Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Accounting for governmental and nonprofit organizations On July 1, 20X3, the City of Chelan issued $2,000,000 of 6 percent term bonds maturing in five years

Accounting for governmental and nonprofit organizations

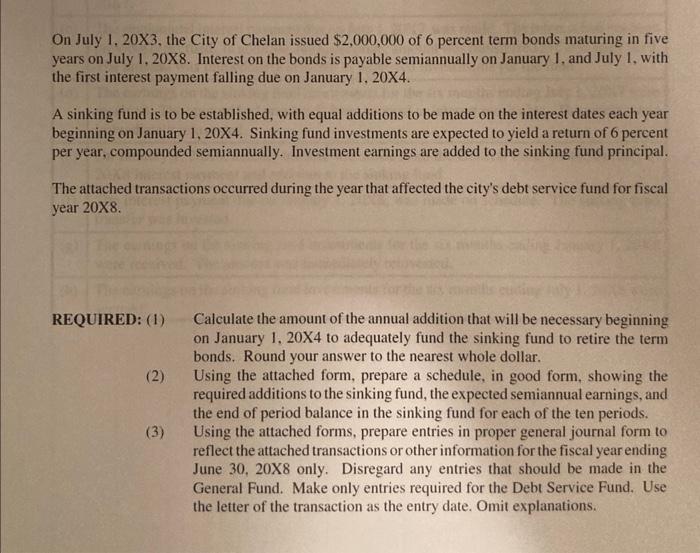

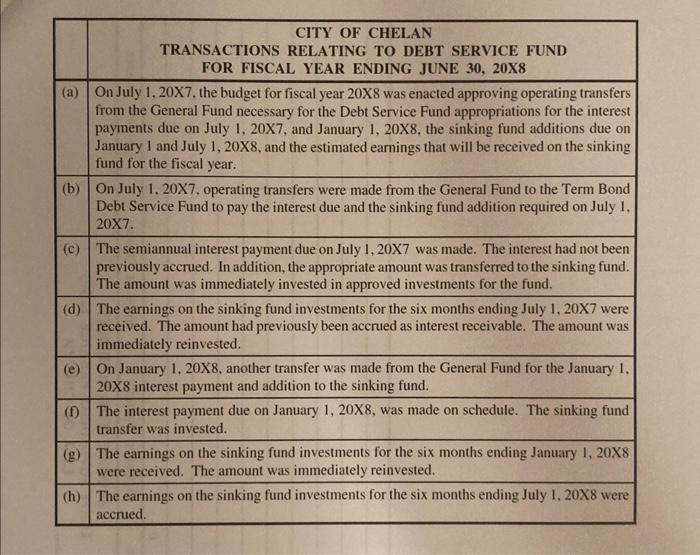

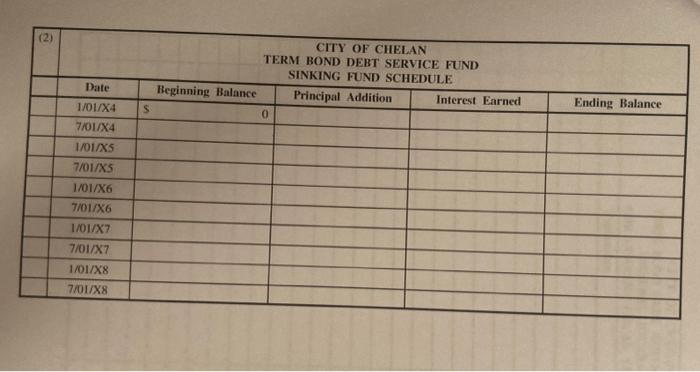

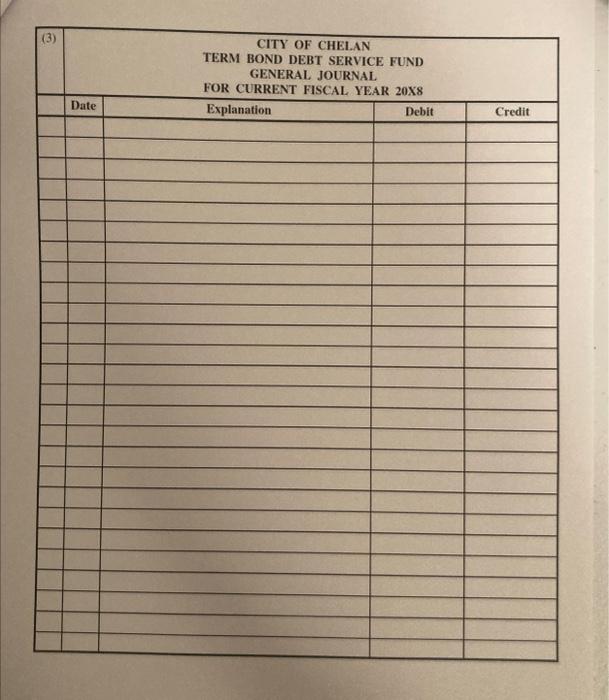

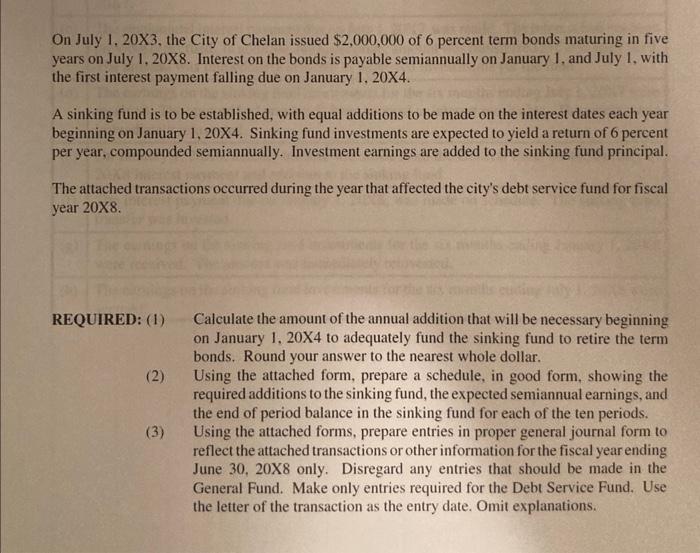

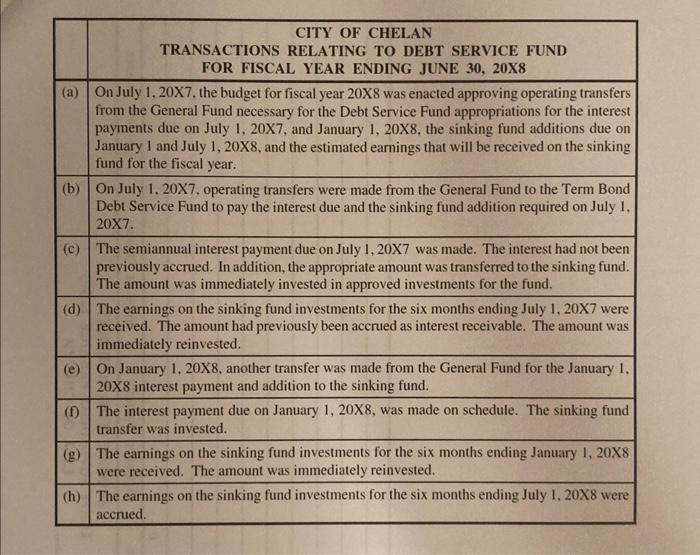

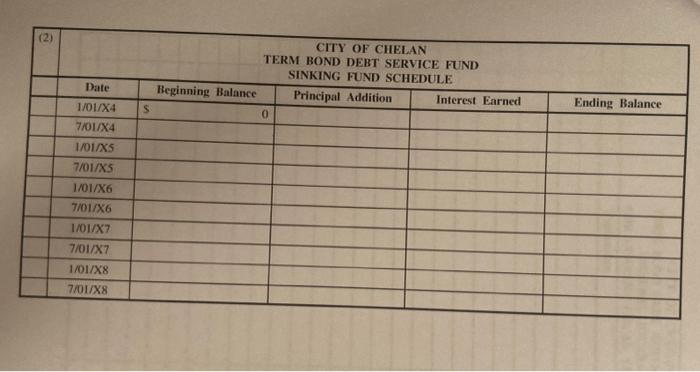

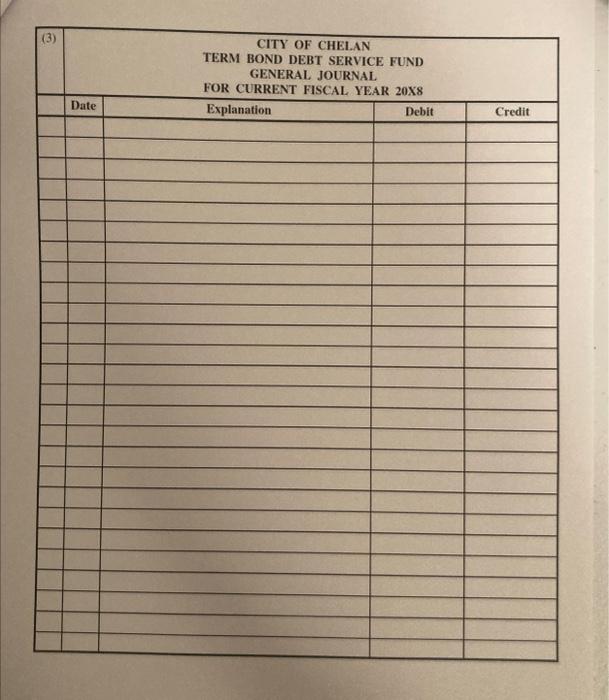

On July 1, 20X3, the City of Chelan issued $2,000,000 of 6 percent term bonds maturing in five years on July 1, 20X8. Interest on the bonds is payable semiannually on January 1, and July 1, with the first interest payment falling due on January 1,20X4. A sinking fund is to be established, with equal additions to be made on the interest dates each year beginning on January 1,20X4. Sinking fund investments are expected to yield a return of 6 percent per year, compounded semiannually. Investment earnings are added to the sinking fund principal. The attached transactions occurred during the year that affected the city's debt service fund for fiscal year 208. REQUIRED: (1) Calculate the amount of the annual addition that will be