Question

Accounting for Fair Value Hedge: Interest Rate Swap On January 2, 2020, Badger Corp. enters into a 5-year interest rate swap contract in order to

Accounting for Fair Value Hedge: Interest Rate Swap On January 2, 2020, Badger Corp. enters into a 5-year interest rate swap contract in order to effectively hedge a 5-year, 5%, $10,000 note, issued on January 2, 2020. The swap calls for Badger Corp. to receive payments semiannually on June 30 and December 31 from the counterparty at a 5% interest rate based on a notional amount of $10,000 and to make payments to the counterparty based upon LIBOR. LIBOR is 4.2% as of January 2, 2020, and the rate will be adjusted every 6 months to the current LIBOR rate. For simplicity, assume that the swap has zero value on January 2, 2020, and on June 30, 2020.

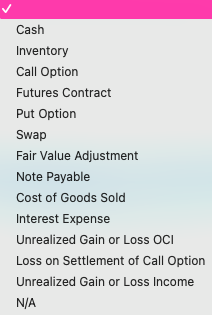

Account Name Options:

Required a. Prepare the journal entry on January 2, 2020, to record the issuance of the note and initiation of the interest rate swap agreement. Note: If a journal entry (or a line of the journal entry) isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero).

Required a. Prepare the journal entry on January 2, 2020, to record the issuance of the note and initiation of the interest rate swap agreement. Note: If a journal entry (or a line of the journal entry) isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero).

| Date | Account | Debit | Credit |

|---|---|---|---|

| Jan. 2, 2020 | Answer | Answer | Answer |

| Answer | Answer | Answer | |

| To record issuance of note |

| Date | Account | Debit | Credit |

|---|---|---|---|

| Jan. 2, 2020 | Answer | Answer | Answer |

| Answer | Answer | Answer | |

| To record issuance of swap agreement |

b. Prepare the entries related to the note payable and the interest rate swap on June 30, 2020, assuming LIBOR is unchanged.

| Date | Account | Debit | Credit |

|---|---|---|---|

| June 30, 2020 | Answer | Answer | Answer |

| Answer | Answer | Answer | |

| To record interest paid |

| Date | Account | Debit | Credit |

|---|---|---|---|

| June 30, 2020 | Answer | Answer | Answer |

| Answer | Answer | Answer | |

| To record interest received |

Please answer all parts of the question.

Cash Inventory Call Option Futures Contract Put Option Swap Fair Value Adjustment Note Payable Cost of Goods Sold Interest Expense Unrealized Gain or Loss OCI Loss on Settlement of Call Option Unrealized Gain or Loss Income N/AStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started