Question

Accounting for Membership Fees and Rewards Program BJs Wholesale Club Holdings, Inc. provides the following description of its revenue recognition policies for membership fees and

Accounting for Membership Fees and Rewards Program

BJs Wholesale Club Holdings, Inc. provides the following description of its revenue recognition

policies for membership fees and its reward program.

Performance Obligations

The Company identifies each distinct performance obligation to transfer goods (or bundle of goods) or services. The Company recognizes revenue when (or as) it satisfies a performance obligation by transferring control of the goods or services to the customer. Merchandise salesThe Company recognizes sale of merchandise at clubs and gas stations at the point of sale when the customer takes possession of the goods and tenders payment.

BJs Perks RewardsThe Company has a customer loyalty program called the BJs Perks Rewards Program for which the Company offers points based on dollars spent by the customer. The Company also has a co-branded credit card program which provides members additional reward dollars for certain purchases. The Companys BJs Perks Rewards members earn 2% cash back, up to a maximum of $500 per year, on all qualified purchases made at BJs. The Companys My BJs Perks Mastercard holders earn 3% or 5% cash back on all qualified purchases made at BJs and 1% or 2% cash back on purchases made with the card outside of BJs. Cash back is in the form of electronic awards issued in $20 increments that may be used online or in-club at the register and expire six months from the date issued. Earned rewards may be redeemed on future purchases made at the Company. The Company recognizes revenue for earned rewards when customers redeem such rewards as part of a purchase at one of the Companys clubs or the Companys website. The Company accounts for these transactions as multiple element arrangements and allocates the transaction price to separate performance obligations using their relative fair values. The Company includes the fair value of reward dollars earned in deferred revenue at the time the reward dollars are earned. MembershipThe Company charges a membership fee to its customers. That fee allows customers to shop in the Companys clubs, shop on the Companys website, and purchase gas at the Companys gas stations for the duration of the membership, which is 12 months. Because the Company has the obligation to provide access to its clubs, website, and gas stations for the duration of the membership term, the Company recognizes membership fees on a straight-line basis over the life of the membership.

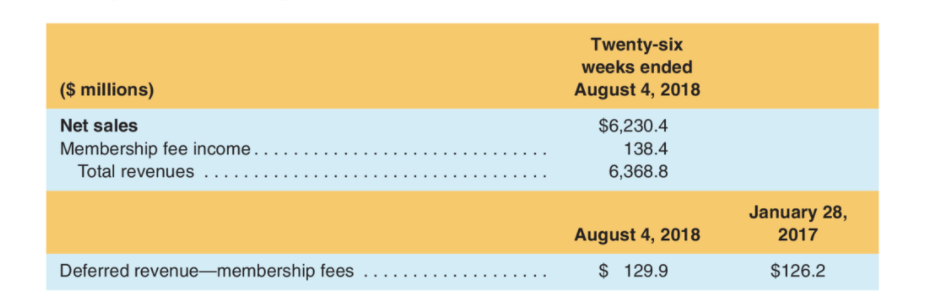

The following data were extracted from income statement, balance sheet, and footnotes of BJs

10-Q report for the second quarter of 2018.

a. Explain BJs accounting for membership fees.

b. Prepare an FSET to record (1) membership fees collected in cash in the first half of fiscal year 2018 and (2) membership fee revenue recognized over that period.

c. Explain BJs accounting for its BJs Perks Rewards program that provides 2% cash back, up to a maximum of $500 per year on qualified purchases made at BJs

TYPO: January 28, 2017 should be January 28, 2018.

Twenty-six weeks ended August 4, 2018 ($ millions) Net sales Membership fee income.... Total revenues .... $6,230.4 138.4 6,368.8 January 28, 2017 August 4, 2018 Deferred revenue-membership fees ................... $129.9 $126.2 Twenty-six weeks ended August 4, 2018 ($ millions) Net sales Membership fee income.... Total revenues .... $6,230.4 138.4 6,368.8 January 28, 2017 August 4, 2018 Deferred revenue-membership fees ................... $129.9 $126.2Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Explain BJs accounting for membership fees BJs recognizes membership fees as revenue over the memb...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started