Answered step by step

Verified Expert Solution

Question

1 Approved Answer

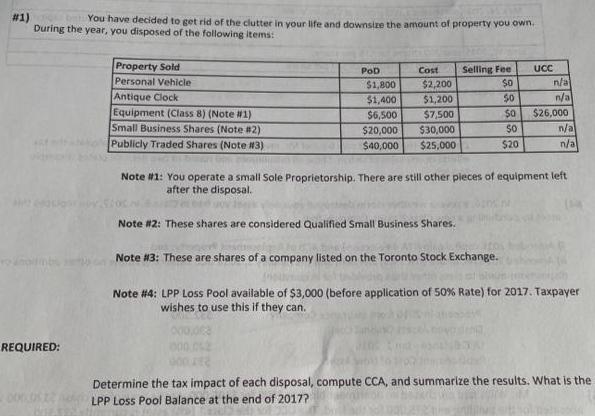

#1) You have decided to get rid of the clutter in your life and downsize the amount of property you own. During the year,

#1) You have decided to get rid of the clutter in your life and downsize the amount of property you own. During the year, you disposed of the following items: ronall REQUIRED: Property Sold Personal Vehicle Antique Clock Equipment (Class 8) (Note #1) Small Business Shares (Note #2) Publicly Traded Shares (Note #3) POD $1,800 Cost $2,200 $1,400 $1,200 $6,500 $7,500 $20,000 $30,000 $40,000 $25,000 Selling Fee $0 $0 $0 50 $20 Note #2: These shares are considered Qualified Small Business Shares. UCC n/a n/a $26,000 n/a n/al Note #1: You operate a small Sole Proprietorship. There are still other pieces of equipment left after the disposal. Note #3: These are shares of a company listed on the Toronto Stock Exchange. Note #4: LPP Loss Pool available of $3,000 (before application of 50% Rate) for 2017. Taxpayer wishes to use this if they can. Determine the tax impact of each disposal, compute CCA, and summarize the results. What is the LPP Loss Pool Balance at the end of 2017?

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

D eter mine the tax impact of each disposal compute C CA and summarize the results ANS WER Personal ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started