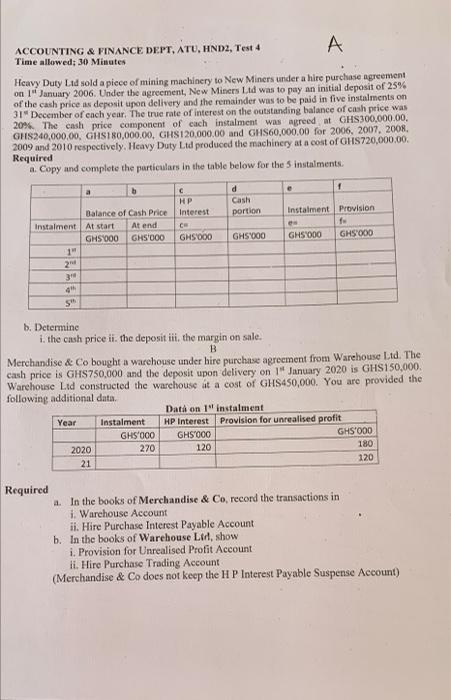

ACCOUNTING & FINANCE DEPT, ATU, HND2, Test 4 A Time allowed: 30 Minutes Heavy Duty Lid sold a piece of mining machinery to New Miners under a hire purchase agreement on January 2006. Under the agreement, New Miners Ltd was to pay an initial deposit of 25% of the cash price is deposit upon delivery and the remainder was to be paid in five instalments on 31 December of each year. The true rate of interest on the outstanding balance of cash price was 20%. The cash price component of each instalment was agreed at GHS300,000.00 GHS240,000.00, GHS180,000.00. GHS120,000.00 and GHS60,000.00 for 2006, 2007, 2008 2009 and 2010 respectively. Heavy Duty Ltd produced the machinery at a cost of CHS720,000.00 Required a. Copy and complete the particulars in the table below for the instalments. 1 C HP Interest ce GHS000 a Cash portion Instalment Provision fe GHS 000 GHS'OOD GHS000 Balance of Cash Price Instalment At start At end GHS000 GHS000 1" 20 3 S" b. Determine i. the cash price ii the deposit ill, the margin on sale. B Merchandise & Co bought a warehouse under hire purchase agreement from Warehouse Ltd. The cash price is GHS 750,000 and the deposit upon delivery on 1 January 2020 is GHS150,000 Warehouse Ltd constructed the warehouse at a cost of GHS450,000. You are provided the following additional data. Data on 1'instalment Year Instalment HP Interest Provision for unrealised profit GHS'OCO GHS000 GHS'000 2020 270 120 180 21 120 Required a. In the books of Merchandise & Co, record the transactions in i. Warehouse Account ii. Hire Purchase Interest Payable Account b. In the books of Warehouse Lart, show i. Provision for Unrealised Profit Account ii. Hire Purchase Trading Account (Merchandise & Co does not keep the HP Interest Payable Suspense Account) ACCOUNTING & FINANCE DEPT, ATU, HND2, Test 4 A Time allowed: 30 Minutes Heavy Duty Lid sold a piece of mining machinery to New Miners under a hire purchase agreement on January 2006. Under the agreement, New Miners Ltd was to pay an initial deposit of 25% of the cash price is deposit upon delivery and the remainder was to be paid in five instalments on 31 December of each year. The true rate of interest on the outstanding balance of cash price was 20%. The cash price component of each instalment was agreed at GHS300,000.00 GHS240,000.00, GHS180,000.00. GHS120,000.00 and GHS60,000.00 for 2006, 2007, 2008 2009 and 2010 respectively. Heavy Duty Ltd produced the machinery at a cost of CHS720,000.00 Required a. Copy and complete the particulars in the table below for the instalments. 1 C HP Interest ce GHS000 a Cash portion Instalment Provision fe GHS 000 GHS'OOD GHS000 Balance of Cash Price Instalment At start At end GHS000 GHS000 1" 20 3 S" b. Determine i. the cash price ii the deposit ill, the margin on sale. B Merchandise & Co bought a warehouse under hire purchase agreement from Warehouse Ltd. The cash price is GHS 750,000 and the deposit upon delivery on 1 January 2020 is GHS150,000 Warehouse Ltd constructed the warehouse at a cost of GHS450,000. You are provided the following additional data. Data on 1'instalment Year Instalment HP Interest Provision for unrealised profit GHS'OCO GHS000 GHS'000 2020 270 120 180 21 120 Required a. In the books of Merchandise & Co, record the transactions in i. Warehouse Account ii. Hire Purchase Interest Payable Account b. In the books of Warehouse Lart, show i. Provision for Unrealised Profit Account ii. Hire Purchase Trading Account (Merchandise & Co does not keep the HP Interest Payable Suspense Account)