Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fox Manufacturing Co. is a well-known and big company that produces many different computer products all around the world. However, Fox started as a

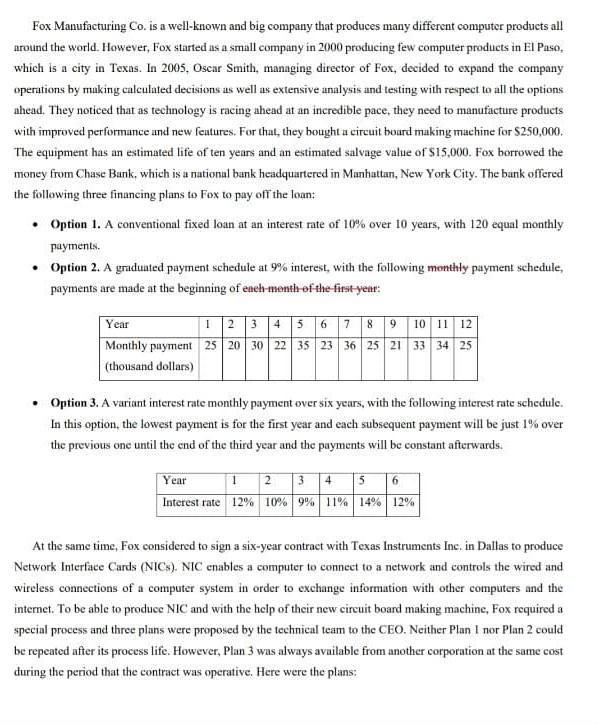

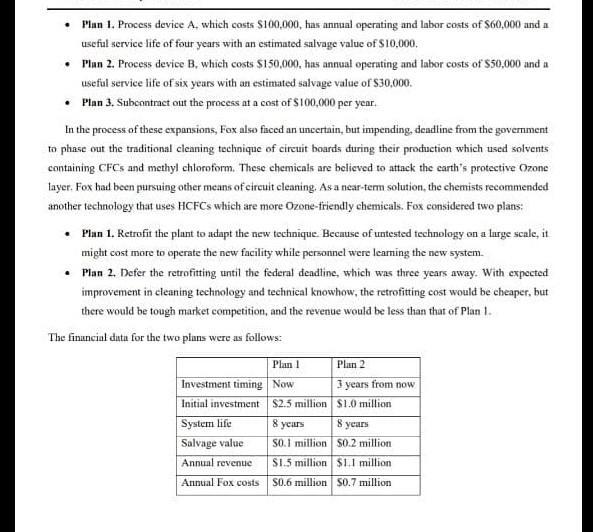

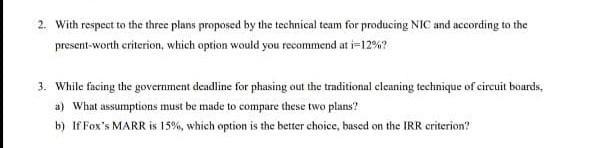

Fox Manufacturing Co. is a well-known and big company that produces many different computer products all around the world. However, Fox started as a small company in 2000 producing few computer products in El Paso, which is a city in Texas. In 2005, Oscar Smith, managing director of Fox, decided to expand the company operations by making calculated decisions as well as extensive analysis and testing with respect to all the options ahead. They noticed that as technology is racing ahead at an incredible pace, they need to manufacture products with improved performance and new features. For that, they bought a circuit board making machine for $250,000. The equipment has an estimated life of ten years and an estimated salvage value of $15,000. Fox borrowed the money from Chase Bank, which is a national bank headquartered in Manhattan, New York City. The bank offered the following three financing plans to Fox to pay off the loan: Option 1. A conventional fixed loan at an interest rate of 10% over 10 years, with 120 equal monthly payments. Option 2. A graduated payment schedule at 9% interest, with the following monthly payment schedule, payments are made at the beginning of each month of the first year: Year 1 2 3 4 5 6 7 8 9 10 11 12 Monthly payment 25 20 30 22 35 23 36 25 21 33 34 25 (thousand dollars) Option 3. A variant interest rate monthly payment over six years, with the following interest rate schedule. In this option, the lowest payment is for the first year and each subsequent payment will be just 1% over the previous one until the end of the third year and the payments will be constant afterwards. Year Interest rate 12% 10% 9% 11% 14% 12% At the same time, Fox considered to sign a six-year contract with Texas Instruments Inc. in Dallas to produce Network Interface Cards (NICs). NIC enables a computer to connect to a network and controls the wired and wireless connections of a computer system in order to exchange information with other computers and the internet. To be able to produce NIC and with the help of their new circuit board making machine, Fox required a special process and three plans were proposed by the technical team to the CEO. Neither Plan I nor Plan 2 could be repeated after its process life. However, Plan 3 was always available from another corporation at the same cost during the period that the contract was operative. Here were the plans: Plan 1. Process device A, which costs $100,000, has annual operating and labor costs of $60,000 and a useful service life of four years with an estimated salvage value of $10,000. Plan 2. Process device B, which costs $150,000, has annual operating and labor costs of $50,000 and a useful service life of six years with an estimated salvage value of $30,000. Plan 3. Subcontract out the process at a cost of $100,000 per year. In the process of these expansions, Fox also faced an uncertain, but impending, deadline from the government to phase out the traditional cleaning technique of circuit boards during their production which used solvents containing CFCs and methyl chloroform. These chemicals are believed to attack the earth's protective Ozone layer. Fox had been pursuing other means of circuit cleaning. As a near-term solution, the chemists recommended another technology that uses HCFCs which are more Ozone-friendly chemicals. Fox considered two plans: Plan 1. Retrofit the plant to adapt the new technique. Because of untested technology on a large scale, it might cost more to operate the new facility while personnel were learning the new system. Plan 2. Defer the retrofitting until the federal deadline, which was three years away. With expected improvement in cleaning technology and technical knowhow, the retrofitting cost would be cheaper, but there would be tough market competition, and the revenue would be less than that of Plan 1. The financial data for the two plans were as follows: Investment timing Initial investment System life Salvage value Annual revenue Annual Fox costs Plan 1 Now $2.5 million Plan 2 3 years from now $1.0 million 8 years 8 years 50.1 million $0.2 million $1.5 million $1.1 million $0.6 million $0.7 million 2. With respect to the three plans proposed by the technical team for producing NIC and according to the present-worth criterion, which option would you recommend at i-12%? 3. While facing the government deadline for phasing out the traditional cleaning technique of circuit boards, a) What assumptions must be made to compare these two plans? b) If Fox's MARR is 15%, which option is the better choice, based on the IRR criterion?

Step by Step Solution

★★★★★

3.60 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

2 To choose between the three plans for producing NICs we need to calculate the present worth of eac...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started