Question

The ABC Company rendered services on 1/1/15 and accepted a $10,000, 6%, 5-year note receivable with interest to be paid annually on December 31 through

The ABC Company rendered services on 1/1/15 and accepted a $10,000, 6%, 5-year note receivable with interest to be paid annually on December 31 through 12/31/19. The principal will be paid in full on 12/31/19. ABC's imputed interest rate is 10% and the effective amortization method is used.

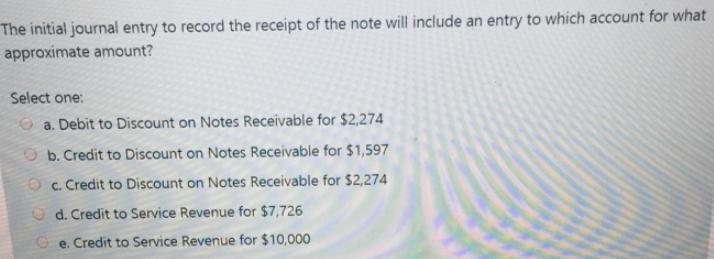

The initial journal entry to record the receipt of the note will include an entry to which account for what approximate amount? Select one: O a. Debit to Discount on Notes Receivable for $2,274 O b. Credit to Discount on Notes Receivable for $1,597 Oc. Credit to Discount on Notes Receivable for $2,274 O d. Credit to Service Revenue for $7,726 Ge. Credit to Service Revenue for $10,000

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Option b Credit to discount on Note...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting A User Perspective

Authors: Robert E Hoskin, Maureen R Fizzell, Donald C Cherry

6th Canadian Edition

470676604, 978-0470676608

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App