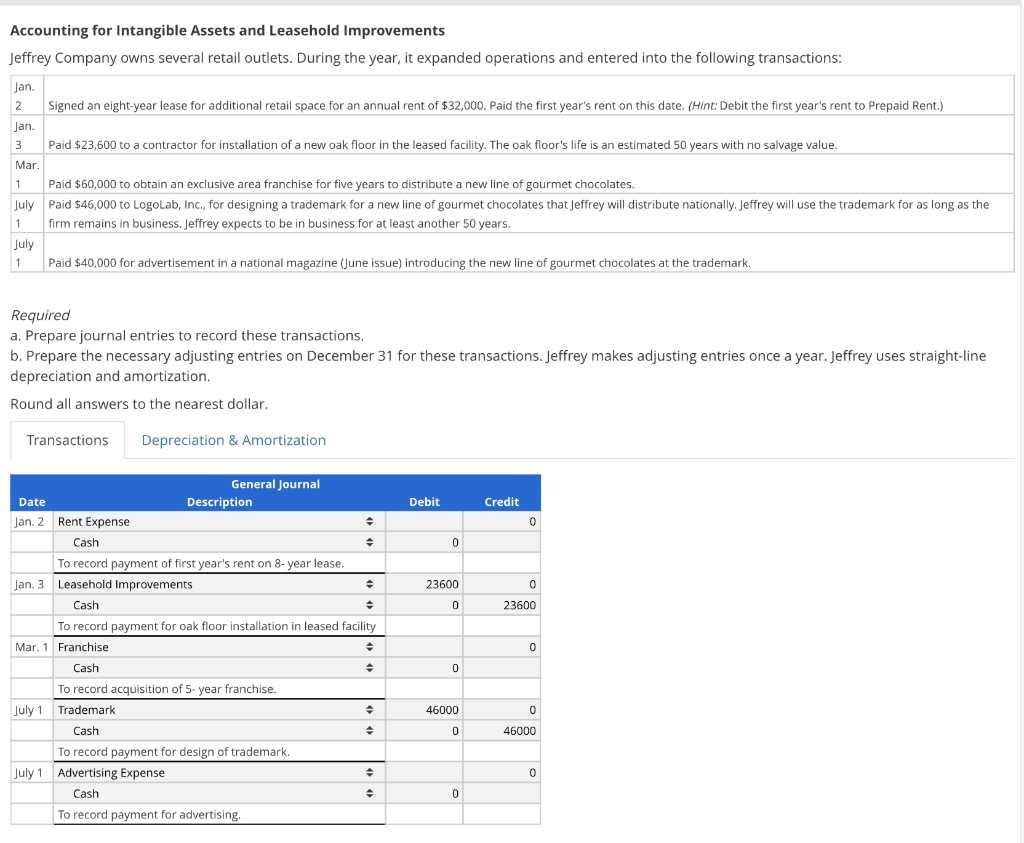

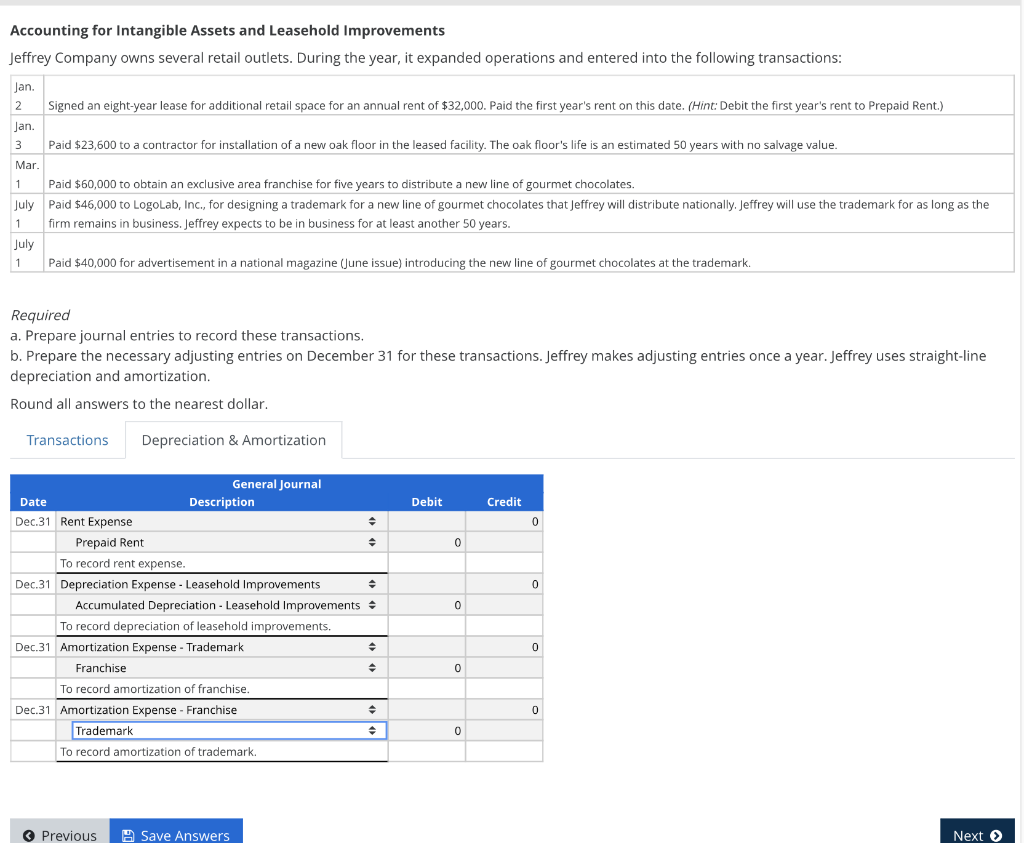

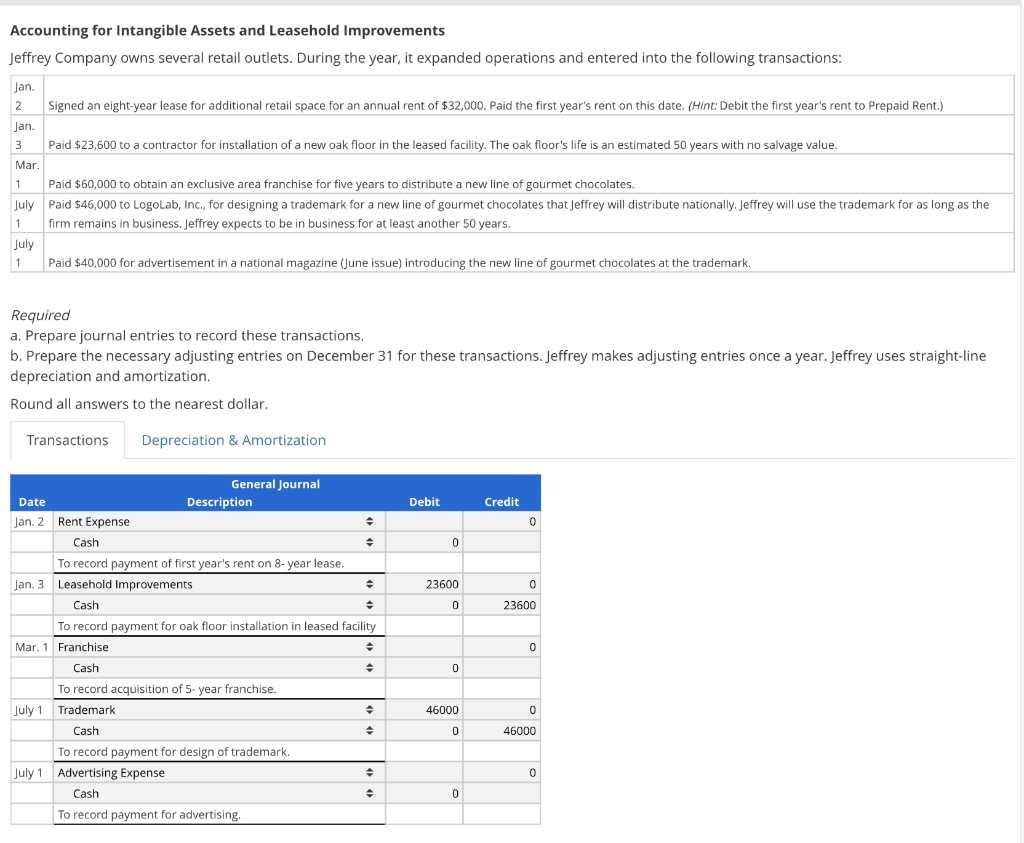

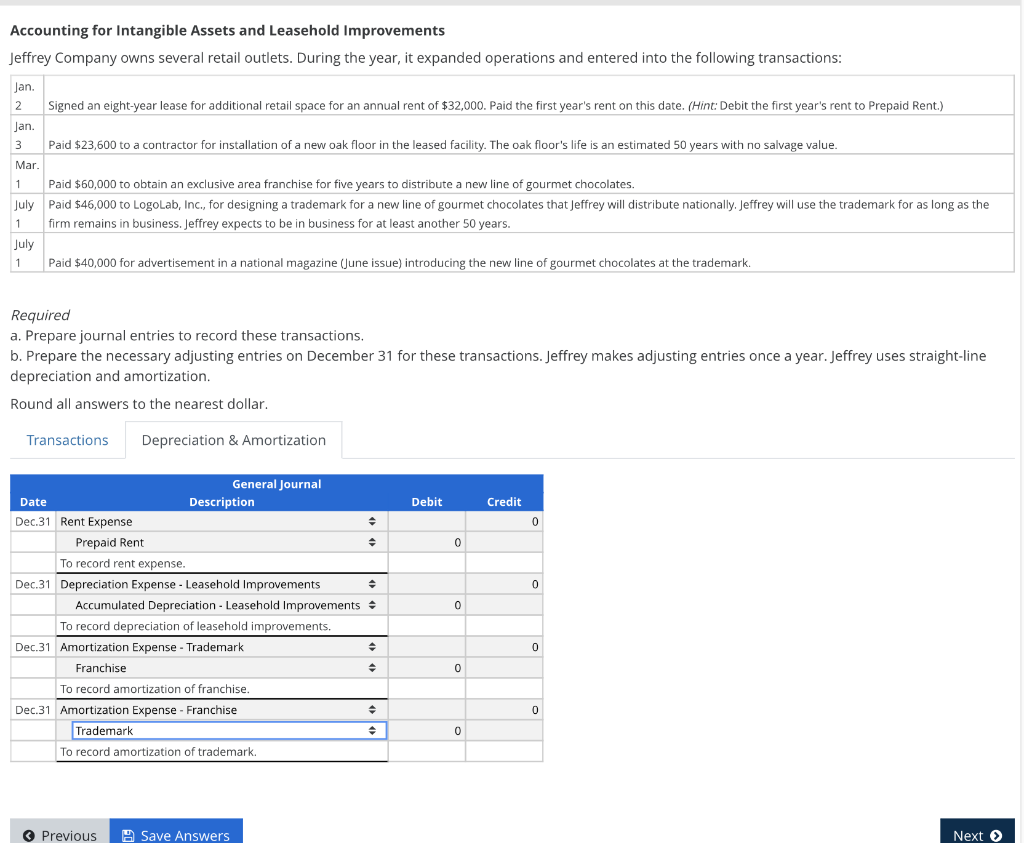

Accounting for Intangible Assets and Leasehold Improvements Jeffrey Company owns several retail outlets. During the year, it expanded operations and entered into the following transactions: Jan. 2 Signed an eight-year lease for additional retail space for an annual rent of $32,000. Paid the first year's rent on this date. (Hint: Debit the first year's rent to Prepaid Rent.) Jan. 3 Paid $23,600 to a contractor for installation of a new oak floor in the leased facility. The oak floor's life is an estimated 50 years with no salvage value. Mar. 1 Paid $60,000 to obtain an exclusive area franchise for five years to distribute a new line of gourmet chocolates. July Paid $46,000 to LogoLab, Inc., for designing a trademark for a new line of gourmet chocolates that Jeffrey will distribute nationally, Jeffrey will use the trademark for as long as the 1 firm remains in business. Jeffrey expects to be in business for at least another 50 years. July 1 Paid $40,000 for advertisement in a national magazine (June issue) introducing the new line of gourmet chocolates at the trademark. 