Answered step by step

Verified Expert Solution

Question

1 Approved Answer

accounting for business combination. i hope you could help me with numbers 2 & 3. thank you! accounting for business combination. i hope you could

accounting for business combination. i hope you could help me with numbers 2 & 3. thank you!

accounting for business combination. i hope you could help me with numbers 2 & 3. thank you!

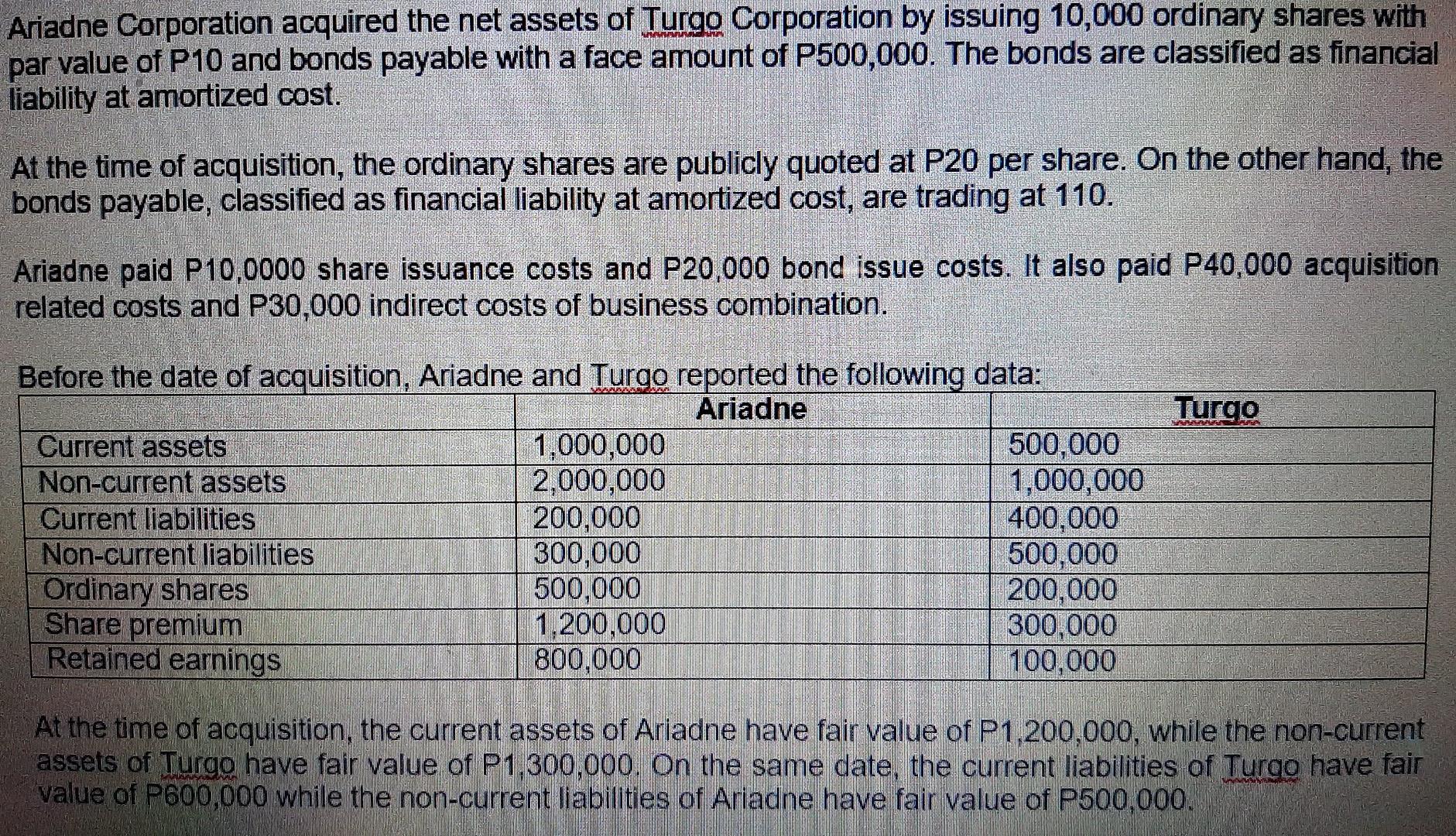

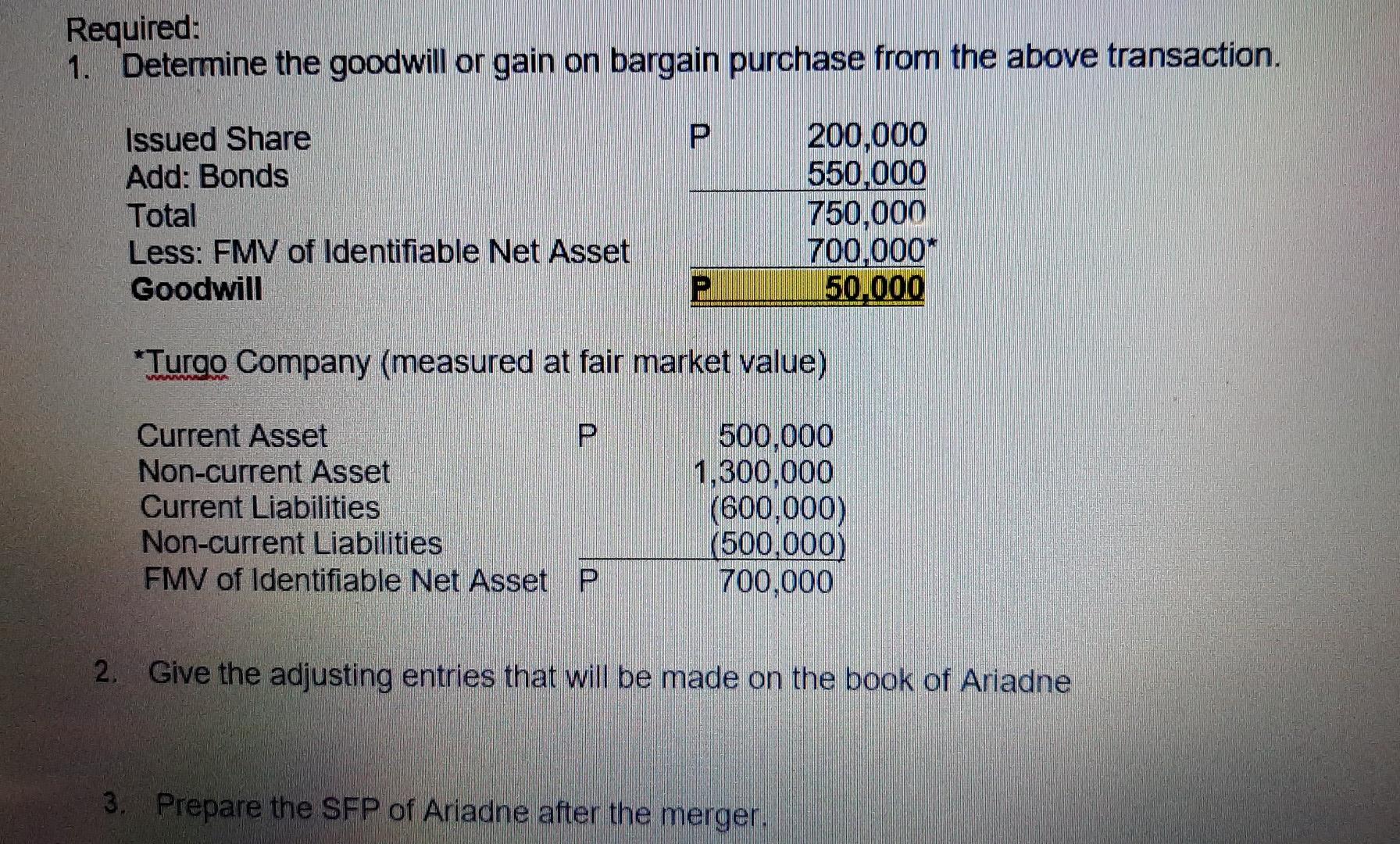

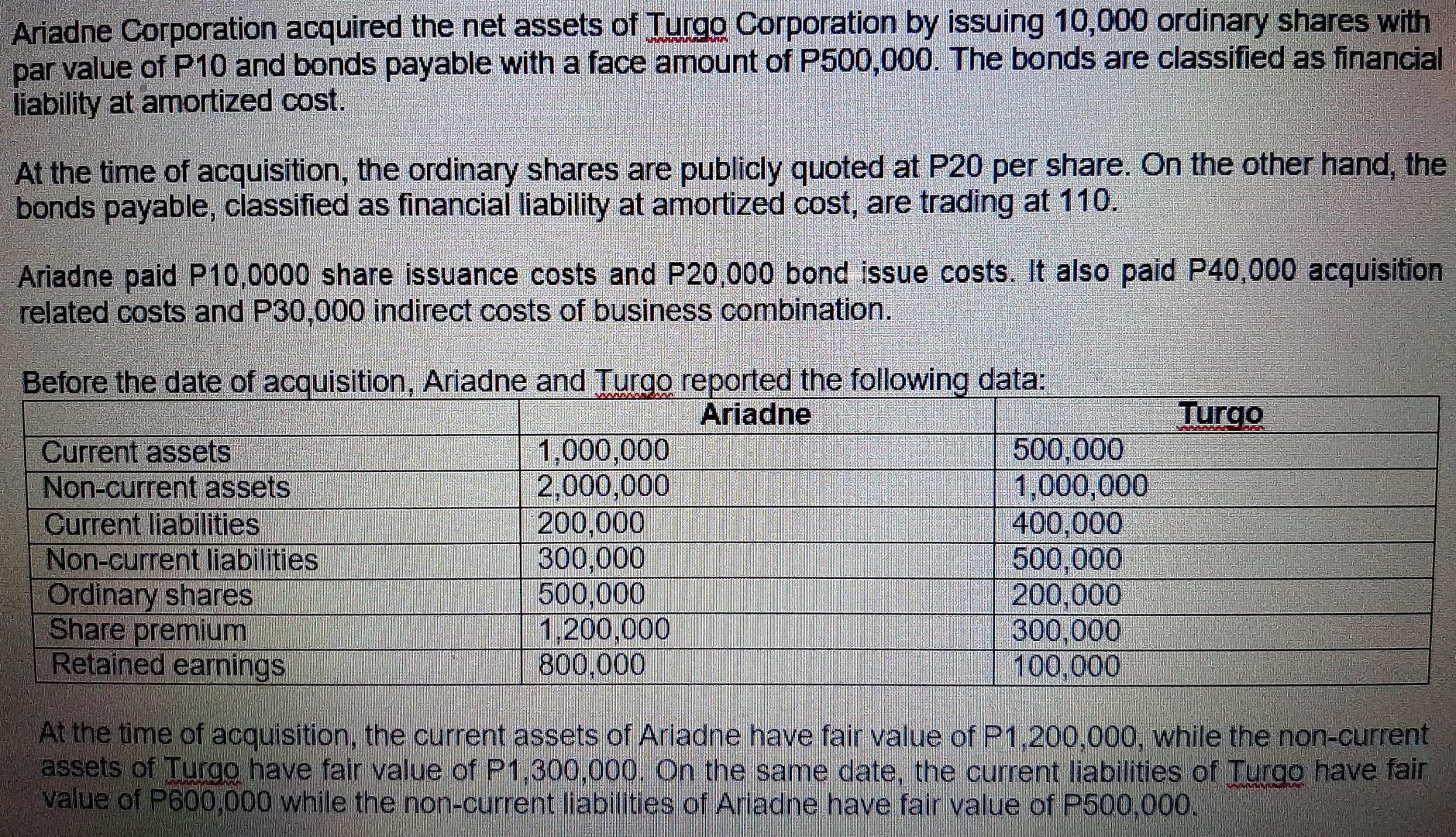

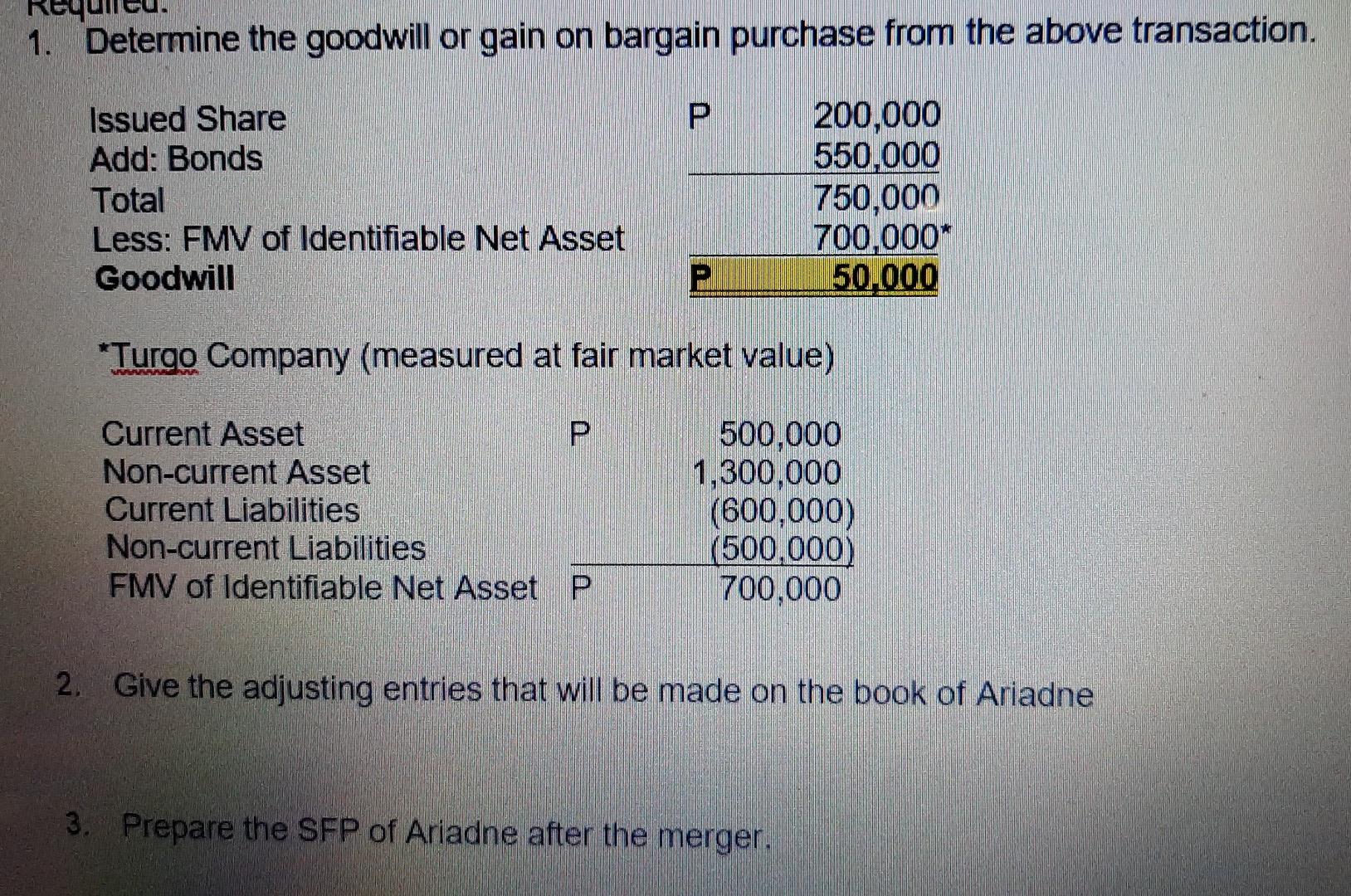

Ariadne Corporation acquired the net assets of Turgo Corporation by issuing 10,000 ordinary shares with par value of P10 and bonds payable with a face amount of P500,000. The bonds are classified as financial liability at amortized cost. At the time of