Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Get-Away World Properties' is a small eco-friendly resort located on a tiny island in Eleuthera, in The Bahamas. The resort consists of 10 freestanding

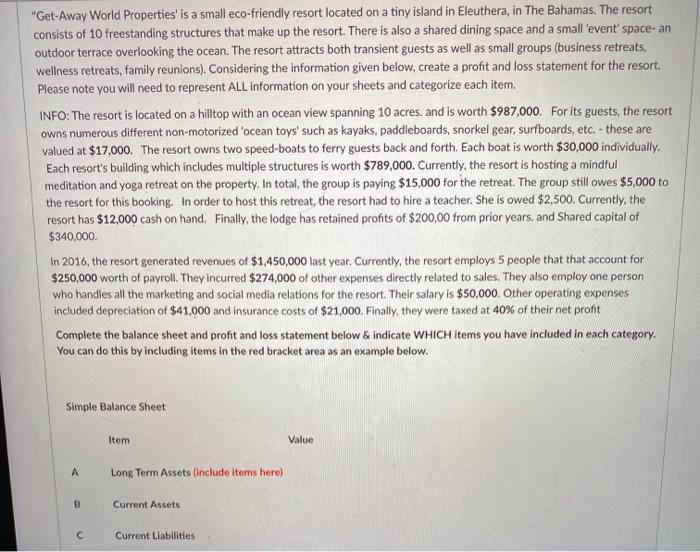

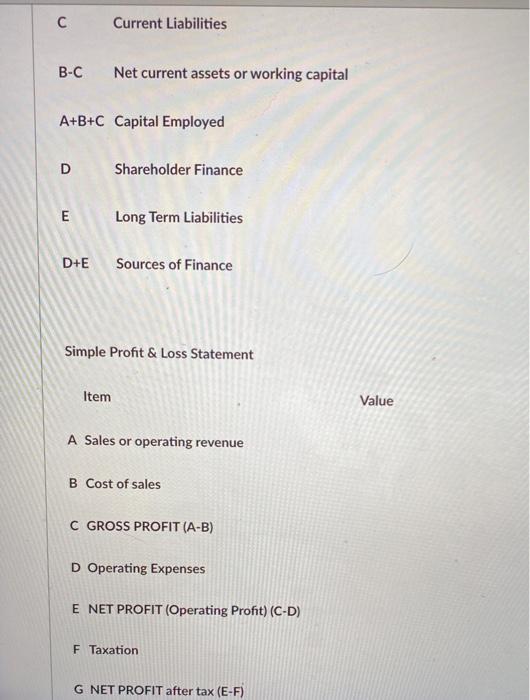

"Get-Away World Properties' is a small eco-friendly resort located on a tiny island in Eleuthera, in The Bahamas. The resort consists of 10 freestanding structures that make up the resort. There is also a shared dining space and a small 'event' space- an outdoor terrace overlooking the ocean. The resort attracts both transient guests as well as small groups (business retreats, wellness retreats, family reunions). Considering the information given below, create a profit and loss statement for the resort. Please note you will need to represent ALL information on your sheets and categorize each item, INFO: The resort is located on a hilltop with an ocean view spanning 10 acres, and is worth $987,000. For its guests, the resort owns numerous different non-motorized 'ocean toys' such as kayaks, paddleboards, snorkel gear, surfboards, etc. - these are valued at $17,000. The resort owns two speed-boats to ferry guests back and forth. Each boat is worth $30,000 individually. Each resort's building which includes multiple structures is worth $789,000. Currently, the resort is hosting a mindful meditation and yoga retreat on the property. In total, the group is paying $15,000 for the retreat. The group still owes $5,000 to the resort for this booking. In order to host this retreat, the resort had to hire a teacher. She is owed $2,500. Currently, the resort has $12,000 cash on hand. Finally, the lodge has retained profits of $200,00 from prior years. and Shared capital of $340,000. In 2016, the resort generated revenues of $1,450,000 last year. Currently, the resort employs 5 people that that account for $250,000 worth of payroll. They incurred $274,000 of other expenses directly related to sales. They also employ one person who handles all the marketing and social media relations for the resort. Their salary is $50,000. Other operating expenses included depreciation of $41,000 and insurance costs of $21,000. Finally they were taxed at 40% of their net profit Complete the balance sheet and profit and loss statement below & indicate WHICH items you have included in each category. You can do this by including items in the red bracket area as an example below. Simple Balance Sheet Item Value A Long Term Assets (include items here) B. Current Assets Current Liabilities C Current Liabilities B-C Net current assets or working capital A+B+C Capital Employed Shareholder Finance E Long Term Liabilities D+E Sources of Finance Simple Profit & Loss Statement Item Value A Sales or operating revenue B Cost of sales C GROSS PROFIT (A-B) D Operating Expenses E NET PROFIT (Operating Profit) (C-D) F Taxation G NET PROFIT after tax (E-F)

Step by Step Solution

★★★★★

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

BALANCE SHEET Alongterm assetsnote 1 1853000 Bcurrent assets note 2 17000 Ccurrent liabilities money ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started