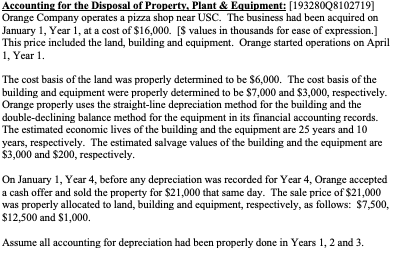

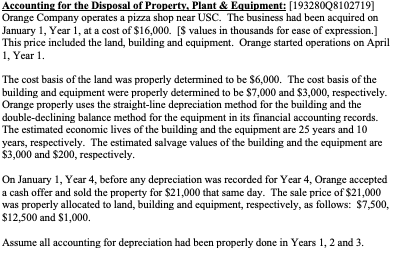

Accounting for the Disposal of Property. Plant & Equipment (19328008102719) Orange Company operates a pizza shop near USC. The business had been acquired on January 1, Year 1, at a cost of $16,000. S values in thousands for ease of expression.] This price included the land, building and equipment. Orange started operations on April 1, Year 1. The cost basis of the land was properly determined to be $6,000. The cost basis of the building and equipment were properly determined to be $7,000 and $3,000, respectively. Orange properly uses the straight-line depreciation method for the building and the double-declining balance method for the equipment in its financial accounting records. The estimated economic lives of the building and the equipment are 25 years and 10 years, respectively. The estimated salvage values of the building and the equipment are $3,000 and $200, respectively. On January 1, Year 4, before any depreciation was recorded for Year 4, Orange accepted a cash offer and sold the property for $21,000 that same day. The sale price of $21,000 was properly allocated to land, building and equipment, respectively, as follows: $7,500, $12,500 and $1,000. Assume all accounting for depreciation had been properly done in Years 1, 2 and 3. Determine the proper journal entry Orange would record from the sale of the Equipment? Accounting for the Disposal of Property. Plant & Equipment (19328008102719) Orange Company operates a pizza shop near USC. The business had been acquired on January 1, Year 1, at a cost of $16,000. S values in thousands for ease of expression.] This price included the land, building and equipment. Orange started operations on April 1, Year 1. The cost basis of the land was properly determined to be $6,000. The cost basis of the building and equipment were properly determined to be $7,000 and $3,000, respectively. Orange properly uses the straight-line depreciation method for the building and the double-declining balance method for the equipment in its financial accounting records. The estimated economic lives of the building and the equipment are 25 years and 10 years, respectively. The estimated salvage values of the building and the equipment are $3,000 and $200, respectively. On January 1, Year 4, before any depreciation was recorded for Year 4, Orange accepted a cash offer and sold the property for $21,000 that same day. The sale price of $21,000 was properly allocated to land, building and equipment, respectively, as follows: $7,500, $12,500 and $1,000. Assume all accounting for depreciation had been properly done in Years 1, 2 and 3. Determine the proper journal entry Orange would record from the sale of the Equipment