accounting for government and non profit organization

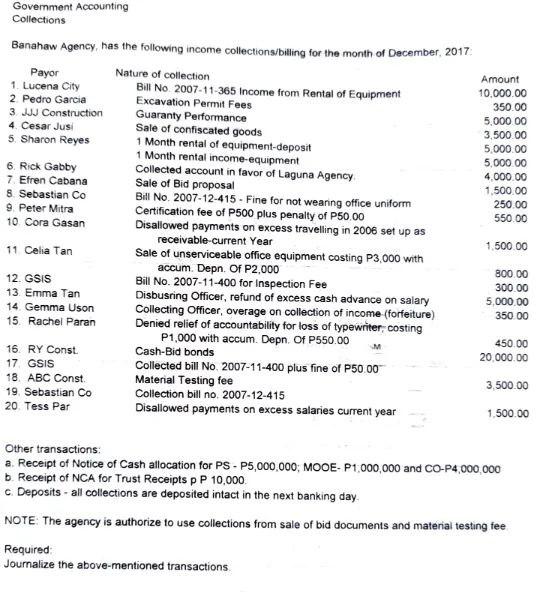

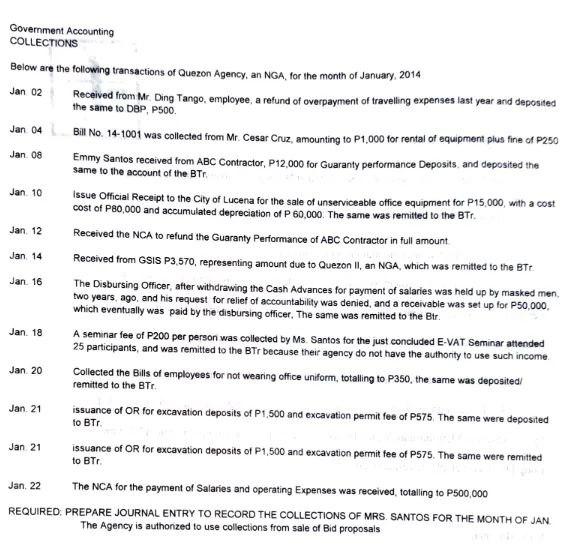

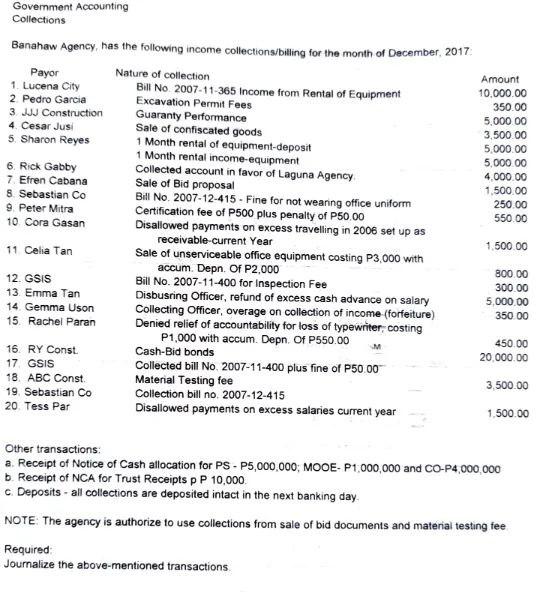

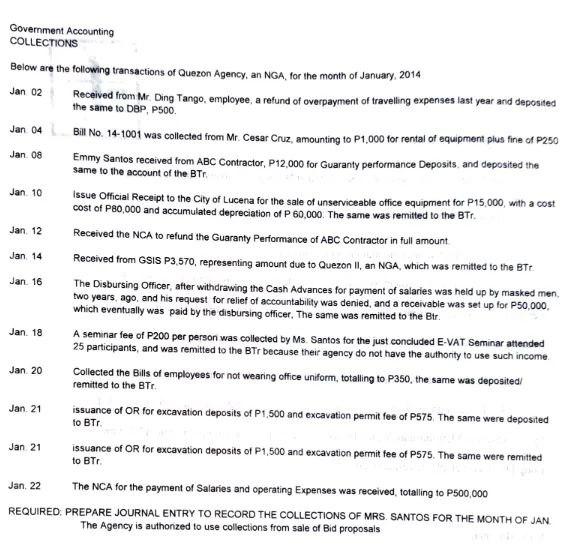

Other transactions: a. Receipt of Notice of Cash allocation for PS - P5,000,000; MOOE-P1,000,000 and CO-P4,000,000 b. Receipt of NCA for Trust Receipts pP10,000 c. Deposits - all collections are deposited intact in the next banking day. NOTE: The agency is authorize to use collections from sale of bid documents and material testing fee Required: Journalize the above-mentioned transactions. the following transactions of Quezon Agency, an NGA, for the month of January, 2014 Received from Mr. Ding Tango, employee, a refund of overpayment of traveling expenses last year and deposited the same to DBP, Psoo. Bill No. 14-1001 was collected from Mr. Cesar Cruz, amounting to P1,000 for rental of equipment plus fine of P250 Emmy Santos received from ABC Contractor, P12,000 for Guaranty performance Deposits. and deposited the same to the account of the BTr. issue Official Receipt to the City of Lucena for the sale of unserviceable office equipment for P15,000, with a cost cost of P80,000 and accumulated depreciation of P60,000. The same was remitted to the BTr. Received the NCA to refund the Guaranty Performance of ABC Contractor in full amount Received from GSIS P3.570, representing amount due to Quezon II, an NGA, which was remitted to the BTt. The Disbursing Officer, after withdrawing the Cash Advances for payment of salarles was held up by masked men. two years, ago, and his request for relief of accountability was denied, and a receivable was set up for P50,000, which eventually was paid by the disbursing officer, The same was remitted to the Btr. A semnar fee of P200 per person was collected by Ms. Santos for the just conciuded E-VAT Seminar attended 25 participants, and was remitted to the BTr because their agency do not have the authonty to use such income. Collected the Bills of employees for not wearing office uniform, totalling to P350, the same was deposited remitted to the BTr. issuance of OR for excavation deposits of P1,500 and excavation permit fee of P575, The same were deposited to BTr. issuance of OR for excavation deposits of P1,500 and excavation permit fee of P575. The same were remitted to BTr. The NCA for the payment of Salaries and operating Expenses was received, totalling to P500,000 D. PREPARE JOURNAL ENTRY TO RECORD THE COLLECTIONS