Question

Accounting for Gift Cards Assume Ikeo Inc. sold $200,000 of gift cards during the last two weeks of December in Year 1. No gift cards

Accounting for Gift Cards

Assume Ikeo Inc. sold $200,000 of gift cards during the last two weeks of December in Year 1. No gift cards were redeemed in Year 1. A total of $180,000 of the gift cards were redeemed for store purchases during Year 2. On December 31, of Year 2, Ikeo Inc. calculates the remaining balance of unredeemed gift cards of $20,000 ($200,000 less $180,000). Based on previous experiences, Ikeo estimates gift card breakage to be 5% of total gift card sales. Ikeo uses the proportional method to recognize income on gift card breakage.

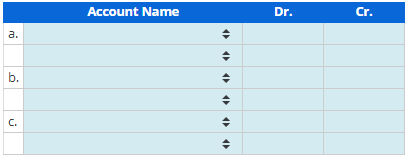

Required a. Record the sale of gift cards in Year 1. b. Record the redemption of gift cards in Year 2. c. Record revenue in Year 2 due to gift card breakage using the proportional method.

Note: Carry all decimals in calculations; round the final answer to the nearest dollar. Note: If a line in a journal entry isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started