Question

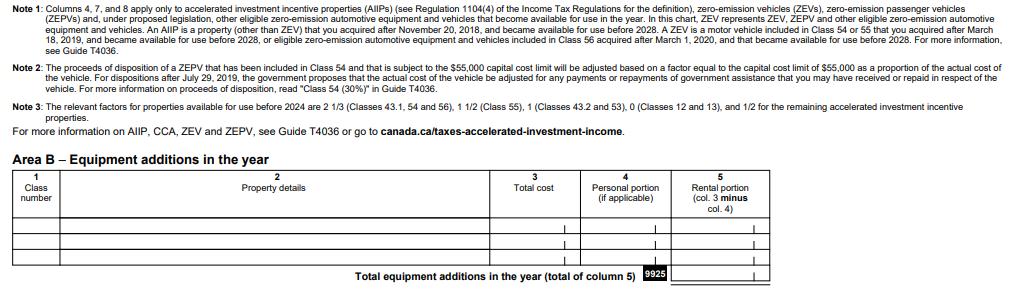

Property #1: Alex Bodvin acquires a residential rental property on June 1, 2019 at a total cost of $423,000. Of this total, $132,000 can be

Property #1: Alex Bodvin acquires a residential rental property on June 1, 2019 at a total cost of $423,000. Of this total, $132,000 can be allocated to the value of the land. He immediately spends $42,000 to make major improvements to the property. Rent for the year total $32,000, while rental expenses other than CCA total $27,500. The rental expenses are made up of the following:

Mortgage Interest ($9,825), Property taxes ($4,250), Utilities ($5,850), Repairs and maintenance ($4,525), Insurance ($2,050), and Advertising ($1,000)

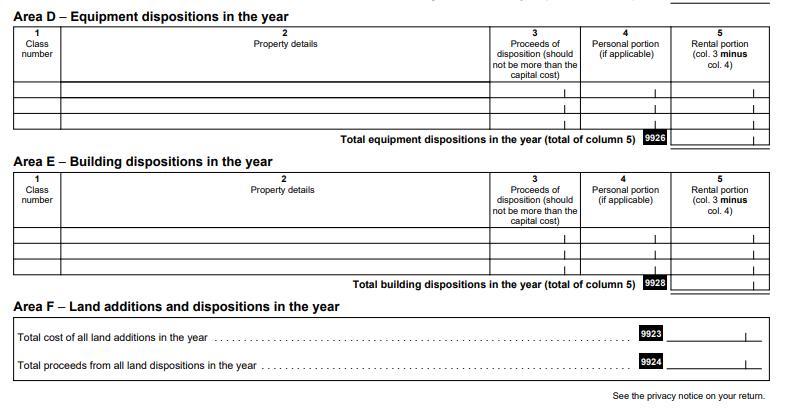

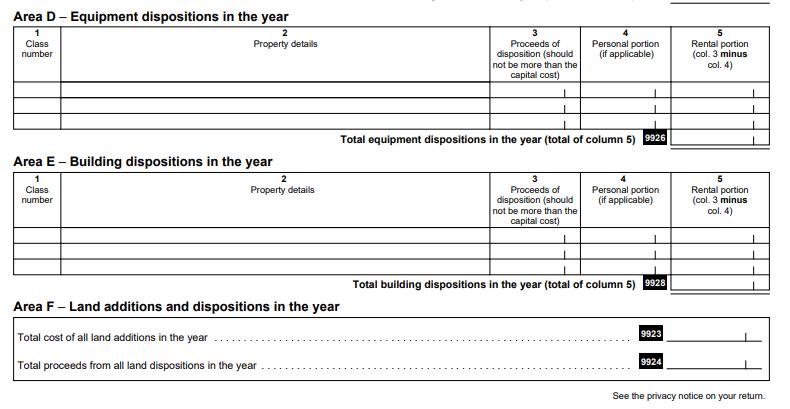

Property # 2: Alex’s second rental property has been held for many years and had an original cost of $24,000, of which $18,000 was allocated to the building and $6,000 was allocated to the land on which it was situated. It is in a single Class 1 (4% CCA rate) with a January 1, 2019 UCC balance of $10,500. At the beginning of 2019, the property was sold for $73,000, with $55,000 being allocated to the building and $18,000 to the land. Rent for the year total $6,000, while rental expenses other than CCA total $1,775. The rental expenses are made up of the following:

Mortgage Interest ($525), Property taxes ($250), Utilities ($850) and Insurance ($150).

