Answered step by step

Verified Expert Solution

Question

1 Approved Answer

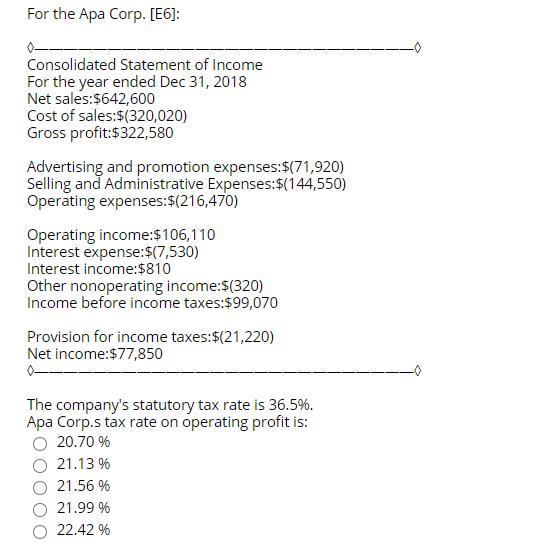

For the Apa Corp. [E6]: Consolidated Statement of Income For the year ended Dec 31, 2018 Net sales:$642,600 Cost of sales:$(320,020) Gross profit:$322,580 Advertising

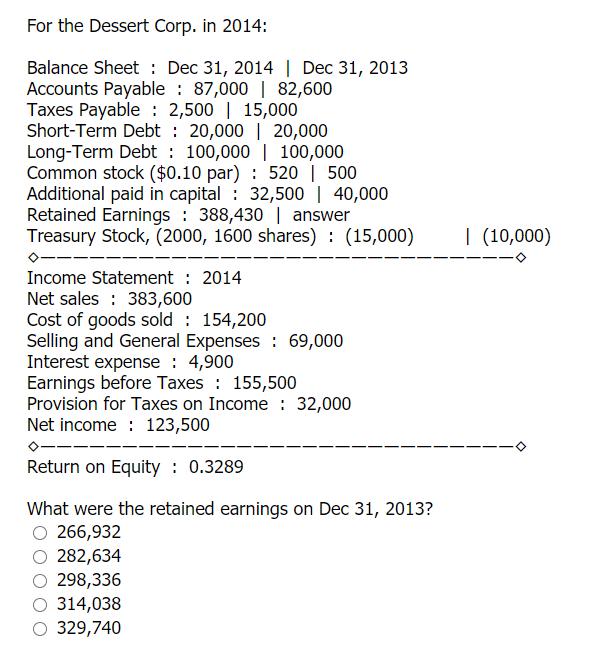

For the Apa Corp. [E6]: Consolidated Statement of Income For the year ended Dec 31, 2018 Net sales:$642,600 Cost of sales:$(320,020) Gross profit:$322,580 Advertising and promotion expenses:$(71,920) Selling and Administrative Expenses:$(144,550) Operating expenses:$(216,470) Operating income:$106,110 Interest expense:$(7,530) Interest income:$810 Other nonoperating income:$(320) Income before income taxes:$99,070 Provision for income taxes:$(21,220) Net income:$77,850 The company's statutory tax rate is 36.5%. Apa Corp.s tax rate on operating profit is: 20.70 % 21.13 % 21.56 % 21.99 % 22.42 % For the Dessert Corp. in 2014: Balance Sheet : Dec 31, 2014 | Dec 31, 2013 Accounts Payable 87,000 | 82,600 Taxes Payable : 2,500 | 15,000 Short-Term Debt 20,000 | 20,000 Long-Term Debt 100,000 | 100,000 Common stock ($0.10 par) : 520 | 500 Additional paid in capital : 32,500 | 40,000 Retained Earnings 388,430 | answer Treasury Stock, (2000, 1600 shares) : (15,000) | (10,000) Income Statement : 2014 Net sales : 383,600 Cost of goods sold 154,200 Selling and General Expenses : 69,000 Interest expense : 4,900 Earnings before Taxes : 155,500 Provision for Taxes on Income : 32,000 Net income : 123,500 Return on Equity 0.3289 What were the retained earnings on Dec 31, 2013? O 266,932 O 282,634 O 298,336 O 314,038 329,740

Step by Step Solution

★★★★★

3.29 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer Answer to Part A APA Corp Income and Expense Statement Particulars Amount Net Sales 64260000 Cost of Sales 32002000 Gross Profit 32258000 Adver...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started