necessary beginning on January 1,20X4 to adequately fund the sinking fund to retire the term bonds. Round your answer to the nearest whole dollar. (2) Using the attached form, prepare a schedule, in good form, showing the required additions to the sinking fund, the expected semiannual earnings, and the end of period balance in the sinking fund for each of the ten periods. (3) Using the attached forms, prepare entries in proper general journal form to reflect the attached transactions or other information for the fiscal year ending June 30, 20X8 only. Disregard any entries that should be made in the General Fund. Make only entries required for the Debt Service Fund. Use the letter of the transaction as the entry date. Omit explanations. CITY OF CHELAN TRANSACTIONS RELATING TO DEBT SERVICE FUND FOR FISCAL YEAR ENDING JUNE 30, 20X8 (a) On July 1, 20X7, the budget for fiscal year 20X8 was enacted approving operating transfers from the General Fund necessary for the Debt Service Fund appropriations for the interest payments due on July 1,20X7, and January 1, 20X8, the sinking fund additions due on January 1 and July 1,20X, and the estimated earnings that will be received on the sinking fund for the fiscal year. (b) On July 1. 20X7, operating transfers were made from the General Fund to the Term Bond Debt Service Fund to pay the interest due and the sinking fund addition required on July 1 , 207. (c) The semiannual interest payment due on July 1, 20X7 was made. The interest had not been previously accrued. In addition, the appropriate amount was transferred to the sinking fund. The amount was immediately invested in approved investments for the fund. (d) The earnings on the sinking fund investments for the six months ending July 1, 207 were received. The amount had previously been accrued as interest receivable. The amount was immediately reinvested. (e) On January 1, 20X8, another transfer was made from the General Fund for the January 1 , 20X8 interest payment and addition to the sinking fund. (f) The interest payment due on January 1,20X8, was made on schedule. The sinking fund transfer was invested. (g) The earnings on the sinking fund investments for the six months ending January 1, 20X8 were received. The amount was immediately reinvested. (h) The earnings on the sinking fund investments for the six months ending July 1, 20X8 were accrued. \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{1}{|c|}{CiTYOFCHELANTERMBONDDEBTSERVICEFUNDGENERALJOURNAL} \\ \hline & \multicolumn{3}{|c|}{ FOR CURRENT FISCAL YEAR 20X8 } \\ \hline & Date & \multicolumn{2}{|c|}{ Explanation } & Credit \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started