Property # 3: Alex’s third rental property has been held for many years and had an original cost of $144,000, of which $102,000 was allocated to the building and $42,000 was allocated to the land on which it was situated. It is in a single Class 1 (4% CCA rate) with a January 1, 2019 UCC balance of $82,500. In the middle of the year, the property was sold for $95,000, with $75,000 being allocated to the building and $20,000 to the land. Rent for the year total $30,000, while rental expenses other than CCA total $15,775. The rental expenses are made up of the following:

Mortgage Interest ($3,150), Property taxes ($2,250), Utilities ($5,100), Repairs and maintenance ($4,375) and Insurance ($900).

Required:

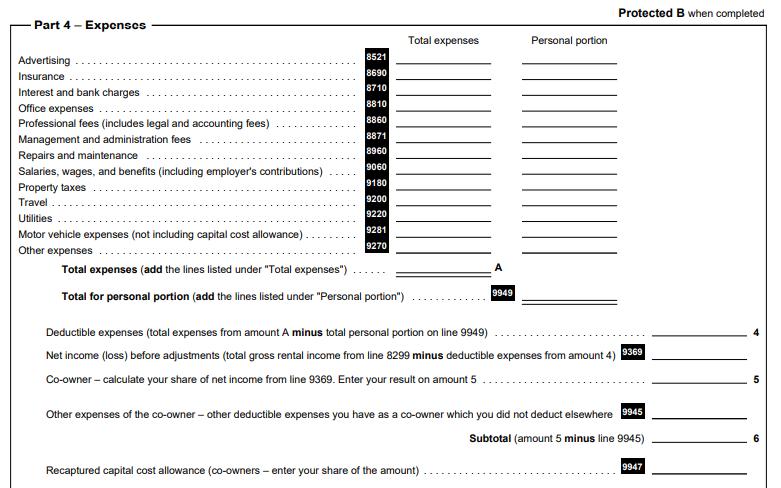

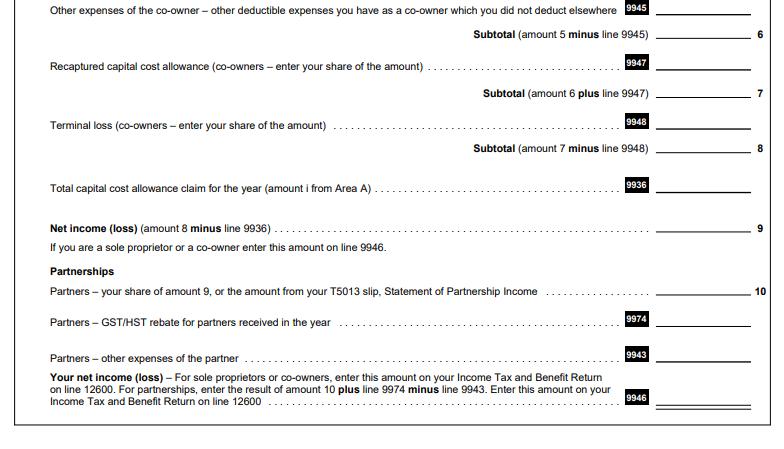

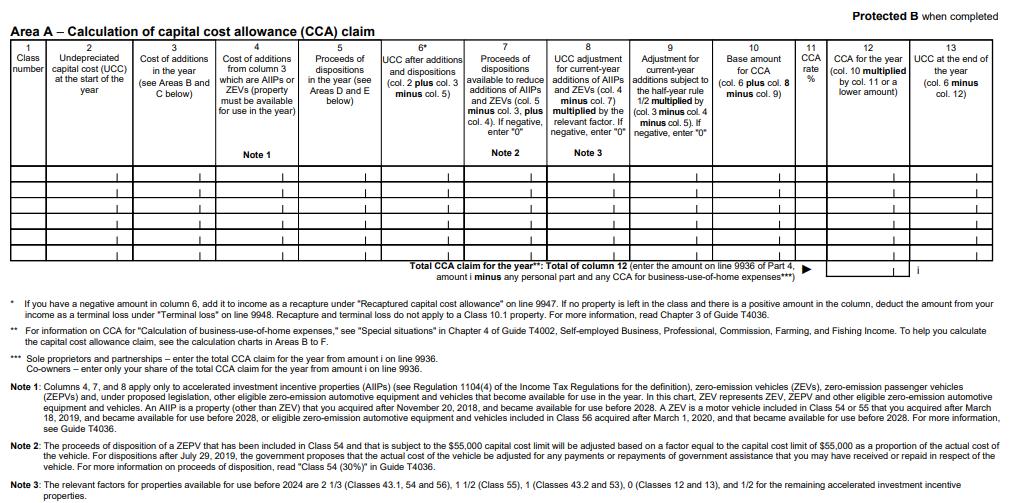

Calculate Alex Bodvin’s minimum net rental income for 2019. You should provide a separate CCA calculation for each property and specify how much CCA should be taken for each building. Complete the T776 form listing all the properties on the same form. In addition to the minimum net rental income, what is the Taxable Capital Gain and Allowable Capital Loss.