acquisition, the ordinary shares are publicly quoted at P20 per share. On the other hand, the bonds payable, classified as financial liability at amortized cost, are trading at 110. Ariadne paid P10,0000 share issuance costs and P20,000 bond issue costs. It also paid P40,000 acquisition related costs and P30,000 indirect costs of business combination. Turgo Before the date of acquisition, Ariadne and Turgo reported the following data: Ariadne Current assets 1,000,000 500.000 Non-current assets 2,000,000 1,000,000 Current liabilities 200,000 400,000 Non-current liabilities 300,000 500,000 Ordinary shares 500,000 200,000 Share premium 11.200,000 300,000 Retained earnings 800,000 100,000 At the time of acquisition, the current assets of Ariadne have fair value of P1,200,000, while the non-current assets of Turgo have fair value of P1,300,000. On the same date, the current liabilities of Turgo have fair value of P600,000 while the non-current liabilities of Ariadne have fair value of P500,000. Required: 1. Determine the goodwill or gain on bargain purchase from the above transaction. P Issued Share Add: Bonds Total Less: FMV of Identifiable Net Asset Goodwill 200,000 550,000 750,000 700,000* 50.000 PO *Turgo Company (measured at fair market value) Current Asset Non-current Asset Current Liabilities Non-current Liabilities FMV of Identifiable Net Asset P 500,000 1,300,000 (600,000) (500,000) 700,000 2. Give the adjusting entries that will be made on the book of Ariadne 3. Prepare the SFP of Ariadne after the merger. Ariadne Corporation acquired the net assets of Turgo Corporation by issuing 10,000 ordinary shares with par value of P10 and bonds payable with a face amount