Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting for governmental and nonprofit organizations 1. Equipment acquired several years ago by a capital projects fund and reported as general capital assets was sold.

Accounting for governmental and nonprofit organizations

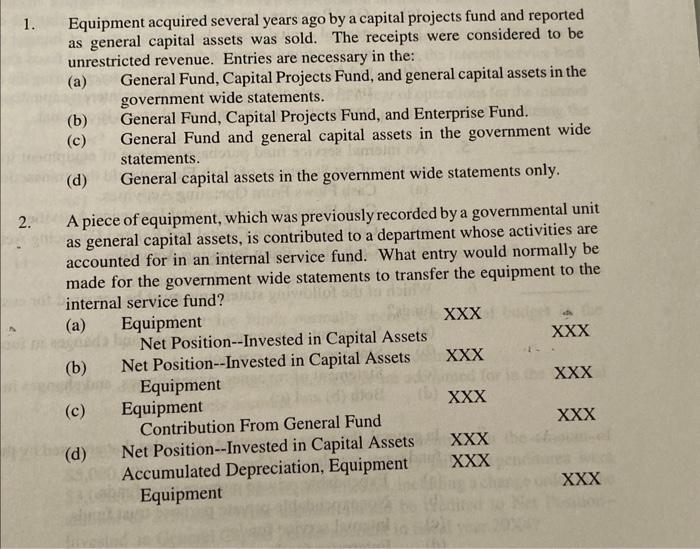

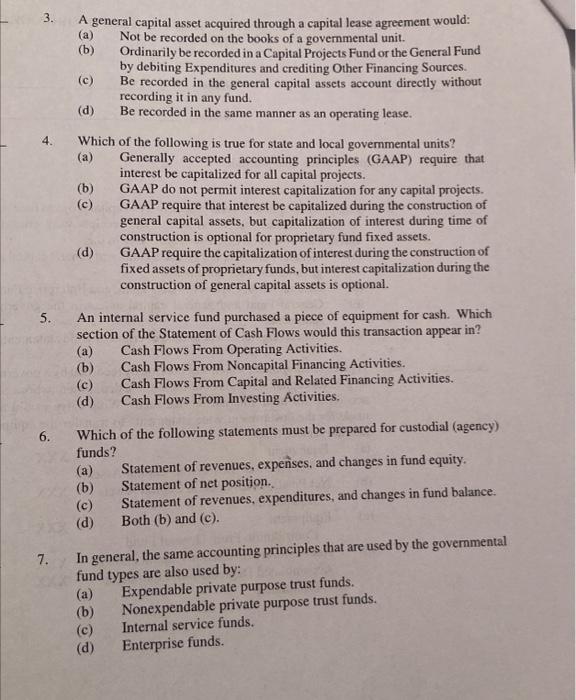

1. Equipment acquired several years ago by a capital projects fund and reported as general capital assets was sold. The receipts were considered to be unrestricted revenue. Entries are necessary in the: (a) General Fund, Capital Projects Fund, and general capital assets in the government wide statements. (b) General Fund, Capital Projects Fund, and Enterprise Fund. (c) General Fund and general capital assets in the government wide statements. (d) General capital assets in the government wide statements only. 3. A general capital asset acquired through a capital lease agreement would: (a) Not be recorded on the books of a governmental unit. (b) Ordinarily be recorded in a Capital Projects Fund or the General Fund by debiting Expenditures and crediting Other Financing Sources. (c) Be recorded in the general capital assets account directly without recording it in any fund. (d) Be recorded in the same manner as an operating lease. 4. Which of the following is true for state and local governmental units? (a) Generally accepted accounting principles (GAAP) require that interest be capitalized for all capital projects. (b) GAAP do not permit interest capitalization for any capital projects. (c) GAAP require that interest be capitalized during the construction of general capital assets, but capitalization of interest during time of construction is optional for proprietary fund fixed assets. (d) GAAP require the capitalization of interest during the construction of fixed assets of proprietary funds, but interest capitalization during the construction of general capital assets is optional. 5. An internal service fund purchased a piece of equipment for cash. Which section of the Statement of Cash Flows would this transaction appear in? (a) Cash Flows From Operating Activities. (b) Cash Flows From Noncapital Financing Activities. (c) Cash Flows From Capital and Related Financing Activities. (d) Cash Flows From Investing Activities, 6. Which of the following statements must be prepared for custodial (agency) funds? (a) Statement of revenues, expenses, and changes in fund equity. (b) Statement of net position. (c) Statement of revenues, expenditures, and changes in fund balance. (d) Both (b) and (c). 7. In general, the same accounting principles that are used by the governmental fund types are also used by: (a) Expendable private purpose trust funds. (b) Nonexpendable private purpose trust funds. (c) Internal service funds. (d) Enterprise funds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started