Answered step by step

Verified Expert Solution

Question

1 Approved Answer

General instructions 1. It is recommended to use EXCEL to facilitate computations. You will need to display the computations (in Excel or by hand,

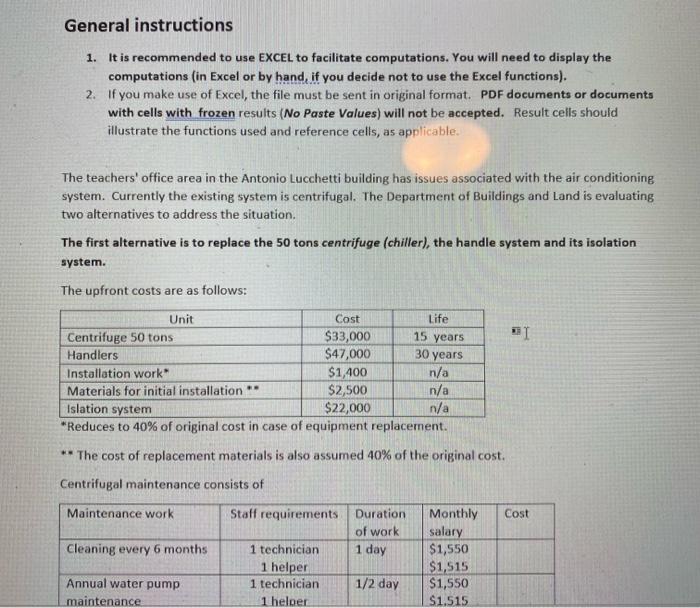

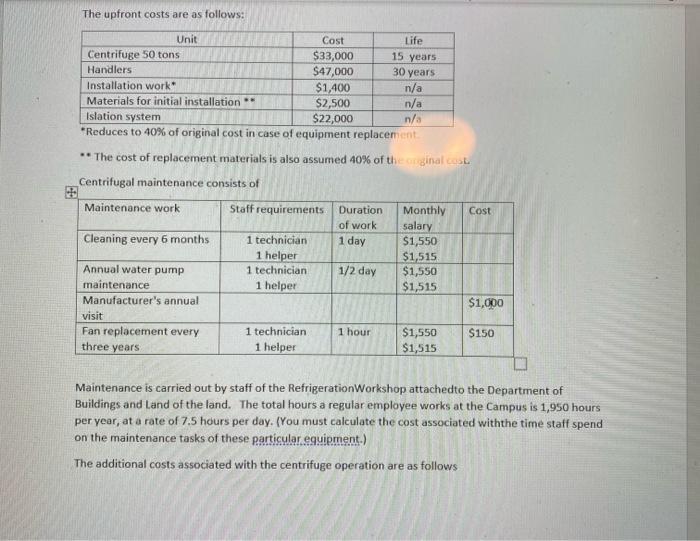

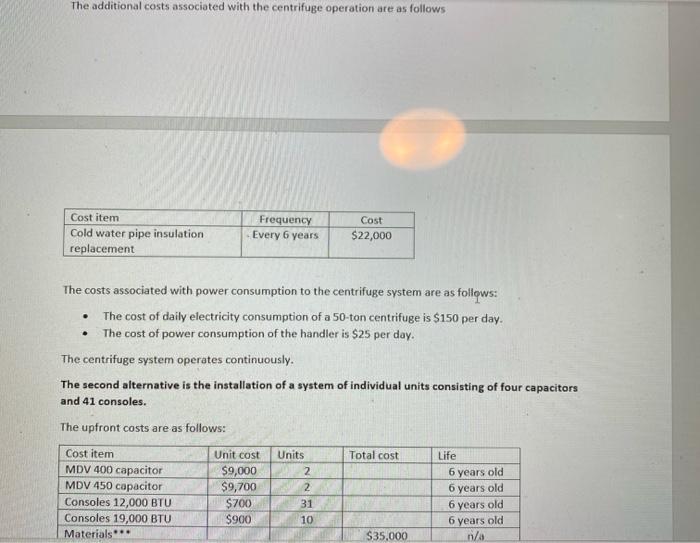

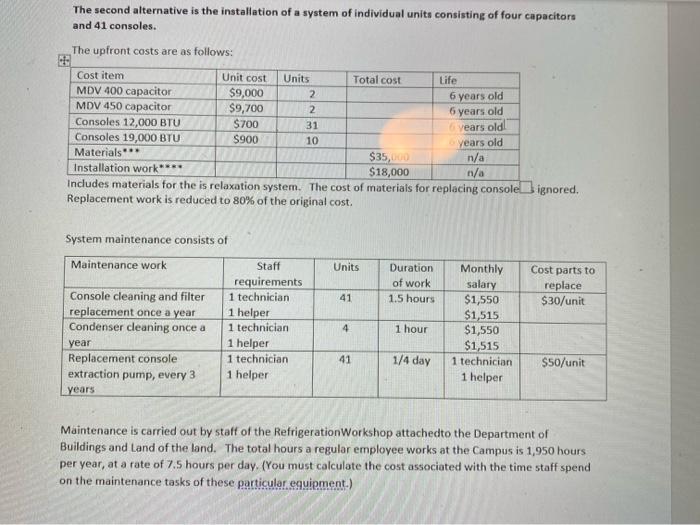

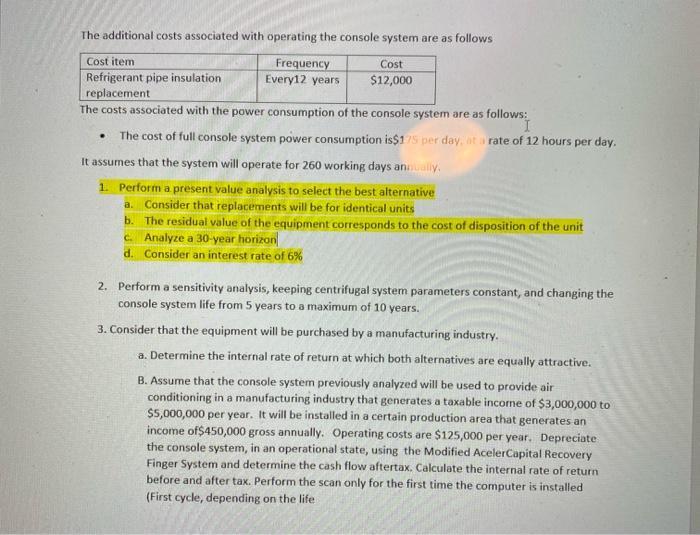

General instructions 1. It is recommended to use EXCEL to facilitate computations. You will need to display the computations (in Excel or by hand, if you decide not to use the Excel functions). 2. If you make use of Excel, the file must be sent in original format. PDF documents or documents with cells with frozen results (No Paste Values) will not be accepted. Result cells should illustrate the functions used and reference cells, as applicable. The teachers' office area in the Antonio Lucchetti building has issues associated with the air conditioning system. Currently the existing system is centrifugal. The Department of Buildings and Land is evaluating two alternatives to address the situation. The first alternative is to replace the 50 tons centrifuge (chiller), the handle system and its isolation system. The upfront costs are as follows: Unit Cost Life Centrifuge 50 tons Handlers Installation work $33,000 $47,000 $1,400 $2,500 $22,000 15 years 30 years n/a n/a n/a *Reduces to 40% of original cost in case of equipment replacernent. Materials for initial installation ** Islation system ** The cost of replacement materials is also assumed 40% of the original cost. Centrifugal maintenance consists of Maintenance work Staff requirements Duration Monthly Cost of work salary $1,550 $1,515 $1,550 Cleaning every 6 months 1 technician 1 day 1 helper 1 technician Annual water pump 1/2 day maintenance 1 heloer $1.515 The upfront costs are as follows: Unit Cost Life Centrifuge 50 tons $33,000 $47,000 15 years Handlers 30 years Installation work n/a n/a n/a *Reduces to 40% of original cost in case of equipment replacenment. $1,400 $2,500 $22,000 Materials for initial installation ** Islation system ** The cost of replacement materials is also assumed 40% of theoginal cost Centrifugal maintenance consists of Maintenance work Staff requirements Monthly salary $1,550 $1,515. $1,550 $1,515 Duration Cost of work 1 technician 1 