Answered step by step

Verified Expert Solution

Question

1 Approved Answer

For the eleven scenarios listed below are items that are treated differently for accounting purposes than they are for tax purposes. Indicate whether the

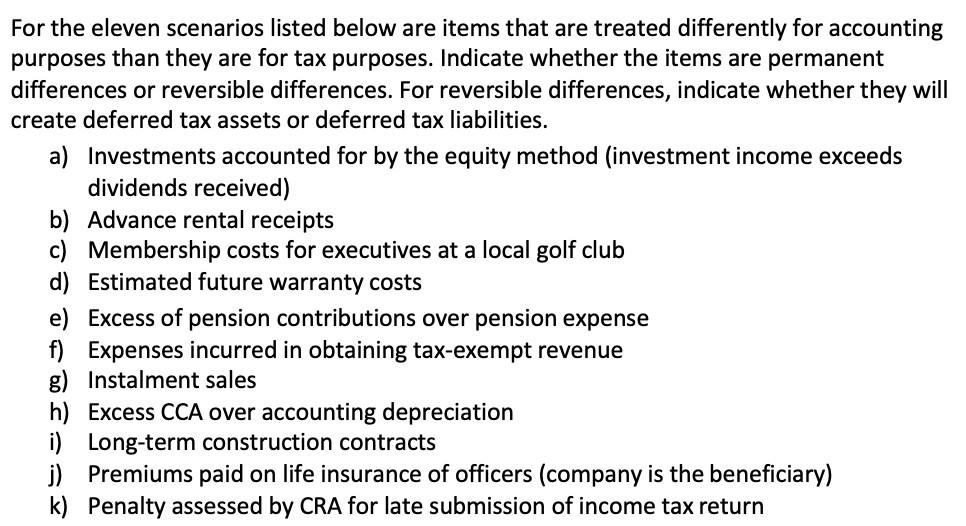

For the eleven scenarios listed below are items that are treated differently for accounting purposes than they are for tax purposes. Indicate whether the items are permanent differences or reversible differences. For reversible differences, indicate whether they will create deferred tax assets or deferred tax liabilities. a) Investments accounted for by the equity method (investment income exceeds dividends received) b) Advance rental receipts c) Membership costs for executives at a local golf club d) Estimated future warranty costs e) Excess of pension contributions over pension expense f) Expenses incurred in obtaining tax-exempt revenue g) Instalment sales h) Excess CCA over accounting depreciation i) Long-term construction contracts j) Premiums paid on life insurance of officers (company is the beneficiary) k) Penalty assessed by CRA for late submission of income tax return

Step by Step Solution

★★★★★

3.54 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Indicate whether the items are permanent differences or reversible temporary differences For ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started