Answered step by step

Verified Expert Solution

Question

1 Approved Answer

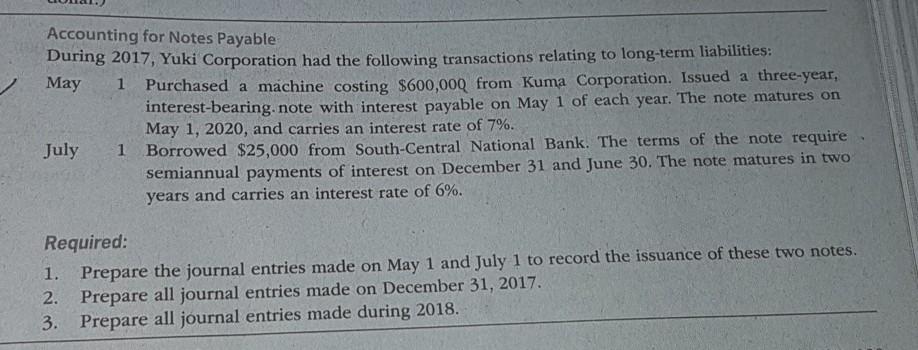

Accounting for Notes Payable During 2017, Yuki Corporation had the following transactions relating to long-term liabilities: May 1 Purchased a machine costing $600,000 from Kuma

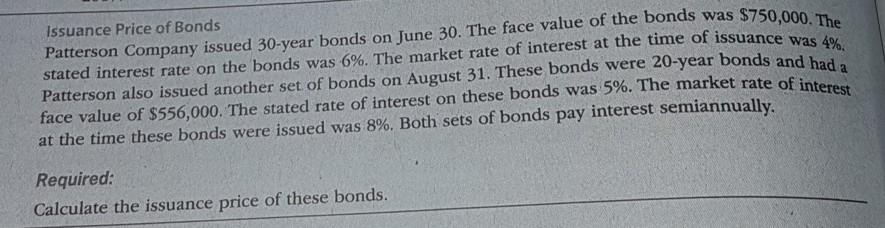

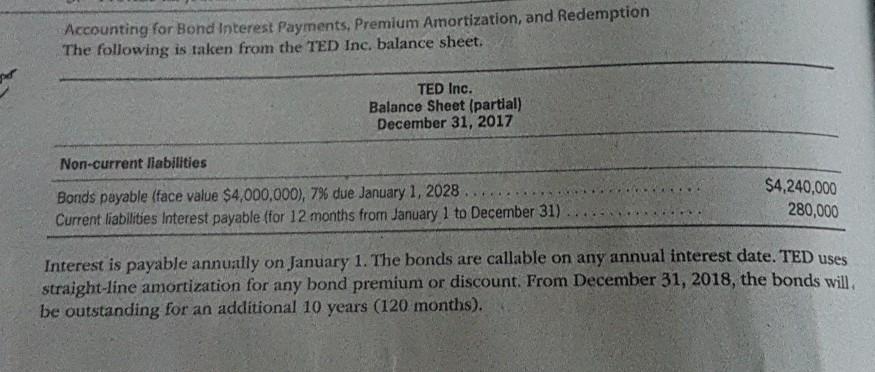

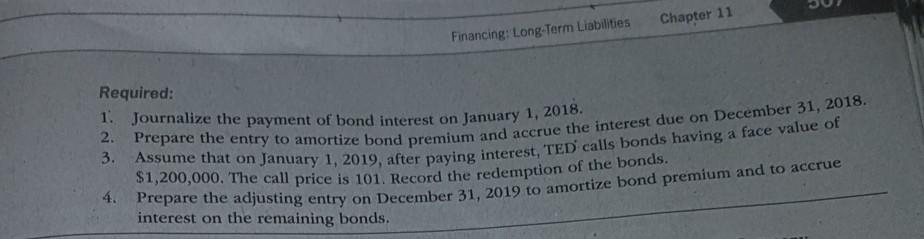

Accounting for Notes Payable During 2017, Yuki Corporation had the following transactions relating to long-term liabilities: May 1 Purchased a machine costing $600,000 from Kuma Corporation. Issued a three-year, interest-bearing. note with interest payable on May 1 of each year. The note matures on May 1, 2020, and carries an interest rate of 7%. July 1 Borrowed $25,000 from South-Central National Bank. The terms of the note require semiannual payments of interest on December 31 and June 30. The note matures in two years and carries an interest rate of 6%. Required: 1. Prepare the journal entries made on May 1 and July 1 to record the issuance of these two notes 2. Prepare all journal entries made on December 31, 2017. 3. Prepare all journal entries made during 2018. Issuance Price of Bonds Patterson Company issued 30-year bonds on June 30. The face value of the bonds was $750,000. The stated interest rate on the bonds was 6%. The market rate of interest at the time of issuance was 4% Patterson also issued another set of bonds on August 31. These bonds were 20-year bonds and had a face value of $556,000. The stated rate of interest on these bonds was 5%. The market rate of interest at the time these bonds were issued was 8%. Both sets of bonds pay interest semiannually. Required: Calculate the issuance price of these bonds. Accounting for Bond Interest Payments. Premium Amortization, and Redemption The following is taken from the TED Inc. balance sheet. TED Inc. Balance Sheet (partial) December 31, 2017 Non-current liabilities Bonds payable (face value $4,000,000), 7% due January 1, 2028 Current liabilities Interest payable (for 12 months from January 1 to December 31) $4,240,000 280,000 Interest is payable annually on January 1. The bonds are callable on any annual interest date. TED uses straight-line amortization for any bond premium or discount. From December 31, 2018, the bonds will, be outstanding for an additional 10 years (120 months). 2. Prepare the entry to amortize bond premium and accrue the interest due on December 31, 2018. 3. Assume that on January 1, 2019, after paying interest, TED calls bonds having a face value of Chapter 11 Financing: Long-Term Liabilities Required: 1. Journalize the payment of bond interest on January 1, 2018. $1,200,000. The call price is 101. Record the redemption of the bonds. 4. Prepare the adjusting entry on December 31 , 2019 to amortize bond premium and to accrue interest on the remaining bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started