Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 note. In exchange, Smith agreed to make (5) annual payments

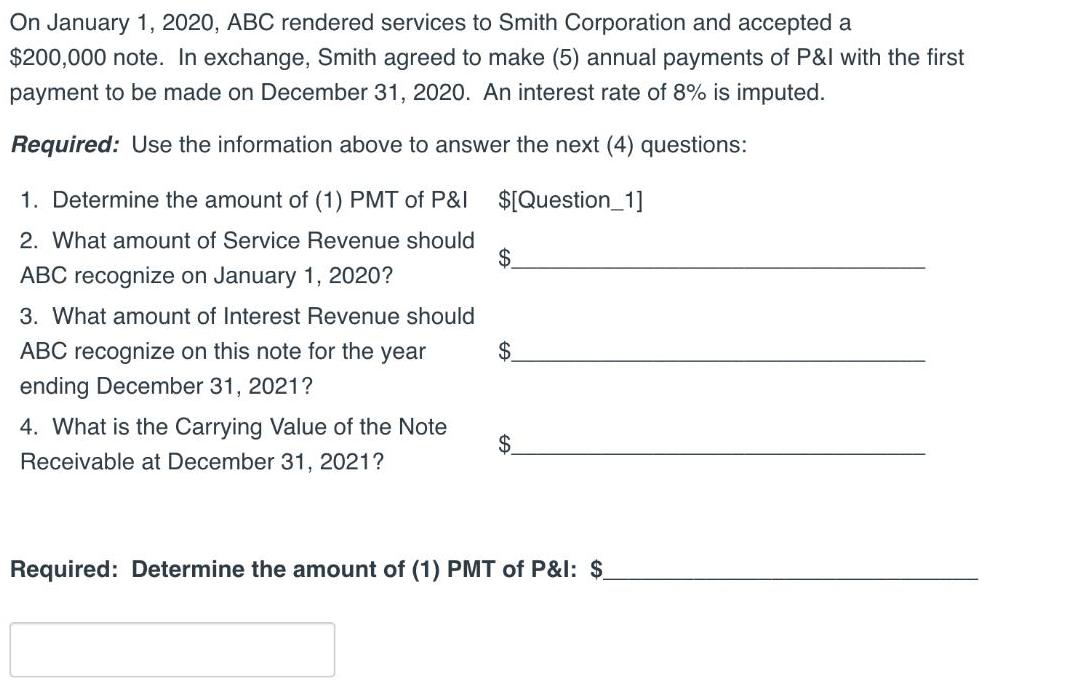

On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 note. In exchange, Smith agreed to make (5) annual payments of P&l with the first payment to be made on December 31, 2020. An interest rate of 8% is imputed. Required: Use the information above to answer the next (4) questions: 1. Determine the amount of (1) PMT of P&I $[Question_1] 2. What amount of Service Revenue should $ ABC recognize on January 1, 2020? 3. What amount of Interest Revenue should ABC recognize on this note for the year 2$ ending December 31, 2021? 4. What is the Carrying Value of the Note 2$ Receivable at December 31, 2021? Required: Determine the amount of (1) PMT of P&l: $ Using the information presented in #5 above, what amount of Service Revenue should ABC recognize on January 1, 2020? Using the information presented in #5 above, determine the amount of Interest Revenue ABC should recognize on their Income Statement for the year ended December 31, 2021: $. Using the information presented in #5 above, determine the carrying value of the note receivable as of December 31, 2021. $ On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 note. In exchange, Smith agreed to make (5) annual payments of P&l with the first payment to be made on December 31, 2020. An interest rate of 8% is imputed. Required: Use the information above to answer the next (4) questions: 1. Determine the amount of (1) PMT of P&I $[Question_1] 2. What amount of Service Revenue should $ ABC recognize on January 1, 2020? 3. What amount of Interest Revenue should ABC recognize on this note for the year 2$ ending December 31, 2021? 4. What is the Carrying Value of the Note 2$ Receivable at December 31, 2021? Required: Determine the amount of (1) PMT of P&l: $ Using the information presented in #5 above, what amount of Service Revenue should ABC recognize on January 1, 2020? Using the information presented in #5 above, determine the amount of Interest Revenue ABC should recognize on their Income Statement for the year ended December 31, 2021: $. Using the information presented in #5 above, determine the carrying value of the note receivable as of December 31, 2021. $ On January 1, 2020, ABC rendered services to Smith Corporation and accepted a $200,000 note. In exchange, Smith agreed to make (5) annual payments of P&l with the first payment to be made on December 31, 2020. An interest rate of 8% is imputed. Required: Use the information above to answer the next (4) questions: 1. Determine the amount of (1) PMT of P&I $[Question_1] 2. What amount of Service Revenue should $ ABC recognize on January 1, 2020? 3. What amount of Interest Revenue should ABC recognize on this note for the year 2$ ending December 31, 2021? 4. What is the Carrying Value of the Note 2$ Receivable at December 31, 2021? Required: Determine the amount of (1) PMT of P&l: $ Using the information presented in #5 above, what amount of Service Revenue should ABC recognize on January 1, 2020? Using the information presented in #5 above, determine the amount of Interest Revenue ABC should recognize on their Income Statement for the year ended December 31, 2021: $. Using the information presented in #5 above, determine the carrying value of the note receivable as of December 31, 2021. $

Step by Step Solution

★★★★★

3.38 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

1 PMT of interest 16000 PMT of principal 3409129 2 Revenue recognized by ABC on January 1 2020 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started