helper 1 technician 1 helper Cleaning every 6 months 1 day Annual water pump maintenance 1/2 day Manufacturer's annual $1,000 visit Fan replacement every three years 1 technician 1 helper 1 hour $1,550 $1,515 $150 Maintenance is carried out by staff of the RefrigerationWorkshop attachedto the Department of Buildings and Land of the land. The total hours a regular employee works at the Campus is 1,950 hours per year, at a rate of 7.5 hours per day. (You must calculate the cost associated withthe time staff spend on the maintenance tasks of these particular equipment.) The additional costs associated with the centrifuge operation are as follows The additional costs associated with the centrifuge operation are as follows Cost item Frequency Every 6 years Cost Cold water pipe insulation $22,000 replacement The costs associated with power consumption to the centrifuge system are as follows: The cost of daily electricity consumption of a 50-ton centrifuge is $150 per day. The cost of power consumption of the handler is $25 per day. The centrifuge system operates continuously. The second alternative is the installation of a system of individual units consisting of four capacitors and 41 consoles. The upfront costs are as follows: Cost item MDV 400 capacitor MDV 450 capacitor Unit cost Units Total cost Life $9,000 $9,700 $700 $900 6 years old 6 years old Consoles 12,000 BTU 6 years old 6 years old 31 Consoles 19,000 BTU 10 Materials" $35,000 n/a The second alternative is the installation of a system of individual units consisting of four capacitors and 41 consoles. The upfront costs are as follows: Cost item Unit cost Units Total cost Life MDV 400 capacitor $9,000 $9,700 $700 $900 2. MDV 450 capacitor 6 years old 6 years old 2. Consoles 12,000 BTU Consoles 19,000 BTU Materials** Installation work**** Includes materials for the is relaxation system. The cost of materials for replacing consolel ignored. Replacement work is reduced to 80% of the original cost. 31 6 vears old 6 years old n/a n/a 10 $35,000 $18,000 System maintenance consists of Maintenance work Staff Units Duration Monthly Cost parts to requirements 1 technician 1 helper 1 technician 1 helper 1 technician 1 helper of work salary $1,550 replace $30/unit Console cleaning and filter replacement once a year Condenser cleaning once a 41 1.5 hours $1,515 $1,550 $1,515 1 technician 1 helper 4 1 