OF MRS. SANTOS FOR THE MONTH OF JAN. The Agency is authonized to use collections from sale of Bid proposais Other transactions: a. Receipt of Notice of Cash allocation for PS - P5,000,000; MOOE-P1,000,000 and CO-P4,000,000 b. Receipt of NCA for Trust Receipts pP10,000 c. Deposits - all collections are deposited intact in the next banking day. NOTE: The agency is authorize to use collections from sale of bid documents and material testing fee Required: Journalize the above-mentioned transactions. the following transactions of Quezon Agency, an NGA, for the month of January, 2014 Received from Mr. Ding Tango, employee, a refund of overpayment of traveling expenses last year and deposited the same to DBP, Psoo. Bill No. 14-1001 was collected from Mr. Cesar Cruz, amounting to P1,000 for rental of equipment plus fine of P250 Emmy Santos received from ABC Contractor, P12,000 for Guaranty performance Deposits. and deposited the same to the account of the BTr. issue Official Receipt to the City of Lucena for the sale of unserviceable office equipment for P15,000, with a cost cost of P80,000 and accumulated depreciation of P60,000. The same was remitted to the BTr. Received the NCA to refund the Guaranty Performance of ABC Contractor in full amount Received from GSIS P3.570, representing amount due to Quezon II, an NGA, which was remitted to the BTt. The Disbursing Officer, after withdrawing the Cash Advances for payment of salarles was held up by masked men. two years, ago, and his request for relief of accountability was denied, and a receivable was set up for P50,000, which eventually was paid by the disbursing officer, The same was remitted to the Btr. A semnar fee of P200 per person was collected by Ms. Santos for the just conciuded E-VAT Seminar attended 25 participants, and was remitted to the BTr because their agency do not have the authonty to use such income. Collected the Bills of employees for not wearing office uniform, totalling to P350, the same was deposited remitted to the BTr. issuance of OR for excavation deposits of P1,500 and excavation permit fee of P575, The same were deposited to BTr. issuance of OR for excavation deposits of P1,500 and excavation permit fee of P575. The same were remitted to BTr. The NCA for the payment of Salaries and operating Expenses was received, totalling to P500,000 D. PREPARE JOURNAL ENTRY TO RECORD THE COLLECTIONS OF MRS. SANTOS FOR THE MONTH OF JAN. The Agency is authonized to use collections from sale of Bid proposais