Question

Accounting for foreign currency transactions On 1 September 2021 Max Media Ltd, a New Zealand company whose functional currency is the New Zealand dollar, placed

Accounting for foreign currency transactions

On 1 September 2021 Max Media Ltd, a New Zealand company whose functional currency is the New Zealand dollar, placed an inventory order for USD 945,000 of IT equipment from the USA. The inventory was purchased FOB San Francisco. The amount is due for payment on 31 May 2022. A decision was made to take out a forward exchange contract for USD 945,000 on 1 September 2021 with AAA Bank, in which AAA Bank had agreed to supply USD 945,000 to Max Media Ltd on 31 May 2022. The forward contract is designated as a hedge of a firm commitment to purchase the inventory. The inventory was shipped on 31 March 2022 and was paid for on 31 May 2022. Max Media Ltd, whose reporting period ends 31 March 2022, uses fair-value hedge accounting to account for the forward exchange contract. Max Media Ltd also prepared quarterly reports on 31 December 2021.

Additional information

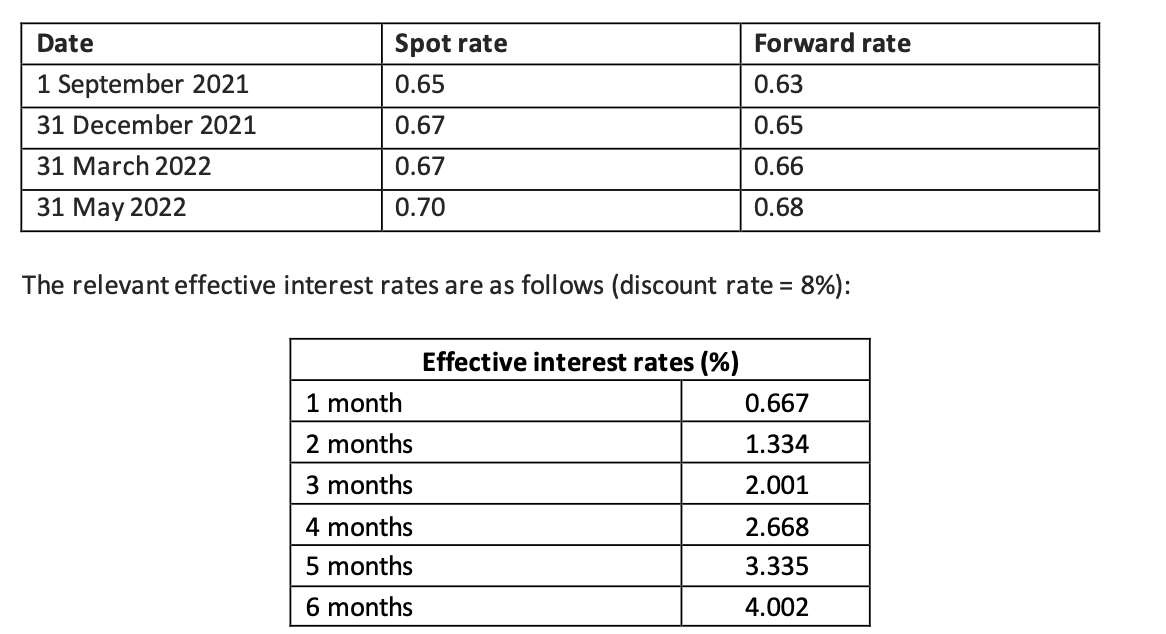

The relevant exchange rates are as follows:

Task

a. Prepare journal entries for Max Media Ltd to account for both the purchase of IT equipment and the forward exchange contract for the period 1 September 2021 to 31 May 2022. Use whole numbers when rounding. Show your workings.

b. Provide calculations indicating to the management of Max Media Ltd the gain or loss on the transaction if they had decided to take out a foreign exchange contract on 31 December 2021. Compare your results with the decision to take out a foreign exchange contract on 1 September 2021.

The relevant effective interest rates are as follows (discount rate =8% ): The relevant effective interest rates are as follows (discount rate =8% )Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started