Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Phil Cousteau is an accountant. Phil is 47 years old and is married to Claire who is 45 years old. She has Net Income

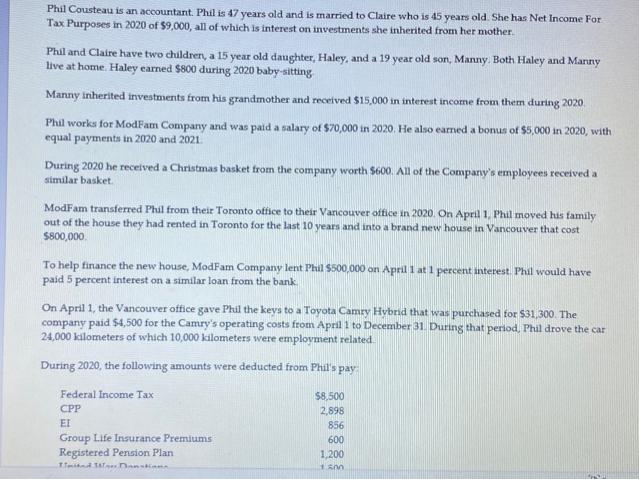

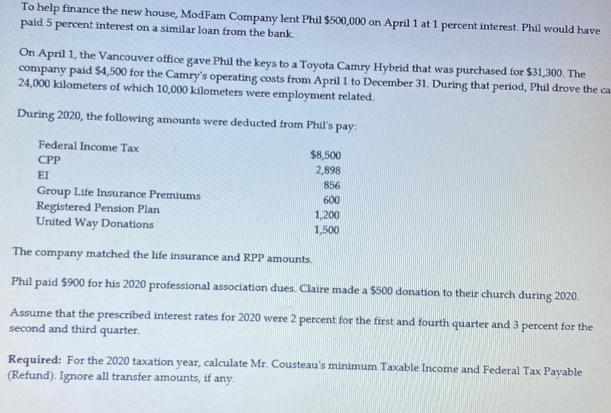

Phil Cousteau is an accountant. Phil is 47 years old and is married to Claire who is 45 years old. She has Net Income For Tax Purposes in 2020 of $9,000, all of which is interest on investments she inherited from her mother. Phil and Claire have two children, a 15 year old daughter, Haley, and a 19 year old son, Manny. Both Haley and Marny live at home. Haley earned $800 during 2020 baby-sitting Manny inherited investments from his grandmother and received $15,000 in interest income from them during 2020. Phil works for ModFam Company and was paid a salary of $70,000 in 2020. He also earned a bonus of $5,000 in 2020, with equal payments in 2020 and 2021 During 2020 he received a Christmas basket from the company worth $600. All of the Company's employees received a similar basket. ModFam transferred Phil from their Toronto office to their Vancouver oftice in 2020. On April 1, Phil moved hus family out of the house they had rented in Toronto for the last 10 years and into a brand new house in Vancouver that cost S800,000. To help finance the new house, ModFam Company lent Phil $500,000 on April 1 at 1 percent interest. Phil would have paid 5 percent interest on a similar loan from the bank. On April 1, the Vancouver office gave Phil the keys to a Toyota Camry Hybrid that was purchased for $31,300. The company paid $4,500 for the Camry's operating costs from April 1 to December 31. During that period, Phil drove the car 24,000 kilometers of which 10,000 kilometers were employment related During 2020, the following amounts were deducted from Phil's pay Federal Income Tax $8,500 CPP 2,898 EI 856 Group Life Insurance Premiums Registered Pension Plan Timidad 1 Danstimmn 600 1,200 1.500 To help finance the new houise, ModFam Company lent Phil $500,000 on April 1 at 1 percent interest. Phil would have paid 5 percent interest on a similar loan from the bank On April 1, the Vancouver office gave Phil the keys to a Toyota Camry Hybrid that was purchased for $31,300. The company paid $4,500 for the Camry's operating costs from April 1 to December 31. During that period, Phil drove the ca 24,000 kilometers of which 10,000 kilometers were employment related. During 2020, the following amounts were deducted from Phil's pay Federal Income Tax $8.500 2,898 CPP EI 856 Group Life Insurance Premiums Registered Pension Plan United Way Donations 600 1,200 1,500 The company matched the life insurance and RPP amounts. Phil paid $900 for his 2020 professional association dues. Claire made a $500 donation to their church during 2020. Assume that the prescribed interest rates for 2020 were 2 percent for the first and fourth quarter and 3 percent for the second and third quarter. Required: For the 2020 taxation year, calculate Mr. Cousteau's minimum Taxable Income and Federal Tax Payable (Refund). Ignore all transfer amounts, if any.

Step by Step Solution

★★★★★

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Answer Part 1 Net Income For Tax Purposes As Mr Cousteaus only incom...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started