For farther information, see "T776 Form 3" .

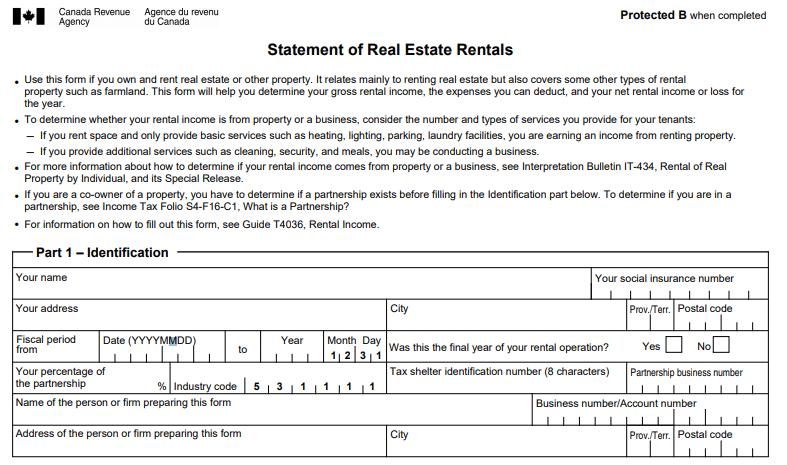

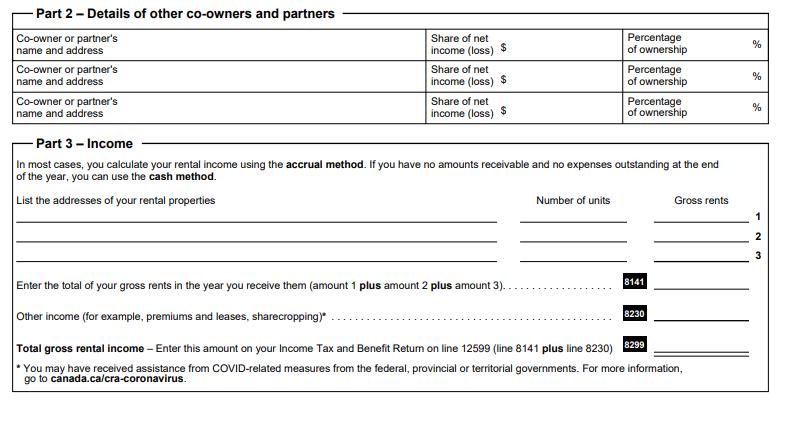

Canada Revenue Agency Agence du revenu du Canada Protected B when completed Statement of Real Estate Rentals . Use this form if you own and rent real estate or other property. It relates mainly to renting real estate but also covers some other types of rental property such as farmland. This form will help you determine your gross rental income, the expenses you can deduct, and your net rental income or loss for the year. To determine whether your rental income is from property or a business, consider the number and types of services you provide for your tenants: If you rent space and only provide basic services such as heating, lighting, parking, laundry facilities, you are earning an income from renting property. - If you provide additional services such as cleaning, security, and meals, you may be conducting a business. For more information about how to determine if your rental income comes from property or a business, see Interpretation Bulletin IT-434, Rental of Real Property by Individual, and its Special Release. If you are a co-owner of a property, you have to determine if a partnership exists before filling in the Identification part below. To determine if you are in a partnership, see Income Tax Folio S4-F16-C1, What is a Partnership? For information on how to fill out this form, see Guide T4036, Rental Income. Part 1-Identification Your name Your social insurance number City Prov./Terr. Postal code Your address Fiscal period from Date (YYYYMMDD Year Month Day 12|3|1 Was this the final year of your rental operation? Tax shelter identification number (8 characters) NoO Yes to Your percentage of the partnership Name of the person or firm preparing this form Partnership business number % Industry code 5 3 Business number/Account number Address of the person or firm preparing this form City Prov./Terr. Postal code

Step by Step Solution

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started