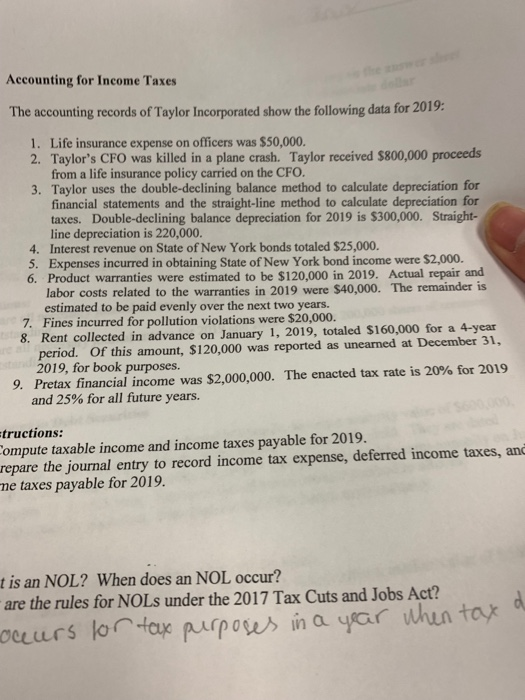

Accounting for Income Taxes The accounting records of Taylor Incorporated show the following data for 2019: 1. Life insurance expense on officers was $50,000. 2. Taylor's CFO was killed in a plane crash. Taylor received $800,000 proceeds from a life insurance policy carried on the CFO 3. Taylor uses the double-declining balance method to calculate depreciation for financial statements and the straight-line method to calculate depreciation for taxes. Double-declining balance depreciation for 2019 is $300,000. Straight- line depreciation is 220,000. 4. Interest revenue on State of New York bonds totaled $25,000. 5. Expenses incurred in obtaining State of New York bond income were $2,000. 6. Product warranties were estimated to be $120,000 in 2019. Actual repair and labor costs related to the warranties in 2019 were $40,000. The remainder is estimated to be paid evenly over the next two years. 7. Fines incurred for pollution violations were $20,000. 8. Rent collected in advance on January 1, 2019, totaled $160,000 for a 4-year period. Of this amount, $120,000 was reported as unearned at December 31, 2019, for book purposes. 9. Pretax financial income was and 25% for all future years. $2,000,000. The enacted tax rate is 20% for 2019 tructions: Compute taxable income and income taxes payable for 2019. repare the journal entry to record income tax expense, deferred income taxes, an me taxes payable for 2019. t is an NOL? When does an NOL occur? are the rules for NOLS under the 2017 Tax Cuts and Jobs Act? occurs lortax purposes in a yar whun tax Accounting for Income Taxes The accounting records of Taylor Incorporated show the following data for 2019: 1. Life insurance expense on officers was $50,000. 2. Taylor's CFO was killed in a plane crash. Taylor received $800,000 proceeds from a life insurance policy carried on the CFO 3. Taylor uses the double-declining balance method to calculate depreciation for financial statements and the straight-line method to calculate depreciation for taxes. Double-declining balance depreciation for 2019 is $300,000. Straight- line depreciation is 220,000. 4. Interest revenue on State of New York bonds totaled $25,000. 5. Expenses incurred in obtaining State of New York bond income were $2,000. 6. Product warranties were estimated to be $120,000 in 2019. Actual repair and labor costs related to the warranties in 2019 were $40,000. The remainder is estimated to be paid evenly over the next two years. 7. Fines incurred for pollution violations were $20,000. 8. Rent collected in advance on January 1, 2019, totaled $160,000 for a 4-year period. Of this amount, $120,000 was reported as unearned at December 31, 2019, for book purposes. 9. Pretax financial income was and 25% for all future years. $2,000,000. The enacted tax rate is 20% for 2019 tructions: Compute taxable income and income taxes payable for 2019. repare the journal entry to record income tax expense, deferred income taxes, an me taxes payable for 2019. t is an NOL? When does an NOL occur? are the rules for NOLS under the 2017 Tax Cuts and Jobs Act? occurs lortax purposes in a yar whun tax