hour year Replacement console extraction pump, every 3 41 1/4 day $50/unit years Maintenance is carried out by staff of the RefrigerationWorkshop attachedto the Department of Buildings and Land of the land. The total hours a regular employee works at the Campus is 1,950 hours per year, at a rate of 7.5 hours per day. (You must calculate the cost associated with the time staff spend on the maintenance tasks of these particular eguipment.) The additional costs associated with operating the console system are as follows Cost item Refrigerant pipe insulation replacement The costs associated with the power consumption of the console system are as follows: Frequency Every12 years Cost $12,000 The cost of full console system power consumption is$1/5 per day, at a rate of 12 hours per day. It assumes that the system will operate for 260 working days analy. 1. Perform a present value analysis to select the best alternative a. Consider that replacements will be for identical units b. The residual value of the equipment corresponds to the cost of disposition of the unit c. Analyze a 30-year horizon d. Consider an interest rate of 6% 2. Perform a sensitivity analysis, keeping centrifugal system parameters constant, and changing the console system life from 5 years to a maximum of 10 years. 3. Consider that the equipment will be purchased by a manufacturing industry. a. Determine the internal rate of return at which both alternatives are equally attractive. B. Assume that the console system previously analyzed will be used to provide air conditioning in a manufacturing industry that generates a taxable incorne of $3,000,000 to $5,000,000 per year. It will be installed in a certain production area that generates an income of$450,000 gross annually. Operating costs are $125,000 per year. Depreciate the console system, in an operational state, using the Modified AcelerCapital Recovery Finger System and determine the cash flow aftertax. Calculate the internal rate of return before and after tax. Perform the scan only for the first time the computer is installed (First cycle, depending on the life

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

To perform the calculations and analysis outlined in your instructions it would be best to use a spreadsheet software like Microsoft Excel Heres a ste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started