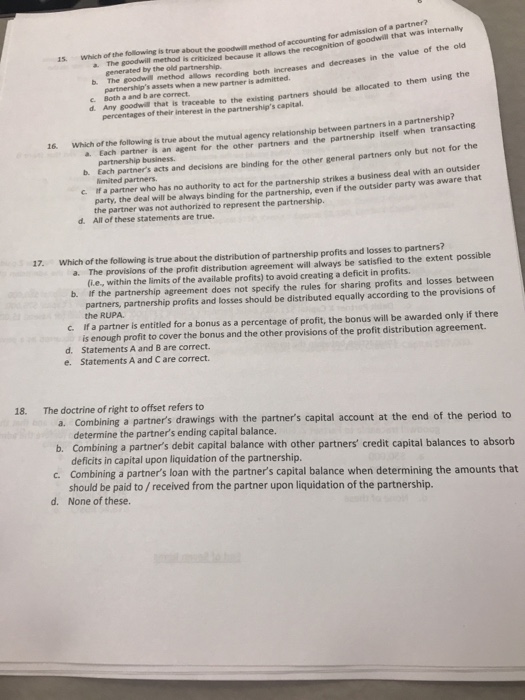

accounting for admission of a partner? it allows the recognition of goodwill that was internaly 1s. Which of the following is true about the goodill method of The goodwill method is criticized because it generated by the old partnership. a. b. The goodwill method allows recording both increases a partnership's assets when a new partner is admitted. Both a and b are correct d. Any goodwill that ls traceable to the existing partners should be allocated to them using the percentages of their interest in the partnership's capital Which of the following is true Which of the following is true about the mutual agency relationship between partners in a partnership? 16. partner is an agent for the other partners and the partnership itself when transacting gartner's acts and decisions are binding for the other general partners only but not for the a. Each partnership business Nmited partners party, the deal will be always binding for the partnership, even if the outsider party was aware c If a partner who has no authority to act for the partnership strikes a business deal with the partner was not authorized to represent the partnership. All of these statements are true. d. 17. Which of the following is true about the distribution of partnership profits and losses to partners? The provisions of the profit distribution agreement will always be satisfied to the extent possible (i.e, within the limits of the available profits) to avoid creating a deficit in profits If the partnership agreement does not specify the rules for sharing profits and losses between partners, partnership profits and losses should be distributed equally according to the provisions of the RUPA. a. b. If a partner is entitled for a bonus as a percentage of profit, the bonus will be awarded only if there is enough profit to cover the bonus and the other provisions of the profit distribution agreement. c. d. e. Statements A and B are correct. Statements A and C are correct. 18. The doctrine of right to offset refers to a. Combining a partners drawings with the partner's capital account at the end of the period to b. Combining a partner's debit capital balance with other partners' credit capital balances to absort c. Combining a partner's loan with the partner's capital balance when determining the amounts that d. None of these. determine the partner's ending capital balance. deficits in capital upon liquidation of the partnership. should be paid to /received from the partner upon liquidation of the partnership