of P500,000. The bonds are classified as financial liability at amortized cost. At the time of acquisition, the ordinary shares are publicly quoted at P20 per share. On the other hand, the bonds payable, classified as financial liability at amortized cost, are trading at 110. Ariadne paid P10,0000 share issuance costs and P20,000 bond issue costs. It also paid P40,000 acquisition related costs and P30,000 indirect costs of business combination. Turgo Before the date of acquisition, Ariadne and Turgo reported the following data: Ariadne Current assets 1,000,000 500,000 Non-current assets 2,000,000 1,000,000 Current liabilities 200,000 400,000 Non-current liabilities 300,000 500,000 Ordinary shares 500,000 200,000 Share premium 1,200,000 300,000 Retained earnings 800,000 100.000 At the time of acquisition, the current assets of Ariadne have fair value of P1,200,000, while the non-current assets of Turgo have fair value of P1,300,000. On the same date, the current liabilities of Turgo have fair value of P600,000 while the non-current liabilities of Ariadne have fair value of P500,000. RG 1. Determine the goodwill or gain on bargain purchase from the above transaction. P Issued Share Add: Bonds Total Less: FMV of Identifiable Net Asset Goodwill 200,000 550.000 750,000 700,000* 50.000 *Turgo Company (measured at fair market value) Current Asset P Non-current Asset Current Liabilities Non-current Liabilities FMV of Identifiable Net Asset P 500,000 1,300,000 (600,000) (500,000) 700,000 2. Give the adjusting entries that will be made on the book of Ariadne 3. Prepare the SFP of Ariadne after the mergerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started