1 Required a. Prepare journal entries to record these transactions, b. Prepare the necessary adjusting entries on December 31 for these transactions. Jeffrey makes adjusting entries once a year. Jeffrey uses straight-line depreciation and amortization. Round all answers to the nearest dollar. Transactions Depreciation & Amortization Debit Credit 0 0 General Journal Date Description Jan. 2 Rent Expense Cash To record payment of first year's rent on 8-year lease. Jan. 3 Leasehold Improvements Cash To record payment for oak floor installation in leased facility Mar. 1 Franchise 0 23600 0 23600 . 0 Cash 0 To record acquisition of 5 year franchise. July 1 Trademark Cash 46000 0 0 46000 0 To record payment for design of trademark. July 1 Advertising Expense Cash To record payment for advertising, 0 Accounting for Intangible Assets and Leasehold Improvements Jeffrey Company owns several retail outlets. During the year, it expanded operations and entered into the following transactions: Jan. 2 Signed an eight-year lease for additional retail space for an annual rent of $32,000. Paid the first year's rent on this date. (Hint: Debit the first year's rent to Prepaid Rent.) Jan. 3 Paid $23,600 to a contractor for installation of a new oak floor in the leased facility. The oak floor's life is an estimated 50 years with no salvage value. Mar. 1 Paid $60,000 to obtain an exclusive area franchise for five years to distribute a new line of gourmet chocolates. July Paid $46,000 to LogoLab, Inc., for designing a trademark for a new line of gourmet chocolates that Jeffrey will distribute nationally, Jeffrey will use the trademark for as long as the 1 firm remains in business. Jeffrey expects to be in business for at least another 50 years. July 1 Paid $40,000 for advertisement in a national magazine (June issue) introducing the new line of gourmet chocolates at the trademark. 1 Required a. Prepare journal entries to record these transactions, b. Prepare the necessary adjusting entries on December 31 for these transactions. Jeffrey makes adjusting entries once a year. Jeffrey uses straight-line depreciation and amortization. Round all answers to the nearest dollar. Transactions Depreciation & Amortization Debit Credit 0 0 0 0 General Journal Date Description Dec.31 Rent Expense Prepaid Rent To record rent expense. Dec.31 Depreciation Expense - Leasehold Improvements Accumulated Depreciation - Leasehold Improvements To record depreciation of leasehold improvements, Dec.31 Amortization Expense - Trademark Franchise To record amortization of franchise. . Dec.31 Amortization Expense - Franchise Trademark To record amortization of trademark. 0 0 0 0 Previous Save Answers Next